April 19, 2022: Curve Stablecoin? 🪙💭

@crypto_condom and @_bout3fiddy_ imagine a Curve stablecoin

Rumors have been circulating about a hypothetical “Curve Stablecoin.” What is this? Why might this be useful?

As long as we’re wildly speculating, we thought to ask the experts. What follows is our interviews with crypto experts @crypto_condom and @_bout3fiddy_ about a stablecoin and much more.

This post is initially reserved for paid subscribers. After 24 hours the post will be unlocked and made public for all.

CMC: First off, for people who don't know you, tell us anything you'd like to share about your background

CC: Former electrical engineer; now healthcare worker. Early Ethereum miner before studying FA based investing.

CMC: Based indeed! Lately you've been keeping the crypto community safe, and teasing the concept of a Curve stablecoin. What do you know about such a stablecoin?

CC: It is important to note that a Curve-based stable coin has not been officially confirmed or announced by the platform. That said, rumors of such an offering originate from Telegram posts that Michael has posted on the Russian Curve TG. Posts there suggest that he has been working on a Curve-based stablecoin with the potential to leverage LP positions + possibly more.

CMC: There are already dozens of stablecoins. What would be the value of yet another stablecoin?

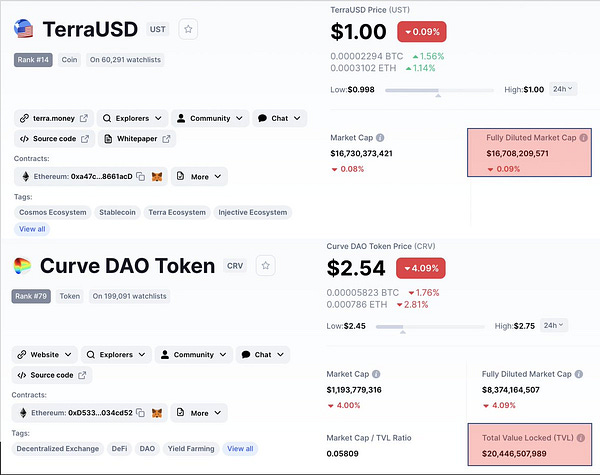

CC: It is difficult to speculate without concrete information. However, hypothetically, the token would be leveraged on the Curve Finance platform TVL to partially or fully collateralize the token, a cUSD, if you will. Since the Ethereum-based TVL is currently $18b for the Curve platform, this would permit the stablecoin to launch with significant collateralization.

Furthermore, Curve is a battle tested protocol with a reputation for safety and efficiency. I think a lot of institutional investors and whales would feel more comfortable using an all-in-one cUSD based position than using an outside protocol which then leverages Curve positions. Lastly, because Curve emissions can be directed to a gauge to used to incentivize liquidity, cUSD could be paired with 2pool to (potentially) offer high liquidity & lower risk of depegging than other alternative stable coins.

CMC: cUSD == Condom USD?

CC: Damn right

CMC: Entering the realm of speculation, if you were designing such a coin, how might you set up the tokenomics to reinforce the broader Curve-Convex flywheel?

CC: I would offer low interest, possibly 0% interest loans to veCRV holders to incentivize borrowing. Weekly 3crv fees could be optionally redirected to the loan to permit self repayment. 90% of liquidation fees could be directed back to platform stakers as yield to incentivize further locking & TVL while 10% of fees could be set aside to “bribe” for increased gauge weight of a cUSD based LP

No-veCRV Borrowers would pay a dynamic interest rate with a target utilization ratio of 80%. When utilization is low borrowing/lending rates are also low. When utilization rates exceed 80%, the borrowing/lending rates increase exponentially - for borrowers, this disincentives borrowing whilst for lenders this incentivizes providing liquidity. All else equal, borrowers will pay back loans and lenders will provide additional liquidity so utilization tends towards 80%.

CMC: You'd mentioned that the coin could capture significant market cap (link) -- do you think it could find itself in competition with some of the other major stablecoins?

CC: As a likely collateralized stablecoin, a cUSD could never be printed at will like certain algo-stables. Its primary utility is presumably predicated in safe lending on the curve platform itself which is a very narrow focus that is unlikely to detract or compete with other major stablecoins.

CMC: Not financial advice of course, but what do you think this all this means for people's bags?

CC: I think anything that Michael designs will be innovative and highly likely to increase Curve platform TVL. More TVL results in more fees for stakers. This will increase demand for CRV and curve ecosystem related tokens like CVX & FXS

CMC: Any parting thoughts?

