April 6, 2023: The SOON™️-iverse and the Rune-iverse 🌌🔭

$crvUSD edges towards deployment and the shakeup at MakerDAO

FRENS: Join us tomorrow for a live Llama Party featuring the great Fiddy!

Tomorrow join us on Discord, or watch on YouTube!

Llama Parties are casual hangouts in which anybody can slide into the conversation and conversate with the guest of honor.

Video enjoy0000rs may be wondering what happened to the daily recap videos we once posted like clockwork. Has @CurveCap turned lazy?

In fact, we’ve spent some months laying the groundwork for something even better…

Join us weekdays at ~7 AM PT for a live 20 minute round table recapping the past day of headlines in crypto. Follow @Leviathan_News on YouTube and never miss a beat! Please ping also if you’re interested in joining the fun.

This AM we were jolted this morning to see 0xbabe [sic], a sensual Curve deployer address, see its first activity in nearly a month. $crvUSD?

Alas, no such luck. In this case it’s a transaction that affects the main registry.

This is still ambiently interesting… the address manually added to the registry is a gauge for a Frax/USDP pool.

This pool only has about $43 dollars though. Why would devs take time to intervene? Is something afoot?

If you’re just here for $crvUSD news though, here’s some hopium for the soonening™️

As spotted by まめだい / mamedai, the deployment script for $crvUSD has been committed to the repository.

Before you get too excited, we’d be willing to bet that we still have a few weeks before the actual deployment. If one presumes the final version of the contract needs to be reaudited, then degens are at the mercy of auditors’ schedules.

Wen?

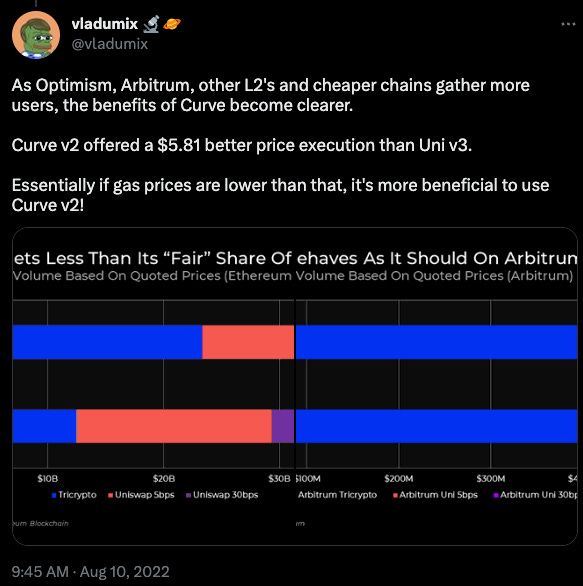

Although there’s clearly intense interest in $crvUSD, the real chads know the real narrative-changer is the gas optimized v2 pool, dubbed “Tricrypto: The Next Generation.” c/f this discussion….

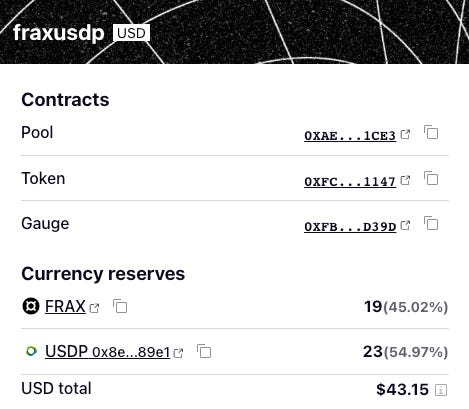

The gas impacts of AMM contracts have a significant effect on the overall landscape of DeFi. From last August’s Delphi report, we observe Curve tends to quote the best rates on mainnet, but when you factor in gas costs, only whales get an outsized bonus for trading on Curve.

The “potential” of Curve v2 pools is therefore better realized on cheaper chains. Compare v2 usage on mainnet….

Versus Arbitrum (where no Curve v2 factory even exists)

The next generation of TriCrypto includes extensive optimizations that significantly improve gas costs, both from improved mathematics and gas golfing in Vyper.

As it turns out, TriCrypto: NG is spearheaded by Fiddy, whom you can ask all your best support questions if you join us for tomorrow’s Llama Party!

Note also that the launch of $crvUSD will likely also see a similar effect play out. The first version of $crvUSD seeds liquidity across several bands to smooth out the effect of liquidations. Very cool, but very expensive to write so much data on-chain.

Hyper-optimized $crvUSD may come along down the road if the first release proves successful. But if it costs, say, ~$100 in gas to manage your $crvUSD position, expect that only whales can play efficiently when it first ships.

Then again, we believe Ethereum mainnet should be exclusively a playground for whales anyway. We fear for the shrimp who stakes a position in DeFi while gas is relatively cheap, and a year from now cannot withdraw because the price of ether has skyrocketed. Poors should be ghettoized into sidechains (myself included TBH).

Never Say DAI

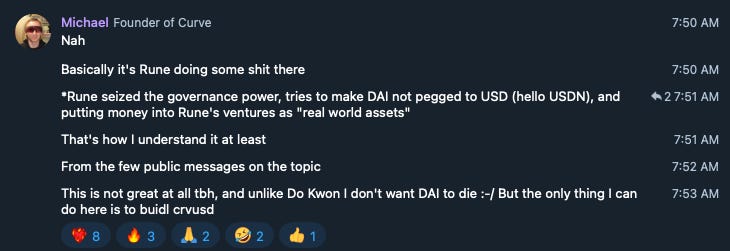

Some seemingly heavy developments out of the Rune-iverse. About half the core team are planning to leave at the end of the month.

We hope it’s nothing, but Mich dropped some gloomier thoughts in public.

We also hope for DAI to continue to thrive. However, if Curve must reduce its DAI footprint, what better opportunity than the pits of a bear market. As a base pairing, FraxBP is already more central to Curve than 3pool. Curve has never been less reliant on DAI, so there’s less ammunition for death spiral000rs to doom-thread. Count us among the believers that the days of collecting fees in 3CRV are numbered.

The Maker Endgame represents an ambitious “make or break” gamble for the protocol. Rune is putting his yield where his mouth is, buying up cheap $MKR.

We sincerely hope he’s right!