April 11, 2022: Curve Smart Router 🧠💱

New curve.exchange frontend, cross-chain boosties, and $FPIS airdrop

Weekends in DeFi are the best. Gas fees are cheap. VCs and their projects are quiet. Highest alfa to noise ratios.

The most dependable devs don’t discriminate against days that begin with an “S.” If anybody created an index that tracked projects by weekend Github activity, I’d be all there for it.

This weekend brought us three notable releases from the Curve and Convex ecosystem:

Curve Smart Router

The Cambrian explosion of v2 pools has been a wonder to behold. We’re up to 27 crypto pools with over $1MM in volume on mainnet, and several more working through the pipeline. Per Metcalfe’s Law, the capability of Curve to route among any assets becomes increasingly powerful as more viable pools get added to the network.

Notably, Curve’s router is extremely efficient due to the bespoke math underlying these pools. Several Curve fans first fell into the black hole simply because of an appreciation of the advanced math.

However, what works great in theory also needs to work in practice. To date, the efficiency of Curve v2 routing was only on display to those who did a lot of heavy lifting to calculate and optimize the routing directly.

Curve’s efficiency is now available to all, with the soft launch of curve.exchange.

The new Curve Smart Router directly solves the NP-hard problem of identifying optimum routing. Casual apes can now enjoy Curve’s pricing with relative ease.

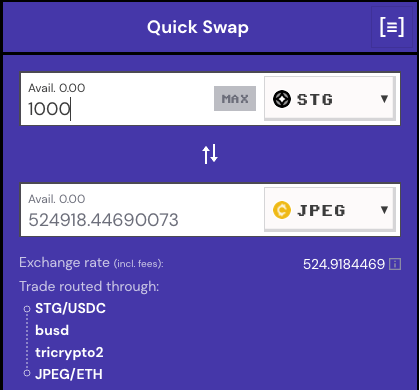

Playing with the frontend, we’ve been able to uncover routes as complex as four hops:

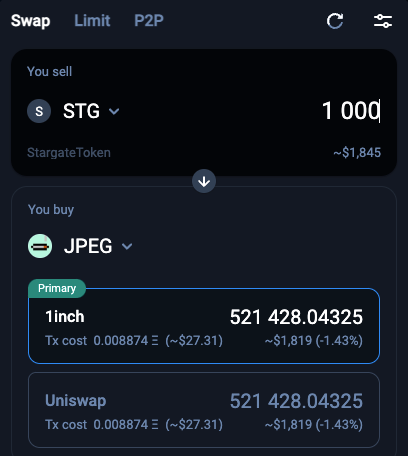

One might expect routing through four pools like this example could be inefficient, but Curve’s algorithm is quite good. Same quote, same time on 1inch:

While doing some weekend portfolio rebalancing, I found myself spot checking the Curve router against other aggregators in case I was getting a bad deal. In every case I tested, Curve routing netted me a few extra tokens. All moves stayed in-house and accrued trading fees back to the flywheel.

Granted, I was mostly rebalancing among Curve pools so I may have been cherry picking tokens where Curve’s router has a natural advantage. Also, the routing is only available among tokens where Curve has viably sized pools.

Under these conditions, where Curve moves through pools of decent size (~$1MM), I’ve found very few cases where the Curve router is less efficient for small trades than the prices displayed on aggregators.

Others also observed the same efficiency on display while playing with the site.

Much of the 300 year bull case for $CRV hinges on significant trading volume finding its way through Curve v2 pools. If Curve routinely provides traders the most efficient routing on most trades, what do you expect will be the outcome? Will traders routinely select options that lose them money?

The biggest obstacle now is aggregators that don’t yet list Curve routing.

Many of these routers present worse quotes because they haven’t integrated the previously opaque Curve routing. We suspect they won’t be satisfied to display inferior rates forever, lest they lose the trust and traffic of their users.

The new endpoint also features a much-anticipated upgrades to the overall UI. Over the weekend users marveled at not just the efficiency, but also the new design. Our prior sneak peek at the UI was fairly divided amongst armchair aesthetes, but the newest iteration appears to be overwhelmingly well-received.

That said, the site is still in beta. Use at your own risk and expect plenty of rough edges. If you do find these bugs, or have feature requests, feel free to report them to me, and I can make sure the right people on the team are made aware.

Cross-Chain Boosties

Curve also took a major step in fleshing out the much anticipated cross-chain boosties:

Observant readers may object that we already have a handful of gauges for cross-chain boosts. Specifically this proposal seeks to upgrade prior gauges to a newer gauge standard, providing for a simpler, unified infrastructure. In the new world order, these gauges will be completely permissionless and not require dev team intervention.

Therefore, this is the missing piece required to enable v2 factory pools in all their permissionless glory on sidechains. Devs have their hands full keeping up with one such factory on mainnet, but this makes the process manageable.

The current gauge vote is therefore critical. With the vote yet to pass quorum, take a minute to review carefully and vote your conscience. Of course, take time to due your due diligence first.

We’ve seen bridges are common sources of hacks elsewhere in DeFi, so more than usual it’s useful to observe the careful implementation in the github repository. In particular, Curve is leaning on the launch of Multichain’s new AnyCall protocol to communicate among chains.

Yes, ser, we do remember! Kingmaker $CVX also had a productive weekend as well...

$FPIS Airdrop

Airdrop season continues, as the much anticipated $FPIS airdrop is now claimable.

The formal documentation will trickle out soon, but essentially the $FPIS is the governance token for the new $FPI stablecoin that adjusts for inflation, which is certainly a hot topic in money-printing nations.

Along with the airdrop came the routine drama about insta-dumpers.

We have a tough time getting too caught up in short term price fluctuations. We find the idea of a stablecoin that keeps pace with inflation to be extraordinarily promising.

We also wouldn’t even necessarily believe it could be done, except for the fact that the FRAX team has a habit of turning the impossible into the possible. Count us bullish.

Disclaimers! Author has $CRV/$CVX/$FXS but sadly and stupidly has no stake in the $FPIS airdrop because he also failed to follow the explicit and rather easy instructions. Apparently others also suffered the same brain lag. Still, we wish well to everybody who got their stimmy.