April 18, 2023: Shapella's First Week 📊🥩

10 Charts that Tell the Story of the Ethereum Withdrawals Era

As we approach the first week since Shapella, let’s pick out 10 charts that sum up the story of how it all unfolded and where we’re going.

1. Inflows & Outflows in ETH -

This is the our favorite chart that visualizes the full story. Immediately after Shapella, a hefty batch of withdrawals. Presumably some people had been staked for a while and needed some money badly.

But then… the withdrawals tapered off to almost nothing. Very few people withdrawing principal, just a trickle of rewards. But more notably, the deposits picked up in a big way, seeing activity that was uncommon before the historic event.

2. ETH Withdrawals - TokenUnlocks

Focusing on withdrawals, we can also forecast a bit forward into the future by looking at the queue. At the moment it’s quiet and getting quieter. Bookmark this site though, when $stETH starts allowing withdrawals you’ll be able to get the first look into the future.

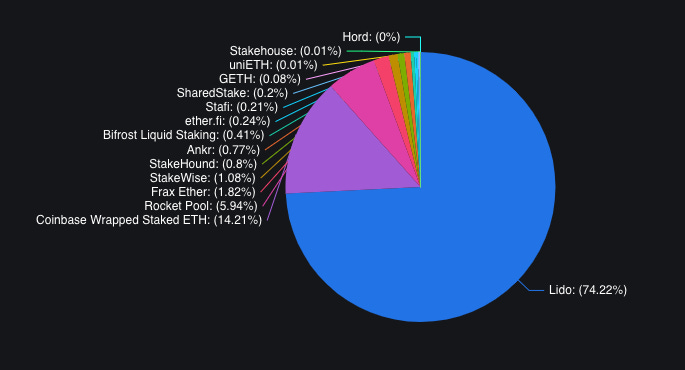

3. Total Value Locked ETH LSDs - DefiLlama

As of the date Shapella went into effect, Lido officially won the staked ETH wars. The protocol started early and had an insurmountable lead. The above chart demonstrates quite how dominant Lido wound up.

Could this be a turning point though? Lido will open withdrawals soon, and what might happen? Well, we can already see. Coinbase’s $cbETH is the first to enable withdrawals, and it’s shifted from up-only to slightly in the red.

But the real story might be the movement on the other tokens in the withdrawal era. Yes, Lido is still gaining, but at a rate of just 2%. The big beneficiary is clearly Frax’s $frxETH.

