The Curve Wars just turned hot, shaking the entire foundations of DeFi.

Some quick context, because the overwhelming majority of human beings still do not understand Curve and why this is so big.

Here are the top three dollar pools by volume locked on Curve.

The first is Curve’s classic 3pool, consisting mostly of two centralized stablecoins, Tether $USDT and Coinbase/Circle’s $USDC, along with a smaller amount MakerDAO’s $DAI. The 3pool is a foundational layer of Curve and extraordinarily stable source of liquidity. The pool is utilized in everything from other Curve pools (aka metapools) to rewards for $CRV stakers. Consequently, it’s grown to over $3 billion in value, despite rather paltry rewards (1.44% boosted).

Two more decentralized stablecoins in the form of $FRAX and $UST take second and third on this chart. $FRAX with $2.8B TVL is nearly as large as 3pool, and offers more substantial 7% boosted rewards. $UST hits as high as 9.5%, and has locked $1.3B. Both are themselves metapools, and thus built atop 3pool.

A hypothetical 4pool containing $USDC, $USDT, $FRAX and $UST would contain a balance — two centralized stablecoins and two decentralized stablecoins. It would also include every coin currently within the top three… except $DAI. Ergo, this is an explicitly hostile action, FRAX Finance and Terra are launching an all-out assault against MakerDAO. Curve Wars getting bloody…

The belligerence was confirmed in the form of an official post by Curve Founder Charlie, who specifically called out the free rider problem in the first paragraph.

“DAI however has not grown at the same pace as USDT and USDC have despite benefitting from deep liquidity due to its presence in the Curve 3pool.”

This thread, itself a must-read source of commentary, specifically requests to shift Curve towards a 2pool standard with just USDC and USDT. The 4pool would become the first implementation, and one FRAX + Terra would push as the new standard.

Curve contracts are of course immutable, so every historical pool using 3pool will remain. This would only apply to new pools going forward.

This announcement shook social media over the weekend. What follows here is a comprehensive mega-thread attempting to capture all the nuances and takes…

FRAX

FRAX Finance is the current behemoth within the Curve Wars. For a sense of scope, in yesterday’s record breaking Votium round, FRAX’s late addition of $8.39MM accounted for fully 38% of the $21.52MM round.

FRAX founder Sam Kazemian took to Twitter following the announcement with a detailed thread, breaking down his master plan with a level of detail that would make a lesser Bond villain jealous.

The entire thread is a fantastic read, with enough big brain takes on Curve to fill its own article. Worth highlighting is this particular gem, that hints at the makings of DeFi Summer 2.0:

What beef might FRAX have with MakerDAO? The two are neck-and-neck in terms of overall market ap.

FRAX Finance has a heavy fan base, who were unsurprisingly delighted.

The subsequent $FXS pump also quickly spilled over to $CVX, which has its own growth plans with the protocol.

Terra

The other half of the assault comes from Do Kwon of Terra. Do became a hero to the crypto markets after he recently embarked on buying spree of Bitcoin to humble Michael Saylor. Relative to Kazemian’s thoughtful and contemplative take, Do’s brash and brazen style makes them a bit of a classic odd couple for crypto.

We now see his tweet from last week was not simply idle bluster.

In fact, the plan appears to have been in the works as far back as the New Year.

Where FRAX’s algorithmic stablecoin has won over many big brains impressed by its technical nuances, Terra’s aggressive hyper-growth has attracted more criticism.

Terra’s ambitious growth has kept pace though, earning plenty of stans in the process.

The official forum announcement holds significantly more detail about Terra’s ambitions.

MakerDAO

Sitting squarely in the crosshairs is MakerDAO. Their semi-decentralized $DAI stablecoin got added to 3pool in the beginning largely because few other viable alternatives existed at the time. However, $DAI has stagnated since then.

We describe Dai as semi-decentralized in that it’s mostly backed by USDC, which is itself highly centralized.

$DAI has a level of liquidity that other protocols are willing to bribe millions to achieve. Diminishing 3pool could cause $DAI’s prospects to dwindle.

