Like it or not, crypto is applied informational arbitrage. Not everybody has the time to trawl through a million Telegram and Discord groups and niche 𝕏 accounts to find the intel that doesn’t bubble up to the UI.

Our responsibility is the Curve beat. Here are the best hidden stories we’ve seen of late.

weETH

The “super-secret alpha” Mich was referring to above is the ether.fi weETH / WETH-ng pool. Why is he referring to it as an “insane pool?”

Here, the UI does offer some partial hints. The trading volume is out of control, sitting in double digits.

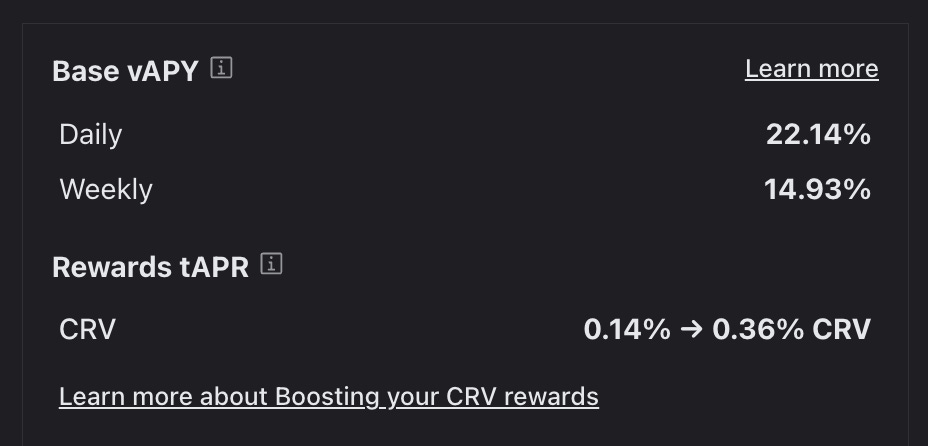

Some users may have become conditioned to seeing very high vAPY numbers and dismissing them. Usually this is a good practice.

Annualizing a day of high volume trading fees is often misleading, because the trading activity generally dies off and the numbers fall back to earth. But there’s not really a better way to present this data, so this will stick around most likely.

Curve helps mitigate misleading yields by showing the weekly numbers. For the case of weETH/WETH-ng, the weekly yield on the ETH-denominated pool is a whopping 15%! You can see the effect in the “up-only” chart of the LP token price in ETH terms, which looks like a staircase to the moon.

Another reason people are perhaps “sleeping” on the pool is that there’s several holdouts among old-timers about the ETH restaking narrative. Admittedly, we’re among the guilty parties here… ETH staking is about as far as we’re willing to trust our money, we don’t touch restaking yet. But we’re likely in the minority here, because the typical degen cares about “risk” about the same amount they care about “decentralization,” (which is to say, they don’t care).

So for the bolder among us, you may take some solace in knowing that the price of the $weETH token has held its peg for its short lifespan.

In this case, the pool already looks decent by most of the data you can gather from the UI. Yet there’s some additional alfa that’s being hidden here.

The first is that, by some estimations, the party is slated to continue.

The other piece not showing in the UI is the “points.” Admittedly, we are also not on the front lines of chasing “points” so we also tend to overlook these opportunities.

But in this case, the pool earns points, and has for a while…

We hunted down the points info in their documentation to confirm it’s legit.

So, it’s real according to the docs…

Sure, we’ll give you the tl:dr… right from the Ether.fi documentation

wrsETH / weETH

Hunting points on points on points? The new wrsETH / weETH pool doesn’t look quite as nice as the above when you look at just trading fees, but it’s earning points from three sources:

sUSDe Llama Lend

Not so keen on ETH restaking? This one caught our eye…

Here’s the story beneath the story visible onthe UI. There are a few moving pieces…

$sUSDe is Ethena’s staked stablecoin, which is meant to be natively yield bearing (the yield coming from bringing the ETH funding rate onchain.)

