Thought you could touch grass on a late summer weekend? Not when there’s new FUD dropping!

Over the past few days, $WBTC let slip a new policy.

Looks as though $WBTC is going to hand the reins to Justin Sun?

The last Justin Sun BTC project is closer in price to USDC than BTC…

His Excellency swiftly addressed the concerns.

$WBTC has been fairly centralized for a while, but it worked well and endured the craziness of several market cycles, so nobody tended to mind much.

However the change left people feeling concerned and suddenly discussing the topic of $WBTC centralization.

So if not $WBTC, then what? Is there a wrapped form of Bitcoin ready to take up the torch?

The concept of $frxBTC is certainly enticing, but SOON is not fast enough for degens who demand NOW.

Avalanche’s BTC.b got a bit of a look

But the potential WBTC replacement most ready for primetime is, in our opinion, Threshold’s $tBTC

Since launch, $tBTC has been a far more decentralized Bitcoin wrapper.

Given the frequent hacks in DeFi, users can be forgiven for waiting a spell to let it prove its resiliency. At this point though, with four years of stability and over a year since the launch of v2, $tBTC has accrued a strong reputation and sufficient Lindyness to have earned at least our trust (YMMV, not financial advice, DYOR!)

While $WBTC reserves are largely accounted for entirely in legacy meatspace, $tBTC reserves can be audited directly onchain, as the wrapper is fully Web3.

So as DeFi writ large engages in hand-wringing about $WBTC, it may have the perfect solution at the ready.

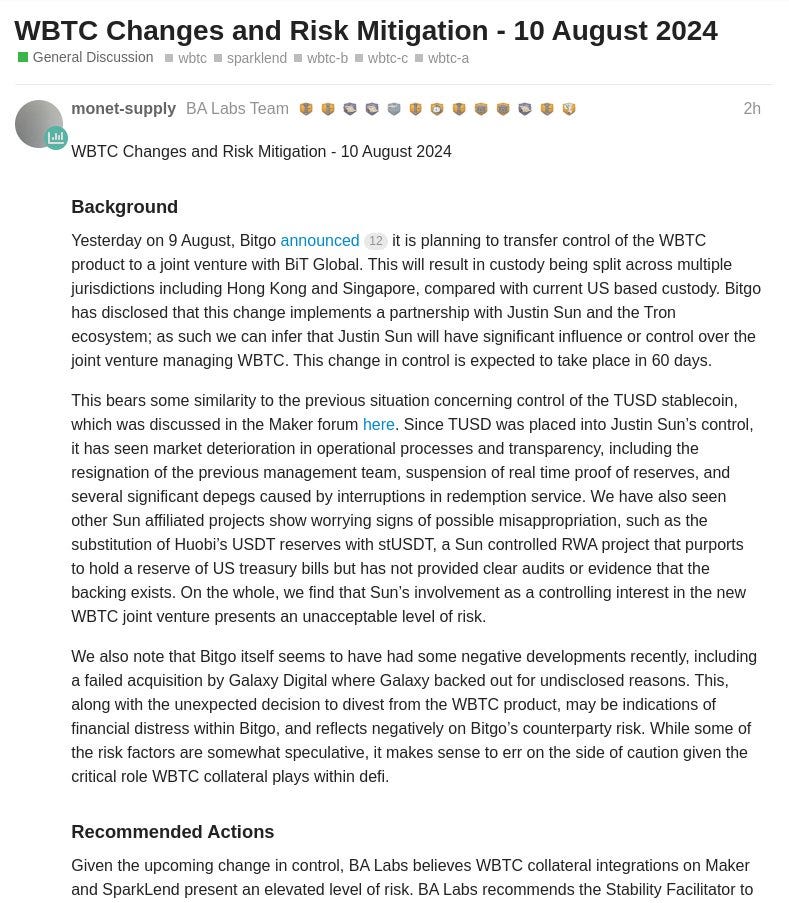

MakerDAO is proposing to close all new WBTC debt, which constitutes about 10% of DAI’s backing.

