¡Hola y bienvenido! @ReserveProtocol ha entrado en “Las Guerras de Curve!”

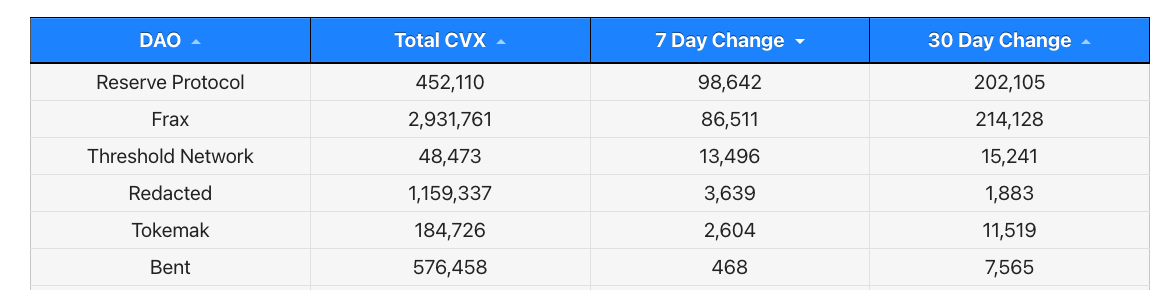

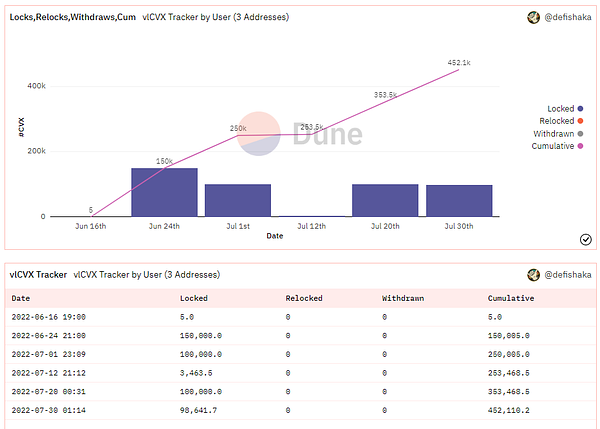

This entry is significant, as Reserve has been gathering several hundred thousand $CVX over the past month.

You can be forgiven if you’ve overlooked Reserve Protocol’s $RSV pool, a seemingly quiet pool which has been in existence nearly as long as Curve. Belying this relatively inactive pool, the team has been incredibly active in their arena.

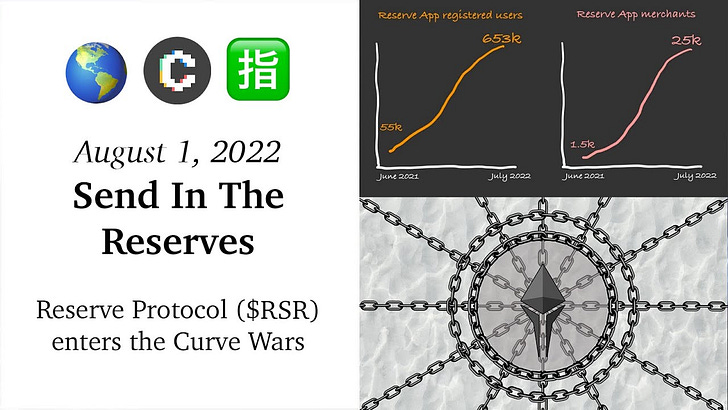

For a few years now, Reserve has been doing the boots-on-the-ground work of showing how cryptocurrency can make a real impact in nations where its most needed. For years, the Reserve launch case has been to build crypto tools to help users fight inflation. They’ve been successfully scaling out the Reserve mobile app, a payment processor which is transacting $150MM per month.

This is on the backs of 653K users at 25K merchants across five Latin American nations where inflation is particularly problematic, and expanding quite rapidly.

It’s a great example of a protocol successfully bridging the gap between the real world and the digital realm, solving the substantial problem of inflation all the while. Next time you hear crypto skeptics dismissively claim there’s no real world use cases for crypto, you can easily point them to Reserve.

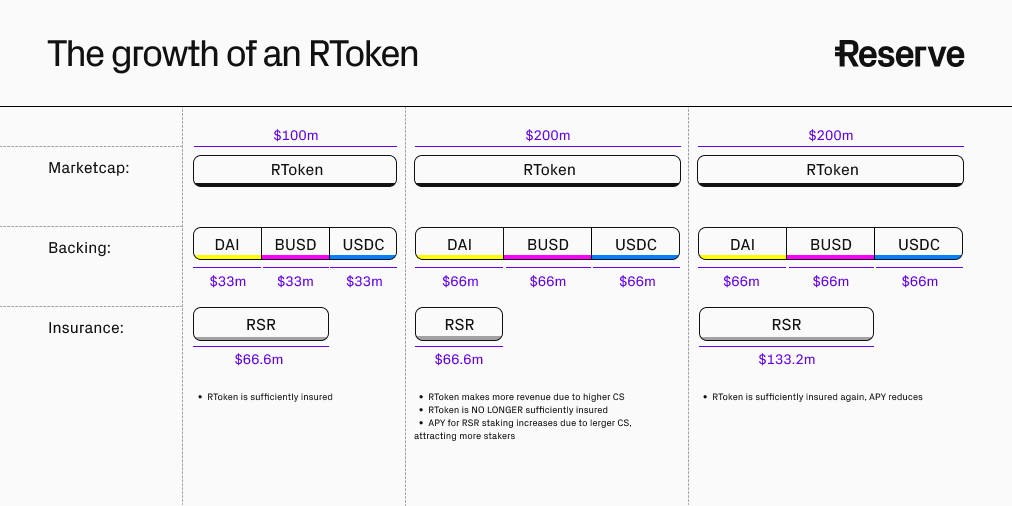

Soon you’ll also be able to point them to Reserve when critics make the same argument against DeFi. Reserve’s ambitious scaling plans is to begin connecting their userbase to the world of DeFi via RTokens. RTokens empower their massive network to launch their own stablecoin-powered economies. This amounts to a factory of fully-collateralized yield-bearing stablecoins. The applications could be tremendous.

The team has been examining the difficult problem of how to create a stablecoin factory in a manner palatable to its userbase, who have plenty of difficult firsthand lived experience surviving badly constructed Ponzi Schemes IRL.

Reserve’s innovative solution will hopefully satisfy this risk-averse userbase. Their RToken platform is built such that yields from RTokens will flow to their native token, which will in turn be used to provide insurance.

The intent of the $CVX acquisition is explicitly to help bootstrap liquidity pools who launch RTokens, as they expect a cadre of stablecoins will require Curve trading pairs.

So the question your bags care about… will there be birbs?

Maybe…

For a bit more depth on Reserve, check out their 1 page overview, which I borrowed from extensively to put this article together.

You can follow the activity on any number of great community-generated sites who have quickly picked up on the action, including DAOCVX and more:

This podcast with the Co-Founder and CEO is also a great overview:

Steady lads… Reserve’s deploying!

Disclaimers! All content is educational, not financial advice.