CC: In volatile times like these, the importance of safe, battle tested smart contracts and consistent yield cannot be underestimated. Curve is a liquidity moat that acts as the lynchpin of DeFi; it should not be underestimated in terms of what it may accomplish…and the value prop it can offer to investors.

CMC: First off, congrats on joining the Curve team officially! For people who don't know, what's your background?

~3.50: I have a PhD in building science algorithms that decipher level 1 data from space based instruments (PhD defense in September). During my PhD I worked with the European Space Agency to build a level-2 data processor for the Sentinel missions. Soon after joined an org in the energy markets as a data scientist / quant and built algo trading modules, real-time steering algos for large windparks. Was quite into web3 because of Charles Hoskinson and Cardano before I realised 'where are the builders?' and happened upon Ethereum.

CMC: There's been a few rumors floating around that Curve may issue it's own stablecoin soon. Knowing that this isn't within your scope at Curve so you're just speculating, not commenting officially, what do you think it might look like?

~3.50: Assuming this does happen:

it would be collateral backed (since that's a tried and tested framework, with good performance in extreme volatility for certain assets).

Knowing that it is Curve that would issue these hypothetical stablecoins, the collateral would have to be an existing curve product (an AMM LP token).

Knowing it could be an LP token for this 'hypothetical' Curve stablecoin, the question is whether it would be a v1 or a v2 LP token (or both?). Will there be a bias for a particular kind of collateral? I suspect (as reality has shown) some collateral (ETH) are better suited than others (Shiba).

There's more than just collateral in stables. The primary concern is to avoid bad debt.

Simple ways to avoid bad debt are: good liquidation engines, good collateral (widespread liquidity, deep liquidity across cexes and dexes of underlying assets). I suspect this hypothetical Curve stable (if it does exist) would try to innovate in these fronts.

CMC: How innovative would you expect? Would this look similar to existing collateral-based stablecoins, or might Michael try for another revolution in DeFi?

~3.50: I would expect something nobody has thought about before. And something that doesn't require active management.

I say the latter because: concentrated liquidity was an active management endeavour before Curve v2 arrived.

So I tend to think Mich likes algos and methodologies that are passive in nature. as do Curve devs (see the recent cross-chain gauge improvement which requires no active gauge management)

CMC: Much to the delight of LPs too!

There's already a few dozen stablecoins -- and arguably several Curve stablecoin LP tokens are already stablecoins. Who's the target user for a crvUSD?

~3.50: That's an interesting question indeed. Stablecoins tend to have a property/utility baked in to their mechanics. I guess the innovation that most decentralised stables have missed (except DAI for example) is willingness to hold the stablecoin. I assume that the mechanics that back the stablecoin would be sound enough to not have to worry too much about risk, making it more desirable to hold.

Even the famous seven siblings that mint a significant amount of DAI had to worry about their Maker vault when the market tanked. I guess the innovation would have to be: the market is tanking, but I don’t need to worry.

And hence, I will hold my stable.

(just riffing here, don't really know what's cooking)

CMC: THIS IS MY CRVUSD. THERE ARE MANY OTHERS LIKE IT, BUT THIS ONE IS MINE. MY CRVUSD IS MY BEST FRIEND. IT IS MY LIFE. I MUST MASTER IT AS I MUST MASTER LIFE. WITHOUT ME, MY CRVUSD IS USELESS. WITHOUT MY CRVUSD, I AM USELESS.

~3.50:

CMC: We're obviously getting deep into speculation, but any thoughts about how a crvUSD might fit into the broader flywheel tokenomics. ie Convex, Union, Curve Wars, 4pools, etc

~3.50: I'd say it's quite early for all of that. If at all such a stablecoin would exist, the plethora of innovations would take months for people to understand. Curve would obviously want such a stable to have deep liquidity and a good peg, which may or may not require bribing (veCRV holders). Beyond that, getting a stable adopted by the wider economy is not a joke. There, I would say, a loooot of work needs to be done by the curve community.

CMC: Any parting thoughts?

~3.50: Curve is community owned. Sure, there's a requirement to own a piece of curve to have a say in how the protocol evolves, but lots of people tend to think that you need to be a whale to make a difference. I'd like to challenge that. A diligent shrimp can out-do a lazy whale. So, this is an invitation to the broader curve ecosystem to buidl cool stuff on top of curve and its bountiful gauges!

Sometimes, providing value can be as simple as assessing risk of assets traded on Curve pools.