April 6, 2021: Cross Asset Analysis 💱🔍

Curve users bought USD + ETH, sold BTC this past month

It’s been a minute since we looked over the trends in Curve’s killer cross-asset transactions feature. It’s the only way to transact vast quantities of money with low slippage. Since launch, over half a billion dollars worth of value has moved across this feature!

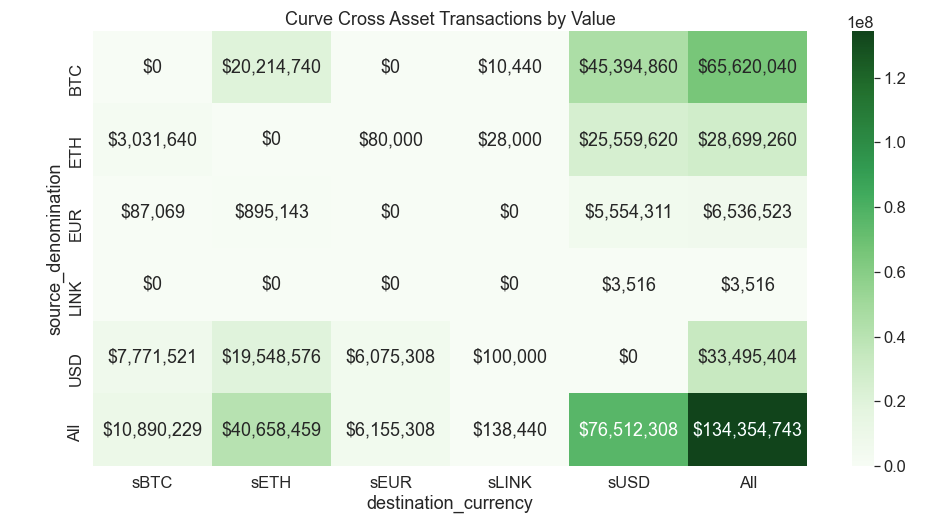

Last time we looked in February, we saw people were selling off dollars in favor of cryptocurrency. This time it’s different. The timeframe here is the past month (March 9 through April 6th to date), where we see $134MM in successful transactions.

BUY USD

People want dollars. Of the $134MM in cross-asset moves, over half ($76MM) went into the greenback. The dollar was the majority destination across all currencies, including BTC (69% of total value sent into USD), EUR (85%), and ETH (89%).

We didn’t take the effort to trace the destination of every such transaction, but spot checking a few transactions we’d guess that they primary use case was to invest such tokens elsewhere in DeFi. It’s worth pointing out that Bitcoin has been relatively stable this past month, primarily in the $50-$60K range, so some speculators may be trying to farm some gains elsewhere during this period.

SELL BTC

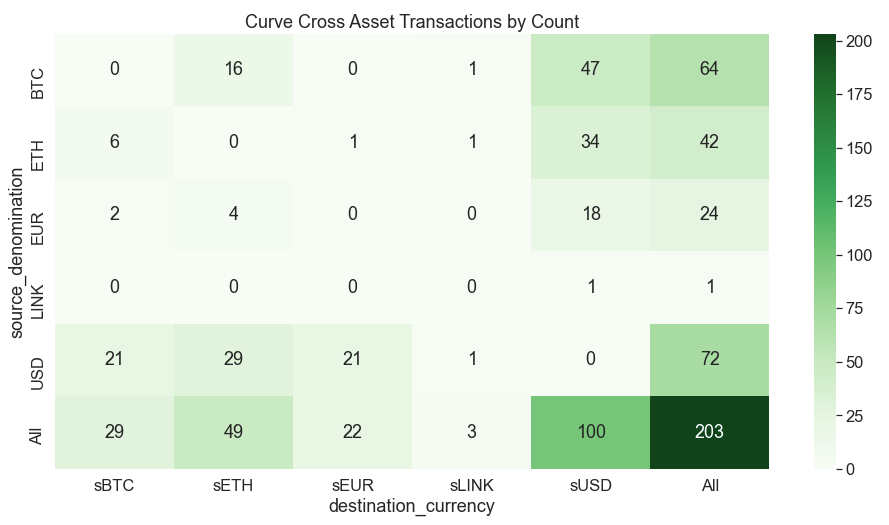

Big dumps of BTC accounted for the plurality of volume, $65MM of the $135MM in total. Most of this was movement into USD, accounting for $45MM of the movement. Eth-heads will be pleased to note $20MM of volume flowing from BTC to ETH, with just $3MM the other direction.

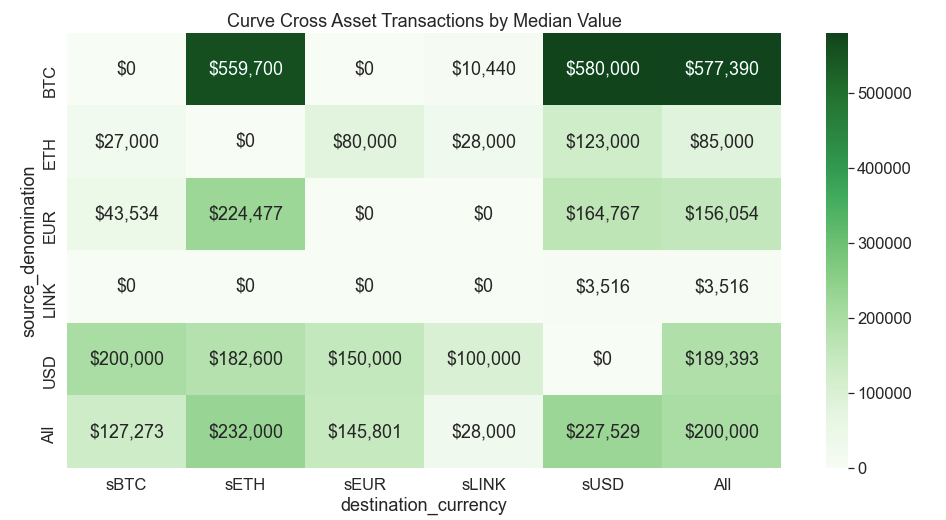

Bitcoin dumps were also largely whale moves. Redoing the above heatmap by median transaction amount shows these transactions tended to be above $500K apiece in pretty much all cases.

Is this a top signal? We can only guess. We can note that this is the first time we’ve noticed more activity flowing out of Bitcoin than flowing in since we first started looking over the activity.

BUY ETH

The second most popular destination after USD was ETH. For dollar outflows, over half the volume went into ETH ($20MM of $33MM spent). As we mentioned above, another $20MM flowed from BTC to ETH. In general, per the chart above, the typical transaction tended to represent a $200K-$600K buy of Ether.

This is also born out by looking at the raw number of transactions. Outside of USD, the largest number of transactions involved buying ETH.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a Curve maximalist, and though cross-assets are our favorite Curve feature, we’ve never run one outside of a test environment.