The Llama Risk team is back, proving once again they are the cream of the crop. In the day since the Curve hack, they’ve put together a highly detailed post-mortem covering the reentrancy exploit that hammered four Curve pools over the weekend. Must read…

We’d like to talk about this at length for today’s article, but crypto thot influencers pivoted too quickly into becoming House Hunters of sorts...

Loan Sharks

Stop me if you’ve heard this one before…

It was… <checks watch>… cripes people, only one month and one half months ago that we last saw the knives last came out in full force against Mich.

June 15, 2023: Moby Dick 🔱🐳

These days, the line separating the “wisdom of the crowds” from the “madness of the mob” is thinner than a politician’s promise. Crypto Twitter remains a collection of several extraordinarily smart people, yet in aggregate they keep re-enacting the exact same farce.

Previously I thought Moby Dick was the best analogy for the situation… all of crypto Twitter, seemingly jealous of Mich the whale, gets consumed by madness in their quest to destroy him, their all-consuming rage leading to a tragic fate.

It’s certainly apt, but it misses the repetitive nature of the phenomenon. For crypto denizens, it’s like after each episode, everybody’s memory is wiped and it starts again anew.

So maybe it’s more like a Bugs Bunny cartoon… Elmer Fudd never learns his lesson and believes that this time, grabbing his shotgun, he’ll be able to hunt down his nemesis, and the audience keeps tooning in to find out what clever scheme the wascawwy wabbit will concoct to foil him each time…

Mich doesn’t tend to say too much about this neverending cycle. He’s allegedly claimed he has the ability to pay off his loans if he wanted. Back at the advent of DeFi, he made ends meet by borrowing against his crypto. Now that he’s mega-wealthy and earns healthy real yield from Curve, he may no longer need to. But he seems to enjoy the thrill of the hunt. He’s used a variety of lending platforms, and never been liquidated, until recently when he did so deliberately while testing out $crvUSD.

So in the one corner we have a gigabrain with a pattern of thriving against the pressure of spiking interest rate loans…

In the other corner, we have a chorus of shrieking voices that come out of the woodwork to concern troll about his loan at highly convenient times.

“Got him! The man with the provable nine figure net worth is clearly running out of options this time! What an idiot!”

If you don’t enjoy watching the farce unfold anew each time, then use each cycle to unfollow the accounts that deliver such poor signal. Otherwise, just prepare yourself for a gish gallop of FUD every time the loan sharks smell a drop of blood.

It’s impossible to categorize all the arguments and refute them, but here’s a few of our faves:

Mich lends to dodge taxes!

Except… and I’m no tax expert… doesn’t Mich reside in Switzerland where capital gains taxes are just about non-existent?Mich is trapped because he bought a nice house!

I’ve yet to see a shred of evidence substantiating that Mich is in over his head managing his offchain loans as opposed to his onchain loans. We know mostly what was published in the real estate article, which is that he previously bought a reasonably sized house and apparently felt so comfortable with the arrangement he opted to double it up. If he’s taken out a mortgage to do so, he clearly already came up with the down payment, so now he needs to scrape together a mere million a year? Pocket change for him at this point...Mich screwed $CRV lockers to buy himself a nice house!

Notice how many concern trolls bring up his house… naked jealousy it appears. Certainly you could dig up some people who are peeved about any token, but the Curve community appears to be incredibly ebullient, and speaking for myself I’m rather pleased with the consistent cash flows the token delivers.If Mich gets liquidated it’s over for $CRV!

This is the same deth spiral000r argument that’s there’s a nebulous death to the resilient protocol if prices go down. Here the best we can say is that nobody really knows what would actually happen in the event of such a massive liquidation. Many people who presently assign $0 value to the $CRV token insist it would result in a $0 value. I imagine the revenue generating token would find a market equilibrium somewhere and the protocol would continue operating uninterrupted, exactly as it did before it issued a $CRV token. Literally nobody has articulated the path from liquidation to $0 when asked. In short, invoking the specter of an unknown unknown is clearly disingenuous fear-mongering and should be ignored.Curve governance takeover by bad actors!

One dopey argument for the above, that at least has some specificity, claims that Mich’s stash could fall into the hands of a nefarious actor, clearly ignoring the fact that there exists sufficient veCRV among other players to prevent this.

There are surely dozens more arguments, but we’ll save those for the comments.

