April 11, 2021: Ellipsis Airdrop Optimization

Introducing an Ellipsis claim calculator for estimating airdrop rewards

Even though Ellipsis’s rewards have cooled off to a meager 1600% from their high north of 2000%, apes are still going bananas about this giveaway. Per Ellipsis, about 80% of Curve users are claiming each airdrop.

The Ellipsis airdrop has a lot of game theory baked into it. Right off the bat, there’s the question of whether to claim and stake the airdrop and lose half the value, or just sit it out and keep the whole amount.

If you do choose to claim, then the low gas price introduces a new dilemma of how often do you claim. The quicker you claim, seemingly your rewards would compound faster (fact check needed). If true, then you need to claim fast, but not so fast that gas fees eat into your earnings. Ellipsis users coming from Ethereum may have never known a world where gas is stupid cheap, so this raises a lot of questions.

Tricky right? We spent a couple hours this morning building you calculator to help figure this out. It’s quick, it’s dirty, and it’s hideous. We present it “as-is” (may have errors, it’s not financial advice, etc.). We talk through some assumptions below so smarter people can help us fact check it. That said, our calculator is available here: https://curvemarketcap.com/calculator/ellipsis

Armed with such a calculator, we can start testing some assumptions. For the sake of this article, we assume airdrops occur every 7 days. We select a starting APY of 2100%, decaying by 2% per day, which looks to somewhat match reality (but we haven’t been tracking it too closely). We then assume fees to claim and stake of $2.25

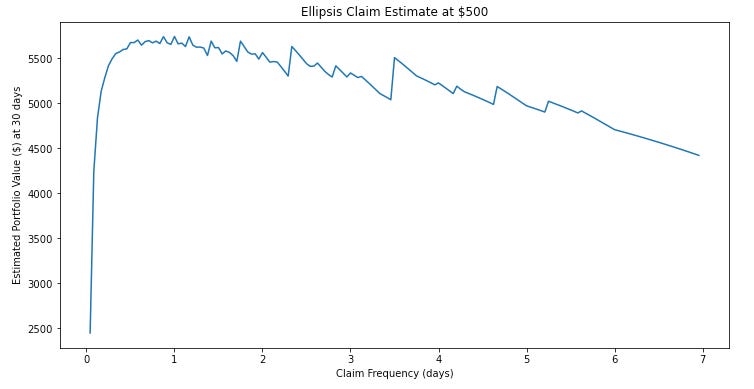

Now, we run this over a variety of different claiming strategies. The x-axis represents our claiming window, with 1 meaning claiming every day, 7 meaning claiming every week, etc. The y-axis represents the value you are left with after a 30 day period. Here’s how the curve looks for a relatively smaller airdrop size of $100:

The jags are where there is a slight discontinuity caused by the claiming frequency. That is, if you claim exactly every 3.5 days then everything aligns such that you immediately capture the airdrop and earn a bit more interest. If you claim every 3.45 days, you miss a few hours of interest, hence the sawtooth effect.

At any rate, the curve above demonstrates that a smaller sized airdrop of $100 would do fine to claim about daily, but claim too much more and they start to lose money. However, this strategy looks to change a bit for larger and larger portfolio balances. Here’s the same math at $500:

If your airdrop is worth $500, the interest becomes substantial enough that you start to lose money if you don’t claim daily. The effect becomes more pronounced at $1K, where restaking multiple times per day becomes an option.

At $10K there’s only a short window of unprofitability

If your airdrop is in the Egorov/Yearn god tier above $100K, you may want to look at claiming and restaking on a block-by-block basis:

Of course, these are all just estimates. We recommend you print these out, toss them into the dumpster, and find a good accredited financial professional who will recommend you buy something like JNJ instead.

One wrinkle we didn’t even try to account for would be to account for the declining value of $EPS, which started around $8 but has since dropped to about $4. We just held it fixed, assuming the portfolio value at realization is the important effect, but perhaps you might account for this by increasing the decay rate or something.

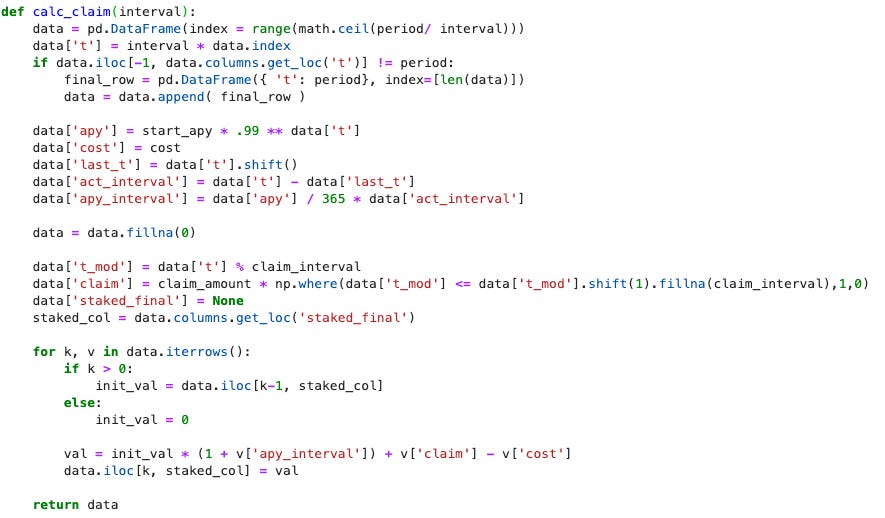

In the interest of transparency, here’s the code we’re using to power the calculator — if anybody alerts us to any errors (we’ve only had 3 cups of coffee so far!), or provides suggestions for improvement, we’ll update this article accordingly and make notes.

Have fun!

** UPDATE: The code as pictured idiotically hard-coded the decay rate (which should really be called sustain rate too) — it is fixed but the screenshot is not yet updated. Thx to @BugFix and @andybeers for finding errors

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice, except perhaps the advice to find a real financial advisor. Author is a maximalist of Curve and any Curve forks.