April 27, 2021: $AAVE Your Cake and Eat it Too 🎂😋

AAVE approves liquidity rewards for both borrowers and lenders

POLONIUS: Neither A Borrower Nor a Lender Be

AAVE: Why not both?

That’s right… this move is so classic we’ve got to bust out the rare and super-unpopular Shakespeare memes for this one. Just yesterday the AAVE DAO approved AIP-16, bringing liquidity mining to the popular protocol.

For the next three months, 2,200 $stkAAVE are being distributed each day. $stkAAVE is essentially the same as the native $AAVE token, but it is staked in their safety module with a ten day cooldown period and two day redemption window.

The $stkAAVE rewards are being split between both lenders and borrowers, which perpetuates the DeFi trend of blasting early adopters with a firehose of free money.

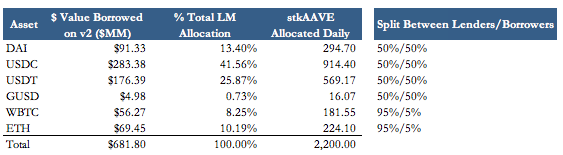

For stablecoins they will be distributed 50/50 between lenders and borrowers, with a 95/5 split for the riskier ETH/BTC markets. The following assets are incentivized:

Does this mean it’s free money time?

Well, a few caveats to consider. Note this is only for variable borrows, not stable.

Additionally, you have to claim liquidity mining rewards in order to receive more AAVE.

Nonetheless, the prospects have got the DeFi world hot and bothered.

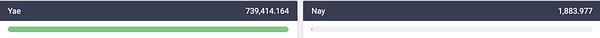

As always, this bleeds over to the benefit Curve. This is already up for a Curve vote.

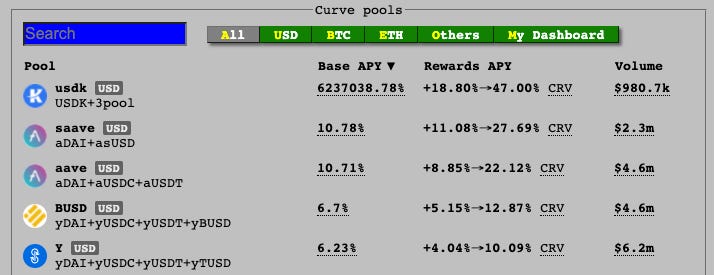

In terms of Curve pools, although many users tend to focus on boosted rewards, by raw cash AAVE is king. Both north of 10% this AM:

Unsurprisingly, AAVE value locked skyrocketed past 10 billy overnight.

For more on AAVE, make sure to check out this recent interview with Stani Kulechov conducted by Bitcoin Suisse.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, owns no $AAVE.