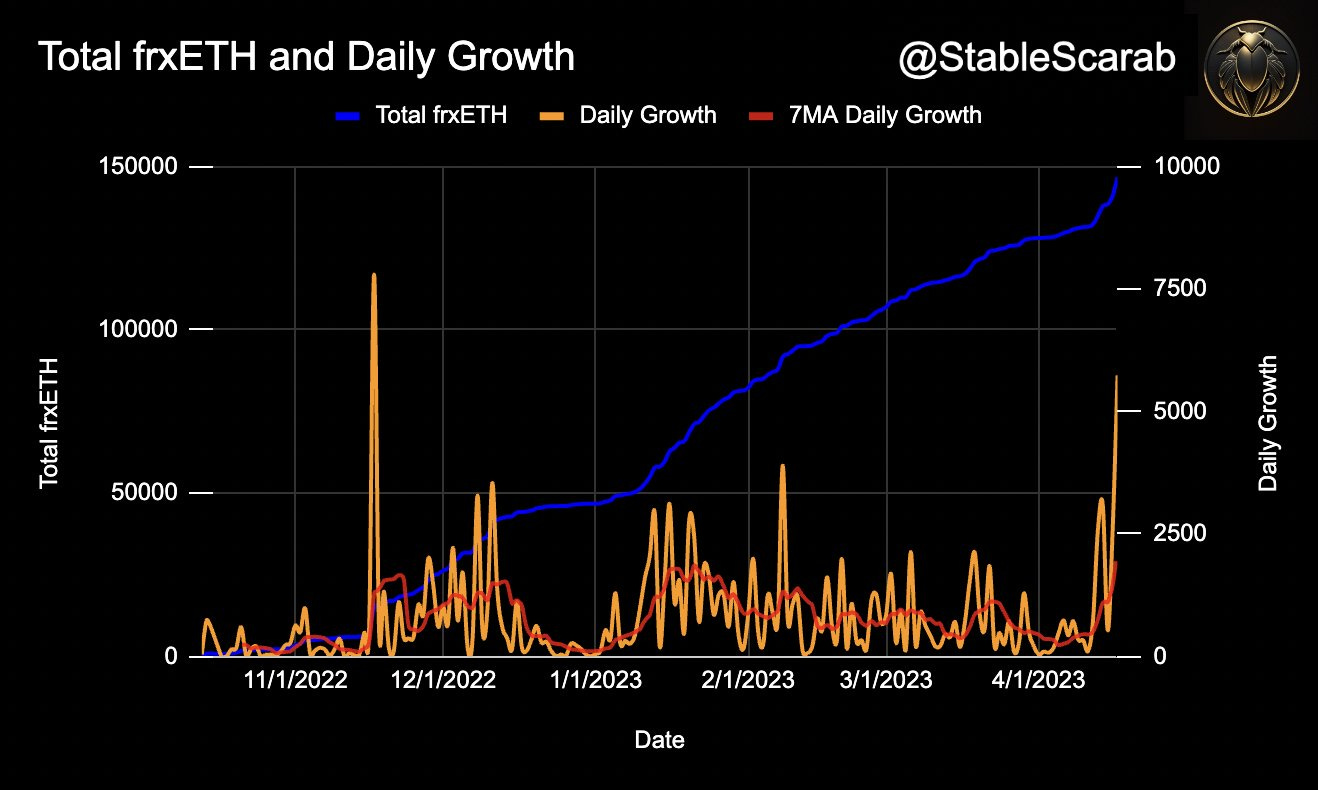

4. Staked ETH per Protocol (log scale) - struct3r

This chart excludes $cbETH, but nonetheless shows the massive success of Frax as a relative latecomer. Despite launching almost a year after Rocket Pool, they may conceivably catch up sometime this year.

The seemingly linear growth here also masks the fact the chart is on a log scale. That’s exponential growth!

5. Curve.fi ETH / frxETH -

Frax’s $frxETH clearly has the big momentum at the moment. Looking into the health of its Curve pool provides a nice snapshot into its growth. Reserves crossed $150MM and show no sign of slowing down. More interestingly, trading volume has moved from an afterthought to significant.

How long can it continue? For the moment, the Frax pool is yielding upwards of 6.2%, still best in class.

It’s Frax’s world at the moment, we just live in it.

6. cbETH: Volume Share by DEX - smyyguy

Over the past few months, Curve has been making some modifications to its pool structure to capture more volume, and it is working. The Curve share has been up only. The potential launch of next generation v2 pools could knock out some of the gas issues which plagued small traders, meaning the trading world is becoming more competitive.

7. Rocket Pool Price Chart - CoinGecko

The biggest speculative winner of the batch is Rocket Pool’s $RPL token, whose price has ticked up in ETH terms in the wake of Shapella.

Curiously, the same can’t be said of $FXS, which has been flat to slightly down on the same period.

Or Lido, which has been down only.

Speculators have offered their two gwei, and they’re betting on Rocket Pool.

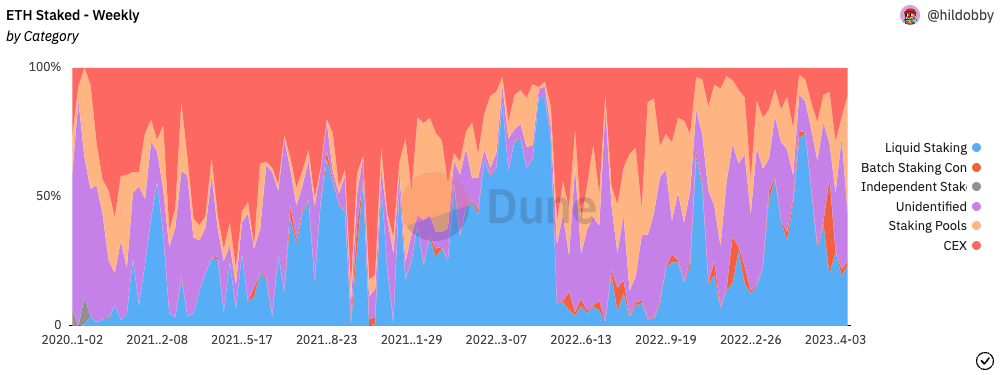

8. ETH Staked - Weekly by Category

In another gem of a chart from Hildobby, we see the story of precisely who is staking. Once upon a time it was heavily CEX, but the effects of the bear market reduced CEX dominance to near nothing. Good for ETH decentralization.

9. ETH Supply - Ultrasound.Money

The usage of Ethereum since Shapella has been crazy. We’re burning $ETH again, with seemingly no respite in sight. We know that future Ethereum upgrades will target scaling, and surely the poors on-chain hope this makes a difference.

10 Average Gas Price Heat Map - BlockNative

Interestingly, the surge in Ethereum usage did not start immediately after Shapella, but it’s only really picked up steam in the past day or two. We don’t know if this is due to some wild NFT mints or is emblematic of a more permanent trend, but gas bills look like they are becoming an issue again.