August 15, 2023: All or Nothing 🎰💸

The Complete N00b's Explainer for How $crvUSD Leverage Works

Yesterday Curve released a leverage button for $crvUSD.

It seems like the most hardcore degenerates already found this button… $crvUSD quickly rocketed past a $100MM supply for its first time since the Vyper exploit.

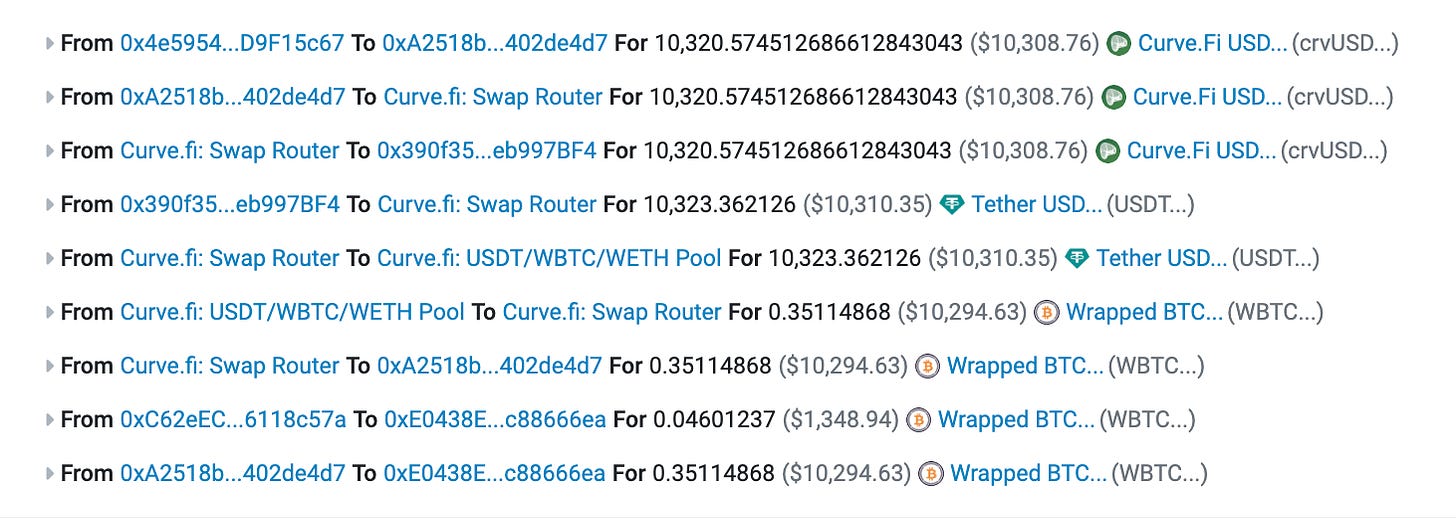

The example in the above tweet is actually a video of a live transaction being made through the new leverage UI. The video features address 0xC62e…c57a, an account with just under $1MM net worth — what Mich might call a test account?

You can see the user in this case dropped just 0.046 BTC — worth about $1350.

Before leverage, the most a user could squeeze out of this using $crvUSD would be just shy of $1200, for a loan-to-value ratio of around 88%.

Flip the leverage button on, and suddenly the $crvUSD max borrow value goes from $1200 to nearly $10K. Suddenly you’re above a 750% loan-to-value ratio.

So what on earth… did LLAMMA just give this user $10K in walking around money on a mere $1K worth of WBTC collateral? Of course not! If this were possible, you could take the $10K, buy more WBTC, and keep printing money forever. That would lead to a death spiral.

Instead, as you can see from their UI, what has happened is that the borrower now has about $10K worth of collateral in their loan.

Note the .046 WBTC supplied is now worth .39716 BTC, about $10K worth of collateral. Not bad!