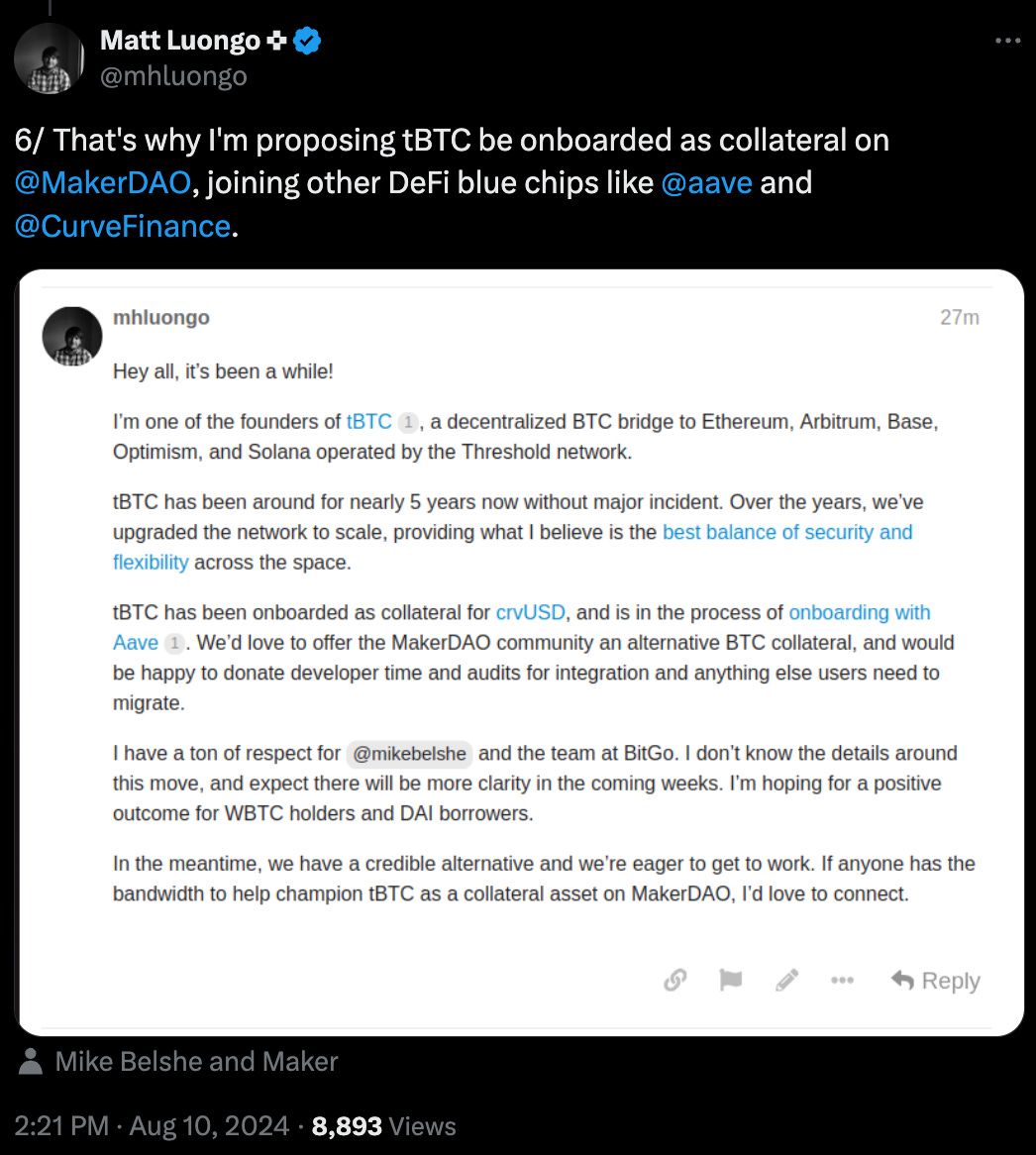

$tBTC is ready to push itself as a suitable alternative.

