Stake DAO has posted a proposal to the governance forum requesting a gauge for three pools, including the $sdCRV/$CRV pool that’s becoming contentious.

We first described the Stake DAO’s liquid Curve last Thursday. However, the proposal is hitting some friction as a gauge vote has hit the governance forum.

Stake DAO is one of the three whitelisted proposals on Curve, along with Convex and Yearn. Convex for its part has been the most successful with its whitelist powers, earning about 50% of veCRV governance power and passing much of this through to its users through its vlCVX mechanism.

Stake DAO’s $sdCRV represents an even more liquid version of veCRV. StakeDAO describes the mechanics in their launch thread from last week, in which CRV holders can deposit $CRV for $sdCRV and further boost this by acquiring StakeDAO’s $SDT.

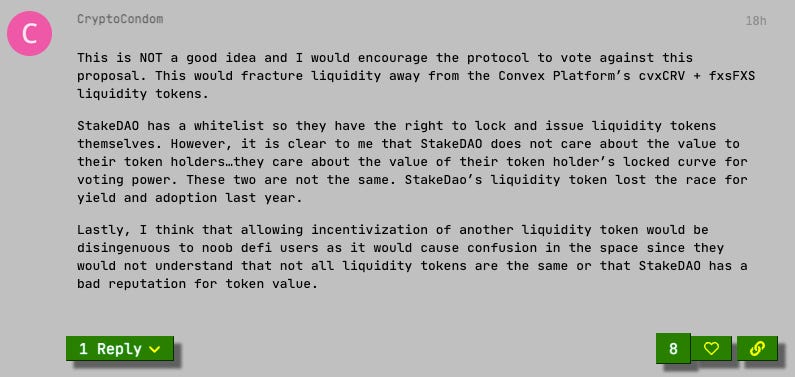

In pursuit of a Curve rewards gauge for the pool, the protocol’s proposal has drawn scrutiny, most vocally articulated by longtime proponent of protection @crypto_condom:

Several members of the Curve community are fiercely protective of the whitelist, last tested when a vote to remove the whitelist failed last year.

0xLeibniz also raised red flags, citing concerns that a liquid veCRV mechanism could put CRV governance at risks like flashloan attacks.

A flashloan attack on governance famously erased $182MM worth of value from Beanstalk Farms about a week ago. This hack, tragic on its own, also had the additional drawback of giving crypto’s opponents yet more ammunition. Naturally, the story was dutifully picked up and amplified globally by legacy media companies eager to hype anything that makes crypto look bad — observe also Time Magazine managing to conjure a negatively framed headline for an otherwise glowing puff piece on Vitalik Buterin.

At any rate, we have desire to protect the ecosystem beyond mere optics. User @Tube replied to 0xLeibniz’s comments, citing the protective mechanism of snapshotting a block height for governance purposes.

Outside of these notes of caution, the comments in the forum have on balance been receptive. Early returns in the signal vote are in favor, albeit we don’t know how many votes were cast before concerns were flagged.

In a lengthy post, @Hatashi argues in favor of the proposal, citing an interest in offering an “alternative to Convex.”

Supporters of the proposal are carefully choosing their words so as not to frame this as an attack by StakeDAO on Convex. Convex’s full-throated opposition to removing the whitelist helped sink the prior proposal.

So how should you vote on this?

Not the wisest idea to wait for my endorsement. I’m an empty suit if ever there was one.

At the moment I’m not issuing an endorsement either way because I still consider myself underinformed (and my voting power is miniscule anyhow).

If $sdCRV is indeed the threat cited by opponents, then halting a gauge would not stop any negative effects, but merely slow them down. A gauge could compound any issues, but if $sdCRV found product-market fit it would likely gain steam without a gauge (an interpretation @crypto_condom concurred with via DM).

To combat an existential threat, the only actual protection would be the severe and potentially fatal step of stripping Stake DAO of its whitelist, something nobody has yet argued is warranted in these circumstances.

