You’ve staked your money into Curve, now what? Should you aim for the max Curve boost? Or should you take your money over to Convex?

Tough call, and for most people you’ll want to look at your own personal situation. If you can max out rewards with enough veCRV, you may be inclined towards keeping things in CRV.

Even if you’re not presently maxing out your veCRV, the rewards for being a veCRV holder are awfully tempting. In addition to everything else, you can even take bribes for voting your veCRV!

The most recent Brownie tutorial video Curve posted includes a script you can use to calculate the answer directly, avoiding all the guesswork. We ran some quick and dirty experiments, looking to get a general snapshot of how various users would actually perform under different conditions. We looked at only pools you could get into with DAI, (no BTC, ETH, or even other dollarcoins). We printed $100K, aped, and looked at the rewards after 24 hours of staking in either CRV or CVX.

Of course this is a bit lacking in many respects. It doesn’t cover every dollarpool. It doesn’t reinvest rewards. It doesn’t consider APY For some users $100K is a lot, for some it’s a rounding error.

Still, it’s a fairly consistent snapshot across a diverse sample of users. We tested a range of users on the Curve Market Cap leaderboard, some with lots of veCRV, some with very little. If you want to see how it would perform for your specific case you can grab the script and plug in your address.

When we first took a look at the data a few weeks ago, the data was decidedly mixed story — sometimes favoring Curve, sometimes favoring Convex. We thought we could get a good article out of comparing and contrasting the best place to park your money. Today it’s a whole different world, and it today this world belongs to Convex.

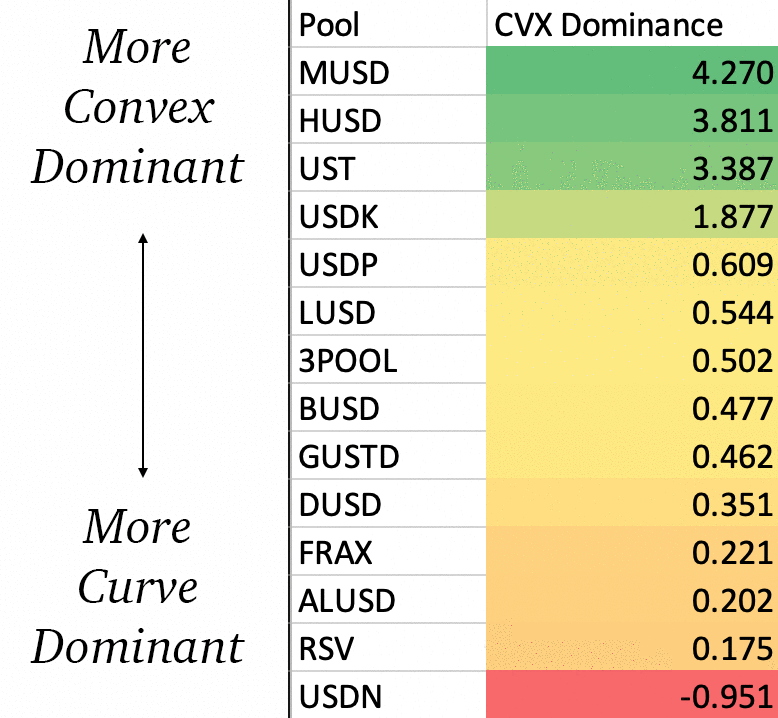

For nearly every pool and nearly every user, the users ended up best off staking in Convex. The main exception was USDN, where every user we looked at did better in Curve due to the relatively lower 1.5x boost Convex is receiving in the pool.

Unfortunately for Convex maxis, this result is fairly meaningless. All it’s really saying is that the spot price of Convex ($5.44) happens to be at a relative high relative to the price of Curve ($2.04). When we first looked the ratio was closer to 2:1 and there was no clear winner. Since staking in Convex earns both CRV and CVX rewards, when the price of CVX is relatively higher it is preferential to be staked in Convex. So all these results say is that today you may be better in Convex, but only if the price doesn’t fluctuate.

Unfortunately we can’t show different numbers at different potential prices because we lack WiFi at the moment. Still, we wanted to leave you with something useful though, so here’s our best stab at using these results to provide some utility.

For each pool here’s the relative ranking of its Convex dominance. That is to say, at the moment users in MUSD average about 430% better rewards in Convex, so even if the price of $CRV shifts upwards MUSD stakers would still be more likely better off in Convex. Meanwhile, at these prices Convex is just 18% better when staked in RSV. Therefore, if the price of $CRV shifts upwards against $CRV, we wouldn’t be surprised if RSV became the first pool to flip back to Curve being a dominant strategy for most users.

Prices may fluctuate, so this can serve as a rough rule of thumb as to how you may generally consider your strategy. Of course as always, this is not financial advice.

What do you think? Do you agree or disagree? Should we do a more robust analysis? Or did you find a bug in our code that makes this all meaningless? We always enjoy hearing your feedback.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at curve.substack.com. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and therefore also a $CVX maxi.