If Maker does onboard $tBTC, it won’t be the first DeFi protocol, as the token has built up several integrations over the years.

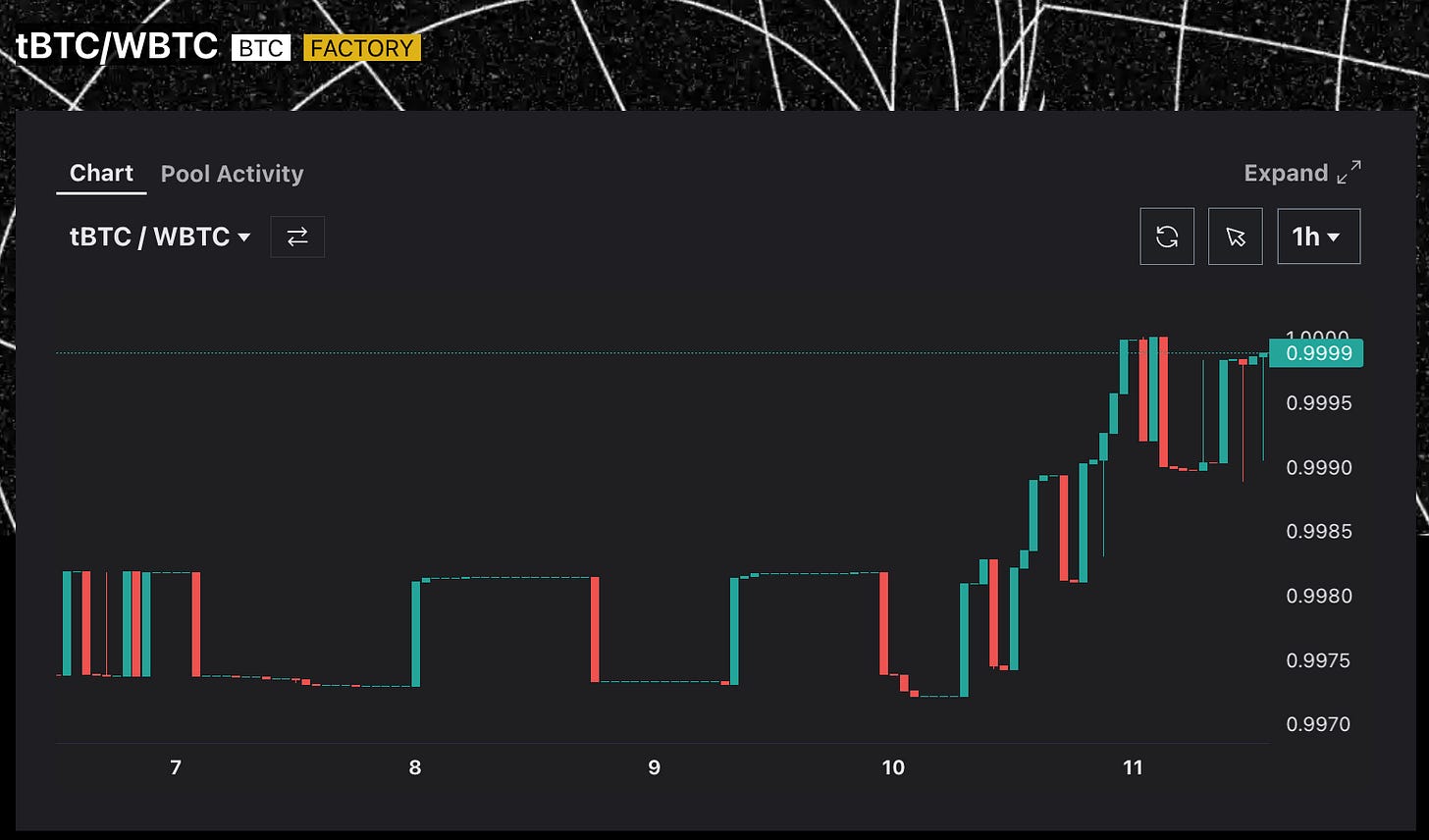

Curve notably has long supported both $WBTC and $tBTC. Several Curve pools, including tBTC/WBTC and TriCryptoLLAMA, have long pushed any such risk onto users. The token has held peg, so LPs willing to rake the risk have profited.

