Think back… all the way back to last week. That crazy bygone era, when you were buying jewel-encrusted monocles instead of filling out job apps for McDonalds. You may vaguely recall the pre-launch announcement of Convex Finance.

The team is working fast towards their upcoming launch date. In fact it’s already up for a gauge vote.

Ahead of schedule and under budget! What else should we expect from Convex other than a demonstrated ability to execute?

Specifically, Convex will make it easier to ape into Curve and receive the maximum boost. Curve’s tokenomics are phenomenal, but if you don’t properly proportion your money for best rewards, you’re leaving money on the table. Convex aims to simplify the process.

Per their abstract:

Convex Finance provides a boost to Curve LPs without auto selling rewards while taking a small performance fee on only CRV itself.

Convex Finance provides more rewards to CRV stakers by passing performance fees to CRV stakers along with their normal 3CRV rewards untouched.

Convex Finance hopes to simplify the Curve boosting system and provide more incentives to locking CRV

Convex plans to accept $CRV and lock it indefinitely, providing users a $cvxCRV token in return they can convert back through incentivized pools. Performance fees are distributed to $cvxCRV holders and $CVX stakers. $CVX is the governance token, which will be airdropped to current veCRV holders. If it sounds like alphabet soup, then maybe it’s good for you.

This particular gauge vote simply approves adding their CurveVoterProxy contract to Curve’s Smart Wallet Whitelist, so it can lock CRV and run all the other fine calculations necessary to achieve max boost.

Convex is supported by the Curve team per their proposal. No doubt because Convex’s homepage, much like Curve, sports a beautiful UI:

The DAO vote is up now, so you should read through their announcement and governance post and cast your ballot.

We’ve not seen anybody articulate an argument against the proposal — maybe if you’re heavily invested in a service like yEarn that could be in competition you might be opposed?

The arguments for voting yes are more loudly articulated.

This includes the likely airdrop for veCRV holders.

It’s even plausible that you could earn $CVX tokens for voting for the proposal:

Of course, Curve users already do their civic duty and vote heavily even in the absence of incentives.

With the yes ballots currently leading the vote, some speculators are already loading up on $CRV.

As a truly random aside, we can’t think about Convex without evoking the person most fooled by nocoiners… Nassim Nicholas Taleb.

Taleb writes frequently on the topic of convexity, and despite Taleb’s boomer stance on the emerging economy, some of his writing is worth reading. His thoughts on seeking systems with “convex benefits” — antifragile systems that gain from disorder — nicely comports with the strategies of many of the people who became wealthy crypto.

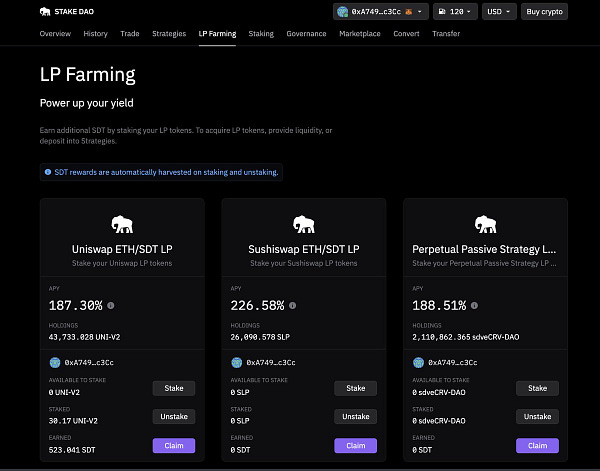

Indeed, the existence of Convex Finance could open up such antifragile opportunities. Consider the effect of $CVX on StakeDAO’s Perpetual Passive Strategy:

So even though Taleb is surely not connected with Convex Finance and hostile towards crypto, the cryptocurrency space may well prove his thesis of convexity — an antifragile outcome if ever there was one.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a Curve maximalist, owns nothing else mentioned here.