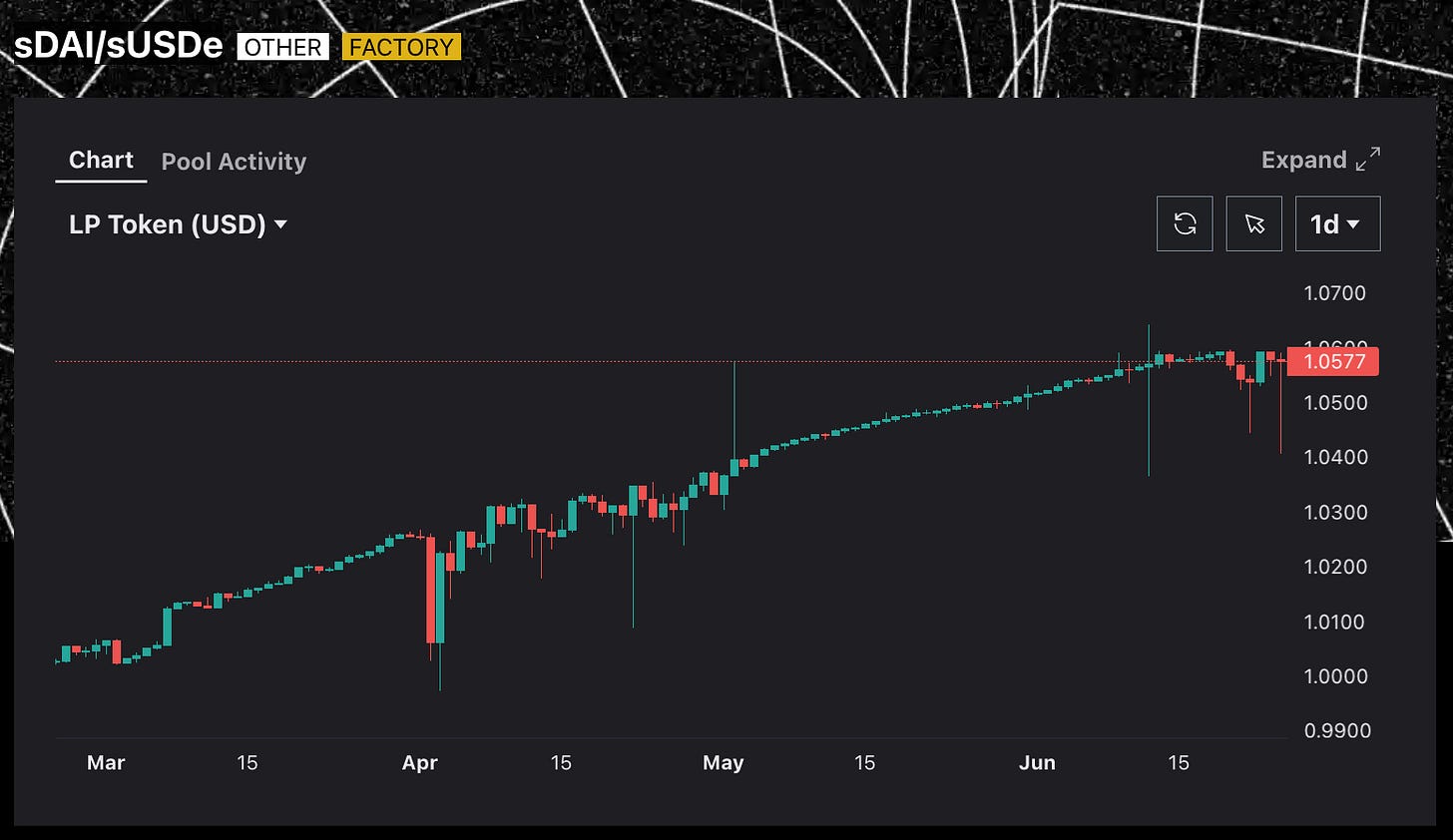

On Curve, the primary hub of liquidity is the sDAI / sUSDe pool, which pairs two yield bearing tokens. You can see that the Ethena stablecoin yield is generally dwarfing the sDAI yield.

The pool is also earning good trading fees without any emissions. You can see that a dollar invested in March would have earned 5.7% already this year.

So it’s already a healthy place to park your money. But, there’s something new afoot.

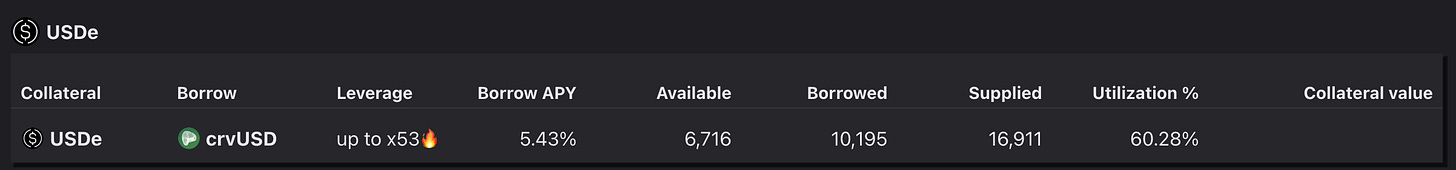

The Ethena team also gets a lot of FUD from the ever-jealous crypto commentariat, and ever so often sees a dip in its price. Curve has the idea of using Llama Lend leveraged trading to allow people to bet on the repeg with 35x leverage to 53x leverage.

So already a lot of quick gains to be had.

Far more so if you layer their points campaign atop. They are offering 5x sats on sUSDe and 20x on USDe.

When you use leverage, it loops this several times, which makes the position substantial. Leveraged points farming!