Except, if you want to pocket this collateral for yourself by repaying the loan, you have to acquire $10K worth of $crvUSD to pay it off. The repay amount also ticks up forever in sync with the ever-fluctuating $crvUSD borrow rate (so far averaging ~5%)

In this leveraged position, the user pocketed exactly $0 in $crvUSD from the leveraged position. To exit their position, they’d need a plan to get that $crvUSD from somewhere. This particular user has about $750K of other assets, so they have an exit plan.

But please, please, please… don’t yeet your entire net worth into a leveraged position without an exit plan.

We know you won’t listen though, so let’s imagine the scenario where you do yeet your entire net worth into an extremely levered position. Why would this be good for you exactly?

The technical term for this is a “leveraging long." You are gambling that markets will only go up, up, up. If anything else happens you lose big. Before we look at the upside, let’s look over the downside events.

If the recent past is any guide, crypto markets will just trade sideways forever. We won’t look too much at this scenario, since all that happens is your repayment amount just keeps going up by the ~5% or whatever $crvUSD borrow rates do going forward.

But people keep saying crypto is volatile. Presuming it eventually moves, let’s consider the hypothetical case where it moves in the wrong direction…

Megalodon Whale Dump

Let’s imagine you go to sleep and wake up to to see Bitcoin prices plummeting. Of course, in this scenario, everybody is crypto is effed. Due to the friendlier liquidation mechanism of $crvUSD, you’re probably far less effed than others — quite likely you have days or even years to rescue your position if you so choose.

But let’s ignore the rare event of getting liquidated in $crvUSD for now, and just look at the difference between leverage and no leverage… what happens if you actually do happen to get yourself liquidated

If you hadn’t played with leverage, the normal use case of $crvUSD hard liquidation is certainly friendlier. In this case, you put in $1.35K worth of WBTC and get $1.2K in $crvUSD back. If you do happen to get liquidated because WBTC rockets to $0, at least you have $1.2K in $crvUSD to do what you want with, so you actually come out ahead.

If you played with leverage though, you get nothing. You deposit your $1.35K in WBTC, and instead of pocketing $1.2K in $crvUSD, you keep looping it to get a position worth about $10K WBTC. Since WBTC has become worthless, you lost big and walk away with nothing.

Hence the refrain that leverage is dangerous. Without leverage, you keep something in the transaction. With leverage, you’re going all in and can lose everything.

Now, let’s consider the scenario where you don’t get liquidated right away thanks to $crvUSD’s friendlier liquidations method. Where most protocols instantly rekt you, within $crvUSD things work differently.

When the price of WBTC goes down below your threshold but doesn’t nuke to zero, you start to find yourself in trouble. The UI refers to this as “soft liquidation mode.” The Curve team has loose plans to rename this but hasn’t gotten around to it… so for the sake of breaking this habit we’ll call it “collateral conversion mode” for the remainder of this article.

If you enter collateral conversion mode, you can no longer add new collateral to shore up your position. All you can do is repay your loan or self-liquidate.

Since you’re playing with leverage, this is where we hope you didn’t use your entire net worth. If you kept some in reserve, you can maybe scrape together up to $10K to shore up your position. If you only had $1K to your name and levered it all up to $10K worth of collateral, then perhaps you may never be able to reclaim your sats.

Adjusting N

When you take out your loan, you have the ability to set “N.”

In theoretical terms, “N” simply refers to the number of bands over which you spread your collateral when you deposit it.

In practical terms, this affects your maximum LTV if you leverage, and has the real effect of making it easier or harder to get liquidated once you enter collateral conversion mode.

If you set N to the lowest possible value, then you have a very tight liquidation range… from the example above, you can see their collateral got set into four tranches, all reserved for prices as close as possible to the current price of WBTC.

A sudden price movement of WBTC into this narrow range doesn’t instantly liquidate you. Instead your collateral starts getting converted into $crvUSD to protect you from liquidation. But high volatility through this range can lead you to get rekt, hence why a narrow range of bands is more likely to trigger a liquidation. Based on existing data, setting N=4 right up against this boundary may trigger a liquidation within a matter of days.

