The smartest people have been rightly buzzing about Frax v3 over the past weeks, as the Frax team have started to drop some alfa on the upcoming stablecoin.

We’ve crawled through all the big videos, threads, chats and articles on Frax v3 so you don’t have to. All the primary sources are linked at the bottom of the article and occasionally throughout.

TL/DR

Frax v3, expected to be launched as quickly as one month from now, is considered internally to be “the final stablecoin” as it's a complete system for a decentralized stablecoin to thrive in high and low rate environments

Offchain: The system will handle RWA, including dollars and T-Bills, through partnership Finres PBC and a potential major collaboration with Paxos.

Onchain: The new architecture is underpinned Frax Bonds and BAMM (Borrow-AMM) lending strategy, which will create an incentivized bond market on Curve

Frax v3

Frax v3 represents a full update of the FRAX Protocol. This represents a major move to remove Frax dependence on USDC and other redeemable stablecoins.

Frax v3 thus upgrades $FRAX to become a hybrid stablecoin, existing onchain yet backable by real world assets (RWAs). The process will bring T-Bill yields onchain in an infinitely scalable manner, via relationships with offchain partners.

Offchain

The limiting factor with the entire strategy is the slower pace of TradFi relative to DeFi. Fortunately, most of the offchain banking relationships have already been put in place, so the launch can happen quite smoothly.

The major partner, presuming the DAO vote goes through, would be FinresPBC. As a public benefit corporation, FinresPBC business model is not take any cut of T-Bill yield. Their public goods focus is on bridging RWAs onchain, so they only charge a minimum of fees. The previously linked DAO vote describes much more context on FinresPBC.

The team is also looking into a potential partnership with Paxos, although details on this are more scarce.

Of course, while the $FRAX stablecoin will remain a decentralized onchain asset without a kill switch, holding the underlying T-Bills will require some tradeoffs to cooperate with regulatory authorities.

Frax is also looking into partnering with other services that seek to bridge T-Bill yields onchain, such as Ondo Finance and OpenEden.

Onchain

The entirety of Frax v3 will be governed by their long-discussed frxGov, which would take great steps towards decentralizing their protocol. Fortunately for their accelerated schedule, the critical pieces for their governance hub have already been deployed, although it is not fully live yet.

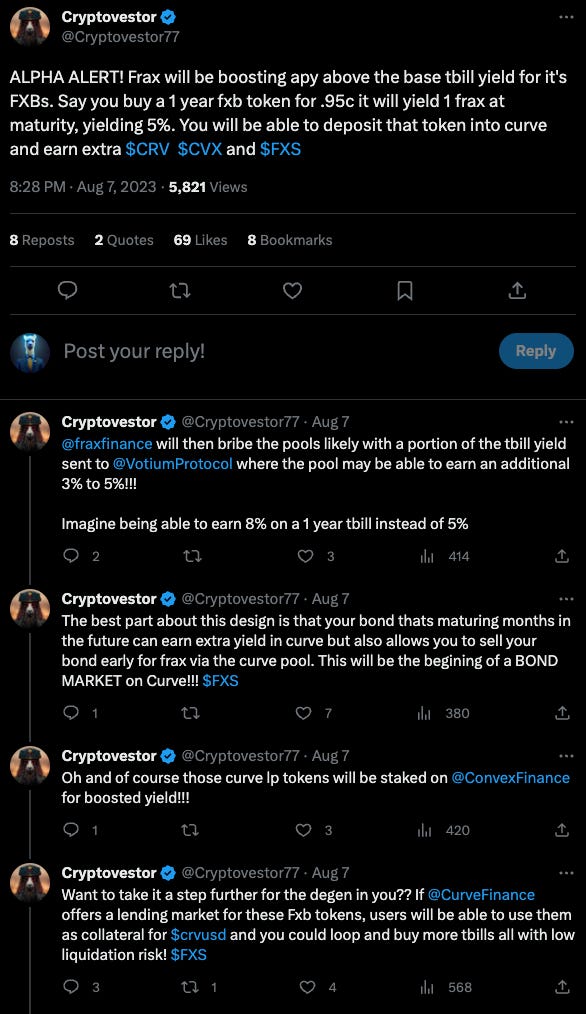

The new ecosystem includes the debut of Frax Bonds. These consist of ERC20 tokens signifying the bond, which convert into the $FRAX stablecoin at maturity date. The existence of different maturities dates will bring the yield curve onchain.

This will also create a bond market on Curve. The bonds can be parked into Curve where they will earn yield and provide fungibility for holders. These can also be composable into other aspects of the flywheel, such as hypothetically serving as collateral for $crvUSD to loop the process.

With their FinresPBC partnership they expect they can offer all (or very nearly all) the entire T-Bill yield to users, since FinresPBC does not take a cut. This contrasts their strategy somewhat with Maker. By utilizing birbs and FXS gauge incentives, Frax expects they can even boost APY above the base treasury rate, making it an attractive offering.

The Frax Bonds tie nicely into Frax’s stealth project BAMM (Borrowing AMM). The BAMM has a number of notable features, like offering rumored 10,000x leverage,

The various discussions around Frax v3 also touch on many other exciting elements around the Frax ecosystem, such as updates on frxETH v2, Fraxchain, Frax Ferry, partnership with PayPal, and much more. We’d expect nothing less from the industrious Frax devs!

For more, please visit the following links:

Web

X, neé Twitter

Audio/Video