At any rate, the latest episode of “Mich vs Short-on-brains Shorters aired yesterday. I partly suspect Mich relishes the attention. Curve doesn’t spend money on marketing, but by harnessing the collective vitriol of his haters, Mich doesn’t particularly need to spend money on marketing. The incidents give him the power to become the center of attention, then use the spotlight to show off his magic.

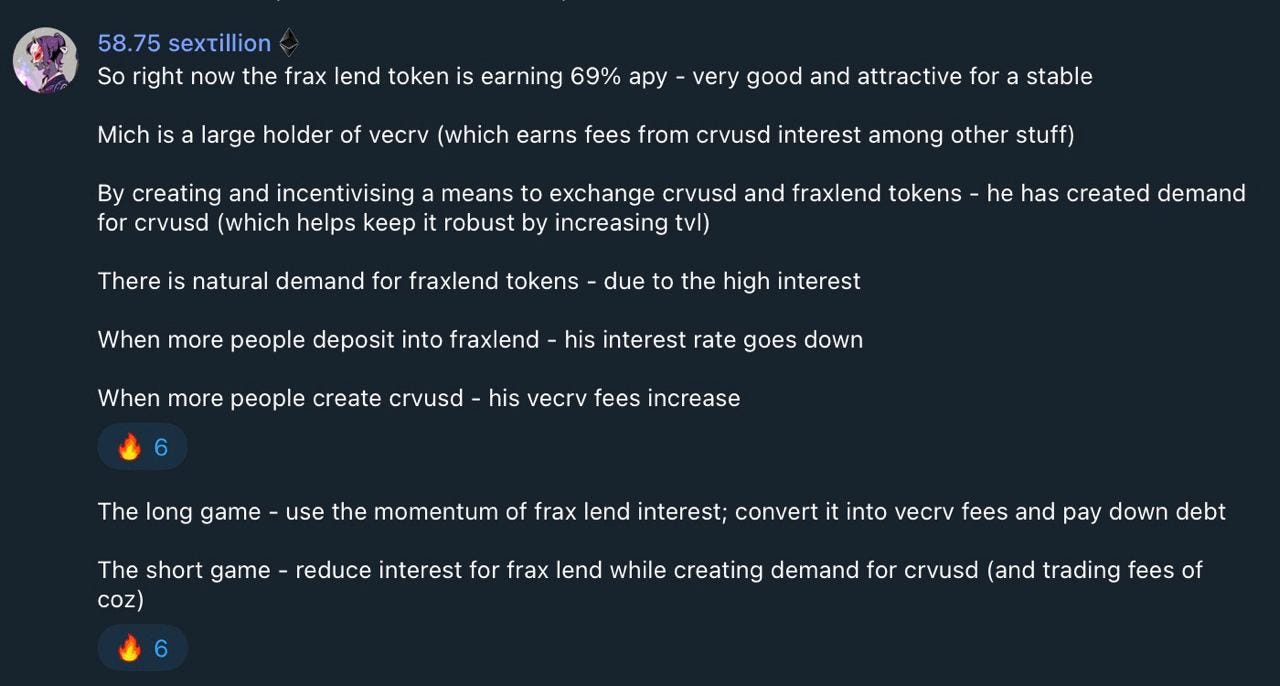

In the most recent go-round, he moved some money to Fraxlend, where concern trolls reckoned he was cornered and out of options. For some background on how Fraxlend actually works (which several influenc000rs got wrong):