Reviewing the audits linked in the forums, auditors cited pages of possible issues as one might expect from a thorough audit. In their reply Stake DAO claims to have resolved several of these issues. Before I could comment, I’d need more time to follow the paper trail and properly review the auditor’s findings and Stake DAO’s corrections. However, at the moment I can’t track down the Github repository linked in their audit, presumably a private repo, so I’m slowed a bit by needing to parse through Etherscan contracts.

Stake DAO’s reply does make it explicit that the “veSDT contract is upgradeable.” For newbies, it’s useful to highlight that contracts that are upgradeable are at heightened risk of wrench attacks. Curve itself goes out of its way to build non-upgradeable contracts for this reason. It elevates the stakes in deployment (no capability of patching bugs later), but thankfully Curve’s chad devs have avoided any severe issues that might be caused by non-upgradeability.

We’ve also seen issues in the past where CRV-pegged tokens failed to maintain their peg. Yearn, who also has a whitelist, found their CRV token lose value against raw CRV.

Without better understanding of the tokenomics, I also couldn’t comment on the likelihood of $sdCRV holding its peg. If it’s directly redeemable then it’s probably little concern. I couldn’t immediately figure this out trying to piece together the math. The Stake DAO webpage cites 4.4MM CRV locked, a value derived by querying Curve’s veCRV amount for their CurveYCRVVoter address. This 4.4MM value is therefore quite trustworthy.

Where I need better understanding of the math is how this connects with the values of 3.4MM sdCRV and 2.7MM sdveCRV-DAO pulled from the totalSupply function on these other seemingly relevant contracts. I don’t yet know how these numbers are meant to tie into the tokenomics, if at all, and I didn’t grok it readily just by reading through the announcement. My leftwit brain just tries adding these together and getting confused it’s 6.1MM and not 4.4MM.

Again, there’s not necessarily any particular issue here — it’s possible the protocol is in fact overcollateralized. I just don’t tend to personally ape until I appreciate how the moving pieces fit together. Bear in mind, I’m also usually the last horse to cross the finish line, so I miss out on lots of opportunities in the process.

At any rate, all you bigger brains should do what the DAO is designed for. Weigh in! Talk! Chat! With a possibly contentious proposal, the more brains you can get in the discussion, the sooner fence-sitters like me can feel comfortable taking a side.

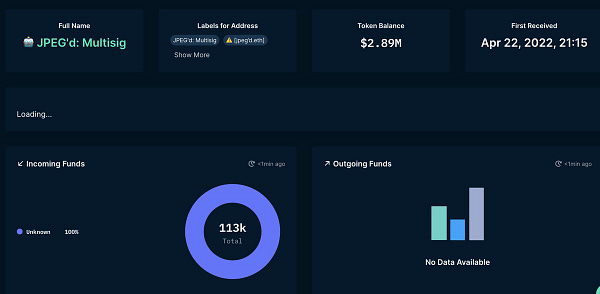

Elsewhere in governance, a vote for at least one JPEG’d gauge has passed.

JPEG’d has become the biggest mover over the past week in the Convex Wars.

$JPEG is the governance token of JPEG’d, and the first of at least two pools the protocol is planning to incentivize. The protocol’s dollarcoin $pUSD is also up for a vote, with no forum discussion at the moment. $pUSD is planned to become the coin issued to users who stake NFTs on the platform, becoming a critical piece in the JPEG’d infrastructure.

All-in-all, this ended up as a particularly exciting weekend for the flywheel. Amidst an otherwise sideways-to-down market, Curve actually enjoyed some upwards price movement.

This came largely through a small number of wild whale moves.

Given the lock as $cvxCRV, this has users excited for $CVX, which has seen its price push downward over the same interval.

For the sake of $CRV, what’s not to enjoy?

Disclaimers! In addition to flywheel assets, author has exposure to $JPEG