The default if you create a loan and don’t adjust this factor, the default value is N=10. This spreads your collateral over more bands and lessens the likelihood of a hard liquidation quite a lot, although it also slightly reduces your max LTV. Here you get just $8.7K worth of collateral, for a LTV of 644% instead of >$10K and 750% at N=4.

The most conservative investors could set N to its max value (N=50). At this value you cannot lever quite so highly (max leverage 3x instead of 9x) for ~$3.4K.

The advantage for conservative investors is that your losses in collateral conversion mode are extremely low… closer to ~10% per year, as opposed to 100% loss in days suffered for N=4.

Curve explains this nicely in their xeet on the subject.

In summary, it all sort of depends on your use case. If you are depositing collateral because you want to receive $crvUSD to hold or farm or something, then you would not want to use leverage.

If you are treating it more like a financial instrument and you are acting as a trader, then it can make sense. In this scenario, you are explicitly betting on the value of your collateral going up.

If you have extreme conviction in this belief, leverage can help you make this into an “all-or-nothing” type bet. You’re betting on a massive pump, and are willing to take any losses if you’re wrong in order to maximize your gains if you are right.

If you’re wrong, you might see your address is locked in collateral conversion mode for days or possibly years. Or you might get hard liquidated and lose it all. We hope you heeded our advice to only play with money you can afford lose. Instead, you shrug your shoulders, swear off playing with crypto, and go back to waging at the neighborhood hamburger shack.

GAME OVER

Megalodon Whale Pump

What if, Gensler forbid, crypto goes up instead?

The ancient texts do tell of a bygone era… an unusual market where bullish news actually caused Bitcoin prices to go up.

“This is it, folks. This is the moment we planned for!”

What happens to your highly leveraged position if you bet right and the market actually goes… up?

Let’s imagine WBTC does a casual 2x. You had deposited the ~$1K from above and got a .39 WBTC position. Initially this was worth $10K, but now it’s worth $20K. You win! Now you have choices.

One option would be to simply repay your loan. You pay back $10K + interest and you get a chunk of WBTC worth $20K. You can sell off half of the $20K to pay for the loan repayment, and you still have pocketed $10K from your initial $1K investment. Instead of a 2x, you claimed a quick ten-bagger on the move.

This suggests another good reason why we hope you don’t YOLO your entire net worth into the trade. To get your collateral back you have to find the money to repay the loans. Maybe you can head upstairs and ask your parents to finance your degenerate gambling habit?

You’ve got another option though… you now have $20K worth of collateral and your loan is quite healthy. You could borrow more $crvUSD against this amount. Let’s say you take out an additional ~$8K worth of $crvUSD against this collateral. Whatever happens next, you’ve already pocketed $8K off your initial $1K bet, so you’re pretty happy.

From here, your WBTC collateral is again in a risky position. If prices go down, you’ll again be at risk of entering collateral conversion mode, losing some or possibly all this newly valuable collateral. It plays out the same as described above though… maybe prices nuke and you don’t care that you might lose it all because you still have your $8K in your pocket. Or maybe prices double again and you keep repeating the process.

Or perhaps you decide to lever up again… take the $8K, buy more WBTC, deposit as collateral… borrow more $crvUSD…. the flywheel of addiction…

Take Caution!

Note, with all of these examples, there’s yet no “deleverage” button — if you want to unwind your position you would have to do manually.

More than ever, remember that none of this was financial advice, but intended to be an idiot’s guide to how this all works. If we were offering any advice, it’s to get off the computer and get a job.

Leverage is extremely risky! As we saw, in the event of a downward move, traders were better off without leverage. With leverage they lost it all. We sincerely hope all readers understand the risk factors and ape responsibly. We’ve seen too many people lose it all and don’t wish this to happen to you!

Great read.

I'm trying out the leverage loan and took a recent "affordable" loss but learnt a lot.

Jumped right back in with another smaller leverage loan and am learning everytime.

Can't stress enough, if you're going to try leveerage start with small amounts and expect losses.

Thanks for the information, there is not enough instruction on this tool.

@rolipony (from Twitter) thanks again for the information. I re-read through the information and think I better understand the options. Appreciate you responding on Twitter.