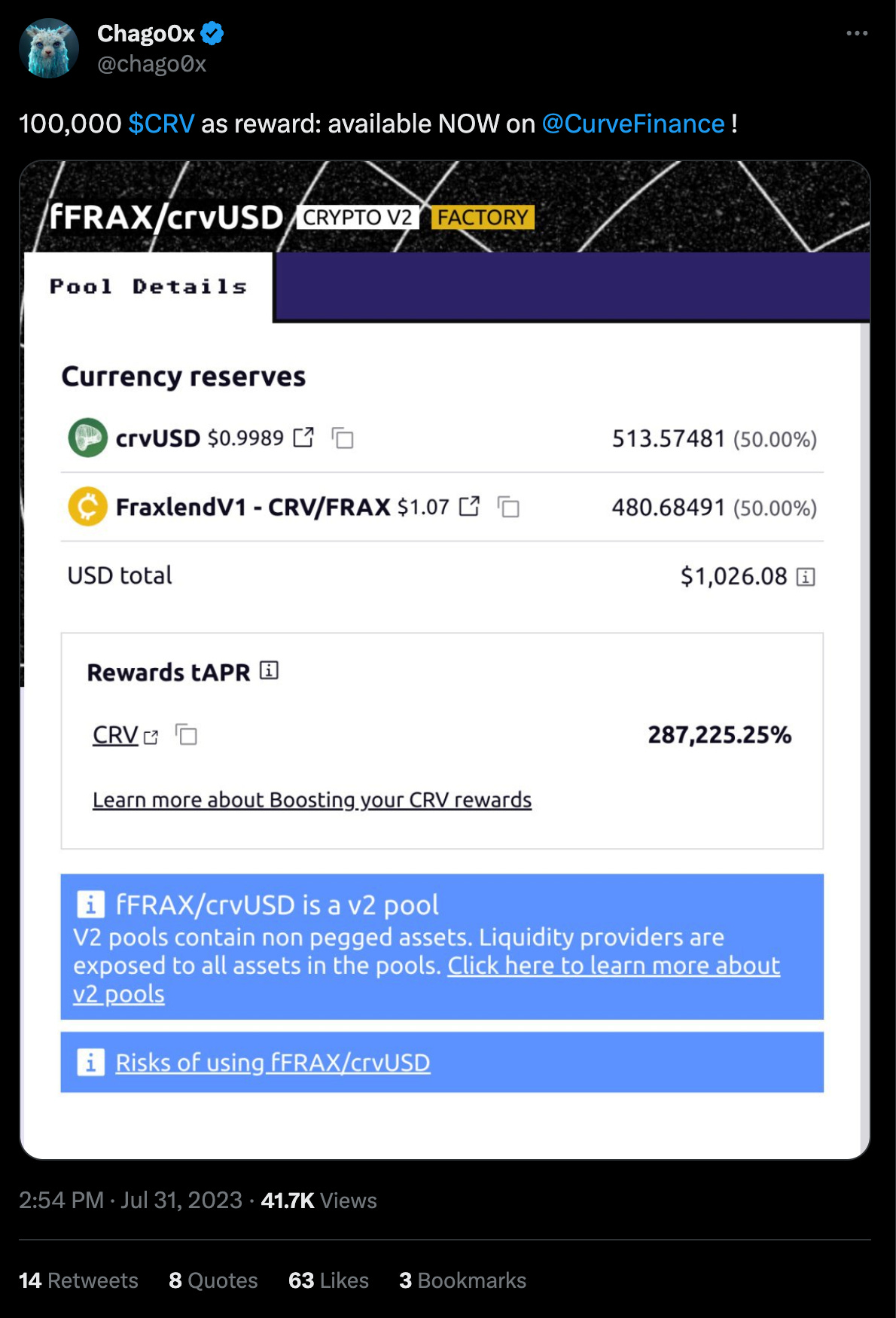

Except, it turns out that the man who’s used his experience lending more money than most of us will ever see to design protocols most of us could never fathom had a plan. With all attention on him, he built his way out of the corner he had deliberately backed himself into. He took the moment to drop and incentivize a new pool, which all the haters who insisted he was doomed failed to imagine.

To break down the chess game going on here…

So the only question is if degens would line up for free money… which, spoiler alert, they did…

In the end, he launched a brand new market that synergized both protocols and left the concern trolls stuttering, and it cost him very little to do so. Best of all, his most ardent haters who refuse to even mention $crvUSD are forced to either ignore the feint or risk their followers nosing into how the innovative new stablecoin works.

We’ll grant you, for the shorters, what better time to strike. The Curve hack provided the perfect batsignal. The unfortunate disappearance of the CRV/ETH pool scrambled the playing field. The shorters all emerged from the dark forest simultaneously at the signal to batter the token price and try to erase his existence.

Under these circumstances, he struck an OTC deal which we presume he’d preferred not to have struck under normal circumstances, but it appears to have staved off the sharks.

So again he survives, just like always. Maybe next week he’ll be kicked off AAVE or get himself into another jam, but for now his strategy continues. What else is he supposed to do, right?

Yes, I might eat crow on all this one day. Maybe one day the shorters will catch him sleeping, slay his position, and $CRV deth spirals to $0. But generally, as a denizen of the flywheel, Mich’s lending preferences don’t particularly bother me, and it’s why I don’t tend to dig in deeply or care much about this inane FUD that rears its ugly head every so often.