More recently, it’s served as a backing for $crvUSD

And some users have begun moving their position accordingly.

Will the latest concerns about WBTC lead to a breakout of tBTC? The hourly chart on the Curve pool suggested some initial movement.

And a few mints were observed in the aftermath.

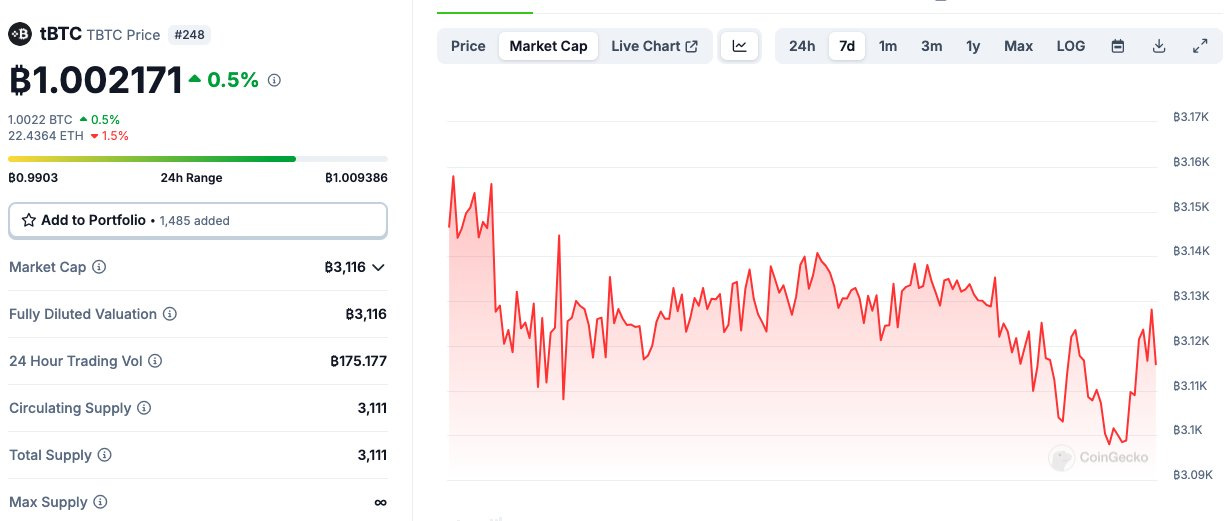

But the market cap of both wrapped forms of Bitcoin has been quite steady the past week, with little exodus into or out of either token.

As you might expect, you can confirm these metrics on the great DefiLlama

If the two tokens remain in a dead heat, a tie goes to WBTC, which holds 155K BTC, versus 3K tBTC. 0xngmi aptly describes this disparity as an “insane moat.”

A particularly notable metric from DefiLlama’s dashboard… in the entire time operating WBTC, there’s been a cumulative $12.7MM in fees on the roughly $9 billion worth of BTC… essentially they’ve been running this service for free.

With a much smaller market cap, liquidity for the token is necessarily smaller, causing slippage for larger sized trades. This is another challenge for $tBTC, which cannot support whale sized moves as readily. In DeFi, size begets size. First movers have a huge advantage that proves difficult to shake.

Given that $WBTC has continued to work well enough in terms of redemptions, holds liquidity advantages, and keeps a strong peg, we suspect it’s unlikely this latest shake-up will immediately spell the end of the predominant Bitcoin wrapper.

However, if you are interested in bridging Bitcoin and supporting decentralization, we’d suggest you consider $tBTC as a viable path.

For more background on how to use tBTC:

This superfan is also logging daily facts about tBTC

Disclaimers! Author has exposure to $tBTC, none to its governance token T 0.00%↑