@BlockEnthusiast took to the Curve Governance Forum to pen a detailed analysis on the subject of Double Dipping. It’s a must-read.

Everybody active in Curve governance should review the complex mechanics of double-dipping and the difficulties in constructing solutions.

Without reduplicating the entire post, the key takeaway is that current attempts to fight double-dipping are scapegoating the wrong pools. It’s not technically possible to double dip from $alUSD, $MIM, or $USDP, yet these pools are more likely to be singled out and flogged.

The sorts of leverage strategies that can be looped all take the following form:

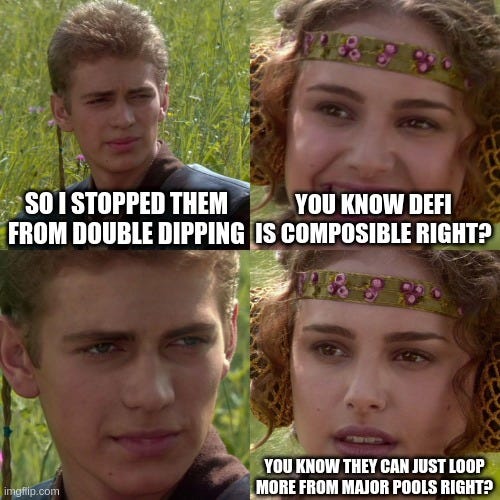

Certainly, double dipping happens, but what, if anything, can be done? To borrow @BlockEnthusiast’s meme, the problem is that DeFi is composible:

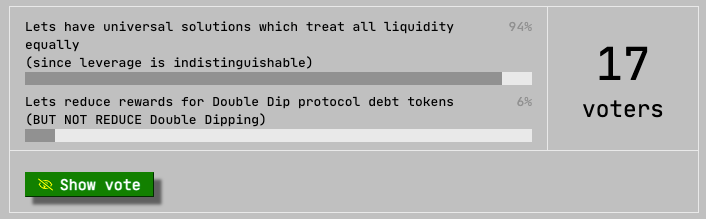

Most of the mere 17 readers who weighed in agree that attacking debt tokens is ineffective, and that we instead need some non-specified “universal solutions.”

Unfortunately, here’s where things get difficult. Everybody may agree on this point, but to my read there’s no specific solution anybody has suggested. @WormholeOracle notes the nuances of the problem:

It does remind me of ecological mishaps when, say, you find yourself with an invasive species, so you introduce another species to eliminate the pest, only to find there are unintended consequences that cause a bigger cascade of problems down the road.

In particular, the following assets can be double dipped: DAI, USDT, USDC, USDN, FRAX, BUSD, UST, TUSD, sUSD, IB. How could you devise a solution that targeted these assets without, say, kneecapping 3pool that serves as the foundation for so many other pools?

Absent an easy solution, it’s far easier to turn into scapegoating. Who can we single out for attack? We tried burning $alETH at the stake, only to discover yet more witches in our midst. Shall we turn our pitchforks upon USDN? The Curve team?

@BlockEnthusiast presses the latter case with gusto, claiming the Curve team appears to be misleading the community. It’s worth a read, if nothing else for the whale-watching of high net worth wallets. Yet my take is that if there was anything nefarious afoot, I highly doubt the Curve team would both be encouraging and joining such a healthy discussion. A sinister team would be deleting the discussion and blocking @BlockEnthusiast from the forums.

In fact, the thread highlighted as most suspicious appears entirely innocuous. It reads simply as a well-intentioned attempt to publicly brainstorm objective and mathematical solutions. This is exactly the sort of productive treatment the problem deserves. Similarly, the MIM gauge vote noted as concerning looks like a fully transparent attempt to engineer a solution to a problem.

What am I missing here? Readers free to educate or even scapegoat me… as I clearly have no issue with looking like an idiot in public.

Could it be that problems which defy solutions are in fact unsolvable? We’ve seen governments attempt to squash all manner of things (terrorism, cryptocurrencies, viruses), and see their efforts backfire spectacularly. Maybe dumpers just gonna dump.

If the problem is indeed unsolvable, consider this half-joking, half-serious solution. Instead of disincentivizing double-dipping, what happens if you try to incentivize it? That is, build solutions to encourage and reward this behavior. Presumably, the more it is incentivized, the quicker that it would hit some theoretical limit, and it would exhaust its effectiveness at whatever point the free market rendered it inefficient. This way the natural behavior still occurs, but at least it’s completely contained and managed within the Curve ecosystem.

As I said, I’ve no problem looking like an idiot in public, so I need some education here too. What’s wrong with the above solution? If actions to stop double-dipping have failed, why not try inaction or pursing opposite actions?

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and has a stake in USDN, USDP, IB, and 3Pool.