The link above to the Ethena “money markets” page is accessible here.

If you don’t like playing such games, you can also choose to supply crvUSD to these markets, which can earn well whenever they prove popular.

For what it’s worth, it looks like Mich is here trying to make it all back in one trade…

Morpho

Here’s another good one, where the alfa flows to those who are willing to do the research.

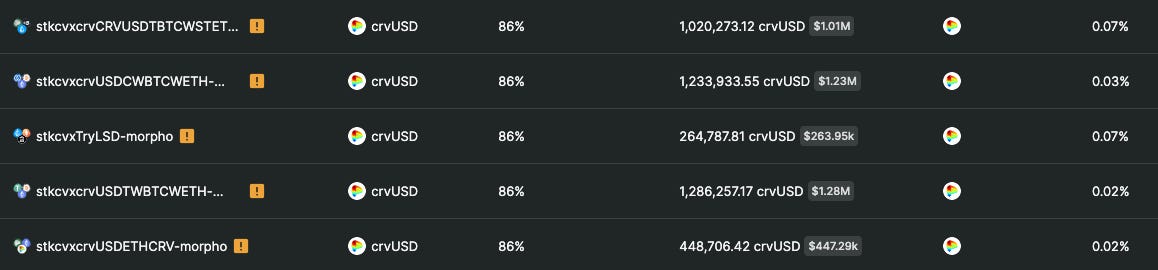

Recently, Llama Risk deployed several Morpho vaults. Once again, the UI doesn’t quite tell the full story.

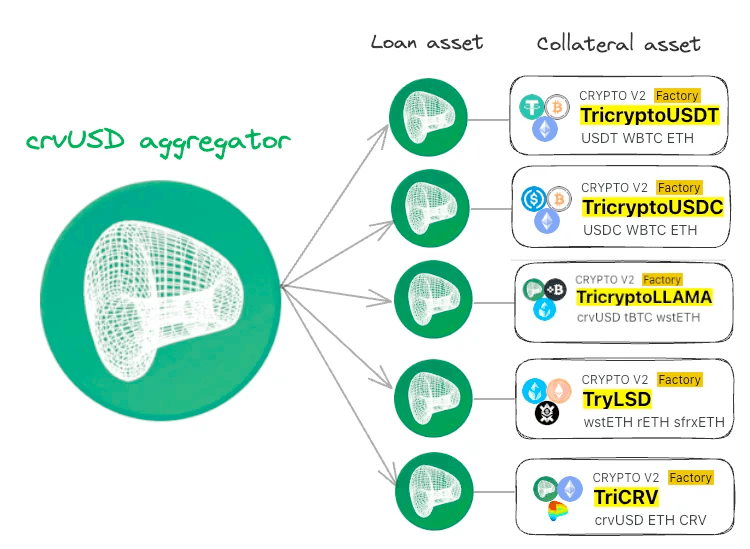

It applies to a handful of TriCrypto pools:

Depending on your mood, you might like the TriCrypto pools that contain several volatile crypto tokens paired with stablecoins, so your LP token gets some (but not all) of the volatility of holding crypto, plus a little extra juice from trading fees.

Or if you just want exposure to ETH, the TryLSD pool has three varieties of wrapped ETH, than earn pretty good trading fees atop the native yield.

Once you have your LP token (don’t stake it in Convex, Stake DAO, Curve gauges, et al), you can head over to Morpho and borrow $crvUSD. Don’t worry, you still earn Convex rewards automatically!

Perhaps due to the alphabet soup that is the LP tokens, few are taking advantage of this so the dynamic interest rate for many of these vaults are just a few basis points. At the moment, it’s basically free to borrow.

You have to monitor your health here, and there’s no LLAMMA to keep this fully passive. And you’ll need to keep an eye on the interest rates. But free borrows of $crvUSD mean you can then farm the $crvUSD elsewhere.

It really is quite a nice deal while it lasts, and among all the strategies we discuss in this article it’s the one the author is most likely to actually try out, since author currently farms modest sized positions in TryLSD, TriCrypto-LLAMMA, and TriCRV on Convex it makes perfect sense. Good then that degens are sleeping on this, but bad therefore that Llama Risk are such clear writers as to make this easy to understand.

Lightning Round

BTC

We know a lot of readers are interested in Bitcoin yields. Worth it to take a look at Mezo, which is building an economic layer that puts Bitcoin to work.

Better yet, they’re offering to boost BTC deposits up to 2x for users who deposit $crvUSD:

veCRV

For veCRV holders, Paladin has a wonderful vote incentives platform, all the more interesting as they recently released v2.

Several protocols are using this to incentivize their Curve pools, good for veCRV voters to get while the getting’s good.

Disclaimers: Author has not used any of these methods yet (soon likely Morpho), so he cannot yet vouch for their veracity. DYOR!