Since the newer subscribers don’t have the benefit of having followed this blog for four years, let’s reiterate our mission statement here.

This is not a blog focused on cryptocurrency prices or trading. If you’re looking for tips or hints on how to get rich, please look elsewhere. We never have, and never will, offer financial advice.

We don’t just recite this to cover ourselves. We don’t offer financial advice because our advice is boring. Our primary investing strategy is basically just holding Bitcoin. This worked well enough for us that we have some degree of financial independence, and choose to repay this by directing the bulk of our efforts into contributing to the crypto space.

Our blog is focused on unpacking and explaining the most interesting technology and products being built in the crypto space. This led our attention away from Bitcoin, which is technologically quite boring, to the epicenter of innovation that is Curve.

From a technology point of view, most of crypto is relatively uninteresting compared with the development emanating from Curve (recently… v2, NG, and LLAMMA all remain relatively poorly understood).

If other pockets of crypto start to emerge as hubs of innovation, perhaps this blog will shift its focus. We do occasionally stumble across interesting developments (and usually cover them), but so much of the crypto market in 2024 is about dumbing things down to appeal to dumb money.

Please don’t mistake a blog that is interested in technological and product development with a blog that will get you rich. If you’re looking to get rich, there’s surely blogs out there with 100x the readership that focus on picking the right memecoins… maybe you’ll get lucky there? We have no illusions this is the current state of the market.

Investing in technological acumen (what one might consider as “fundamentals”) is likely a bad strategy in crypto, or anywhere really. Boomers know this in the “VHS beat Betamax” analogy. For Zoomers, ChatGPT suggests an appropriate analogy is Snapchat Stories losing to Instagram Stories. The price of a technological breakthrough is prohibitive, the cost to copy it is lower.

As an investment, the $CRV token has inarguably been a poor investment as of April 16, 2024. We hope this fact shakes out the tourist type readers who are here hoping for quick profits. Begone! We prefer our smaller niche readership focused on tech and product, because they’re more interesting to chat with.

We’re here for however long Curve keeps pushing the frontiers of what can be accomplished onchain with pure math and code. We sincerely hope this is why you’re still here reading, and we hope this is the reason our blog continues growing despite the fact that $CRV sentiment is in the toilet.

The Toilet

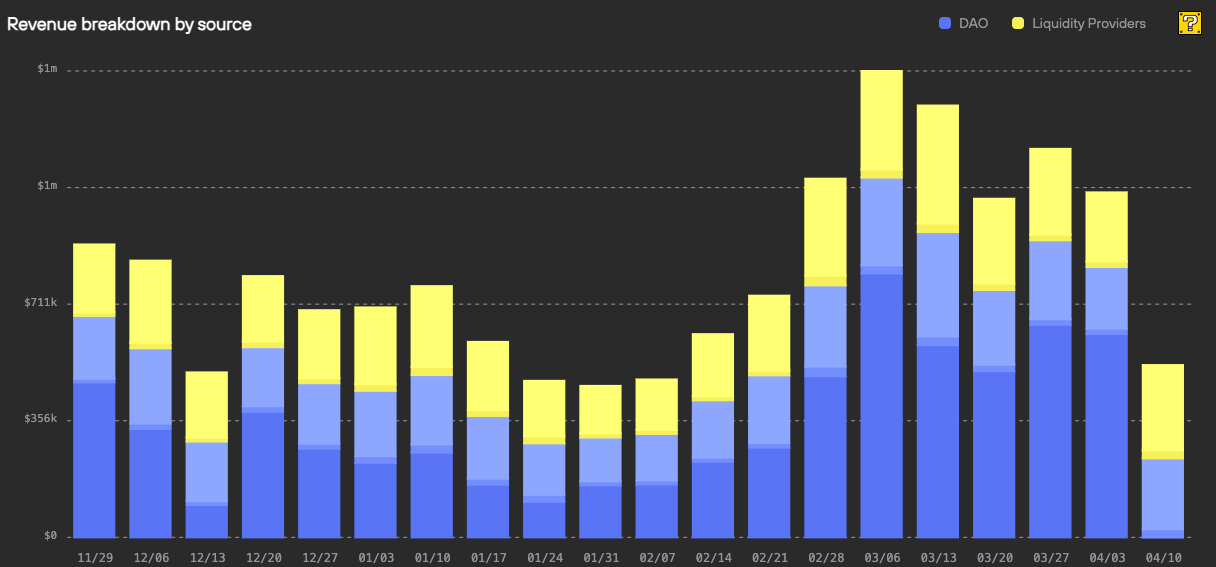

It’s a funny thing, that veCRV yields from fees (not looking at incentives here) are consistently pushing highs around $0.08, at a time the $CRV token is pushing all time lows.

The $CRV Social Channel on Telegram is ordinarily a fun time… a bit like a casual happy hour gathering where people chill and joke around through thick and thin.

However with $CRV’s recent price action, it’s become a sewage pipeline the past few days.

We struggle to imagine a less productive use of one’s time than showing up in a chat to complain about bad token prices. If token is so bad, you should just short $CRV instead and get rich off your brilliant insights? It’s easy! You can even do it for extremely cheap on Llama Lend…

If they’re not putting their money where their mouth is, we have to conclude the whingers are either poor, stupid, or lacking sincerity. We wouldn’t have the willpower to tolerate this barrage of negative energy, so massive respect to the bespoke admins who work tirelessly to mute the trolls and keep the vibe flowing.

April 2024 is not a terribly popular time to be a $CRV bull, but some in the channel do make the case…

One of the most relevant comments to emerge from the chat concerns Mich’s plans.

This stance doesn’t appear to satisfying his fiercest critics, but this strikes me as the proper tone. For one thing, complaints about what Mich does with his private wallets are disingenuous. The haters won’t become advocates if he caves to the mob.

For our sake, we wouldn’t be terribly interested in projects where the founders were overly focused on playing random games with ponzinomics to try and juice token prices, (though we concede this may be a good growth hack to get started!) Markets will do what markets will do, and budging a token away from its fair market valuation is a bit like pushing on a rope.

Focusing on driving more revenues and value to the token is very much under the purview of what the founders can and should realistically control. $CRV initially had value from stablecoin trading. Through ingenuity, v2 layered on revenue from volatile trading, which was a purely additive source of revenue. The competitive DEX business is of course tough, with the market driving fees towards zero. Fortunately, next came the introduction of $crvUSD and LLAMMA. This effectively diversified revenue streams and doubled to tripled revenues without undermining existing revenue streams (likely improving these streams at the margin). Impressive.

Isn’t this exactly what we want out of a founder? To drive revenues?

As a result of his efforts, veCRV is consistently hitting highs. As a believer in efficient markets, what to make of $CRV token price pointing towards all time lows?