If MakerDAO does opt to enter the Curve Wars, they have enough dry powder to make the wars turn brutal. From the great roundup on the subject from The Average Joe’s Crypto Substack.

Yet many onlookers don’t imagine the protocol itself is likely to intervene directly in the Curve Wars. Co-Founder @RuneKek said as much in response.

@MonetSupply of the $MKR risk team was also dismissive of the 4pool announcement.

Outside of Maker, @NourHaridy of Inverse Finance expressed bullishness on $DAI.

For context, Inverse Finance’s $DOLA announced it will be entering the Curve Wars, albeit tepidly and reluctantly.

Ergo a solution to “save” Dai may come not from Maker participation in the Curve Wars, but possibly an attempt at building a Curve killer.

The Tribe also criticized the concept of a 2pool, which it described as a more centralized alternative to 3pool.

The community at large seems to feel 3pools’s role in reinforcing Dai to be incidental.

As the traditional work week kicks up, every DeFi watcher will certainly be waiting to see if MakerDAO issues issues a counterpunch of any kind.

War Sims

Breaking out the calculator, analysts had a tough time getting the numbers to crunch. The immediate announcement by Do was tightly covered by @crypto_condom.

Which led to more plenty of detailed calculations.

While Do Kwon was presumably just speaking hyperbolically (see Greene’s 28th Law), the exaggeration certainly did its part in attracting attention to his boastful announcement. Witnessing the dueling spreadsheets, I was reminded of the old proverb.

Two people hiking in the woods come across an angry bear. The first person bends over to start tying their shoes. “What are you doing? You can’t possibly outrun a bear!” shouts the second. The first looks up and says, “I don’t have to outrun the bear. I just have to outrun you.”

Although Terra are unlikely to get 51% influence in raw numbers, we can easily expect that FRAX + Terra combined can easily outpace an idle Maker. Notably, the two already recruited plenty of allies to their cause.

Additional Participants

The new offensive is not taking place in a vacuum. Alliances with other major participants in the Curve Wars are crucial to the gambit’s success. Redacted Cartel’s $BTRFLY has the fourth largest $CVX share outside $FRAX, $BADGER, and $TERRA. They also announced they would join the assault against $MAKER.

Olympus DAO $OHM also flexed their might.

$USDC bulls watched the action unfold with amusement, although if $DAI falls out of relevance, one presumes the alliance may seek to next unseat stablecoins.

Further Reading

This post is already miles long and we’ve barely scratched the surface. Over the weekend, everybody channeled their inner @adamscochran and took to writing up helpful explainer threads. For more background and takes, we’ve assembled as many of these thread, articles and videos as we could find, sorted by likes. If you find something good I missed, drop a message and I’ll update this:

Parting Thoughts

As you can see, this was clearly a momentous announcement. For some final thoughts, we note that a resident Curve mathematician @nagakingg has stamped a seal of approval on the concept of more flexible building blocks than 3pool.

The first implementation of 4pool on Fantom already passed governance by an overwhelming margin.

A Signal vote on the subject shows the community has lopsided feelings, albeit unclear which direction it’s pointing due to the Signal UI.

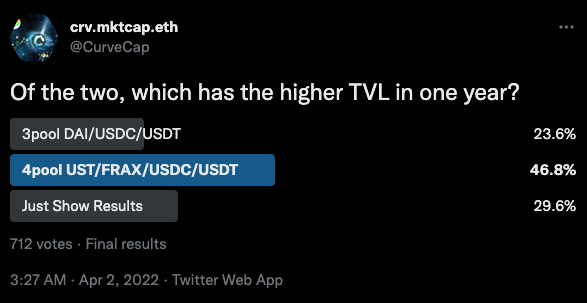

In a quick poll, the community tends to expect 4pool to prevail over 3pool by about a 2:1 margin.

And most importantly for Orville Redenbacher bulls, $CRV has already flippened $BTC in terms of attention according this ultra-scientific study.