Runaway inflation… Middle East turmoil… ‘70s throwback is chic. Ethereum’s channeling that retro spirit in the form of soaring gas prices.

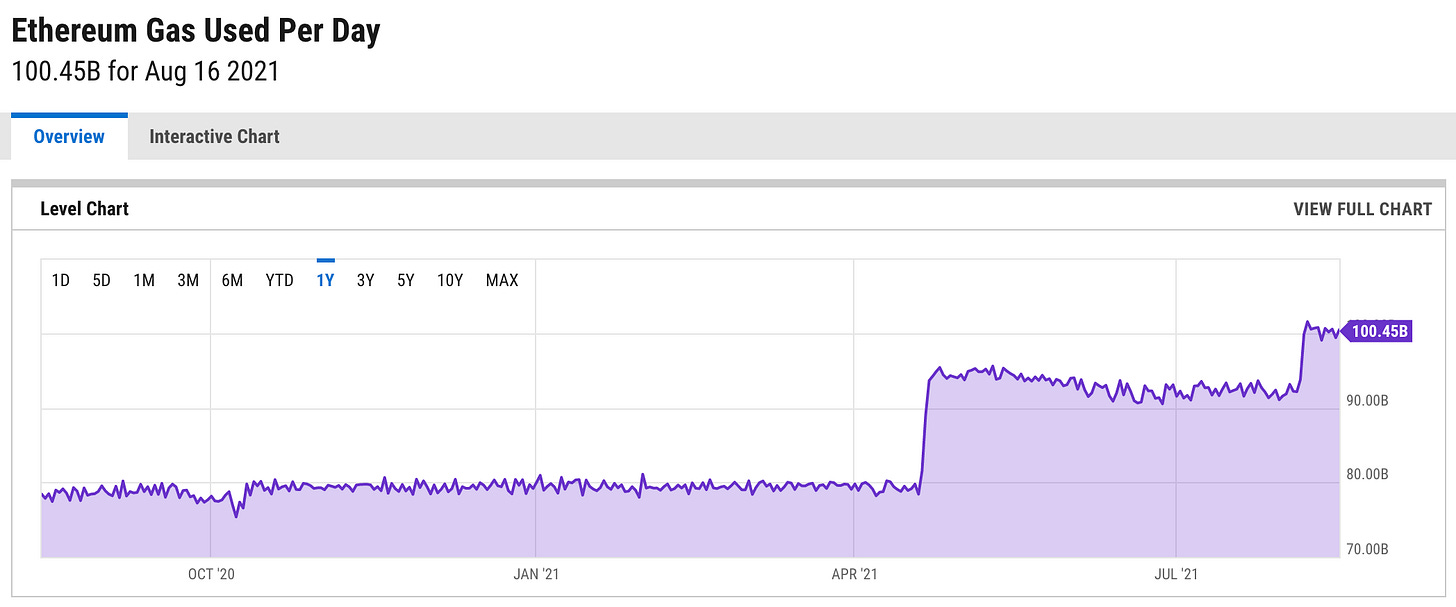

Observe the big jump on August 5th, when EIP-1559 went live.

So what gives, is it time to grab the pitchforks?

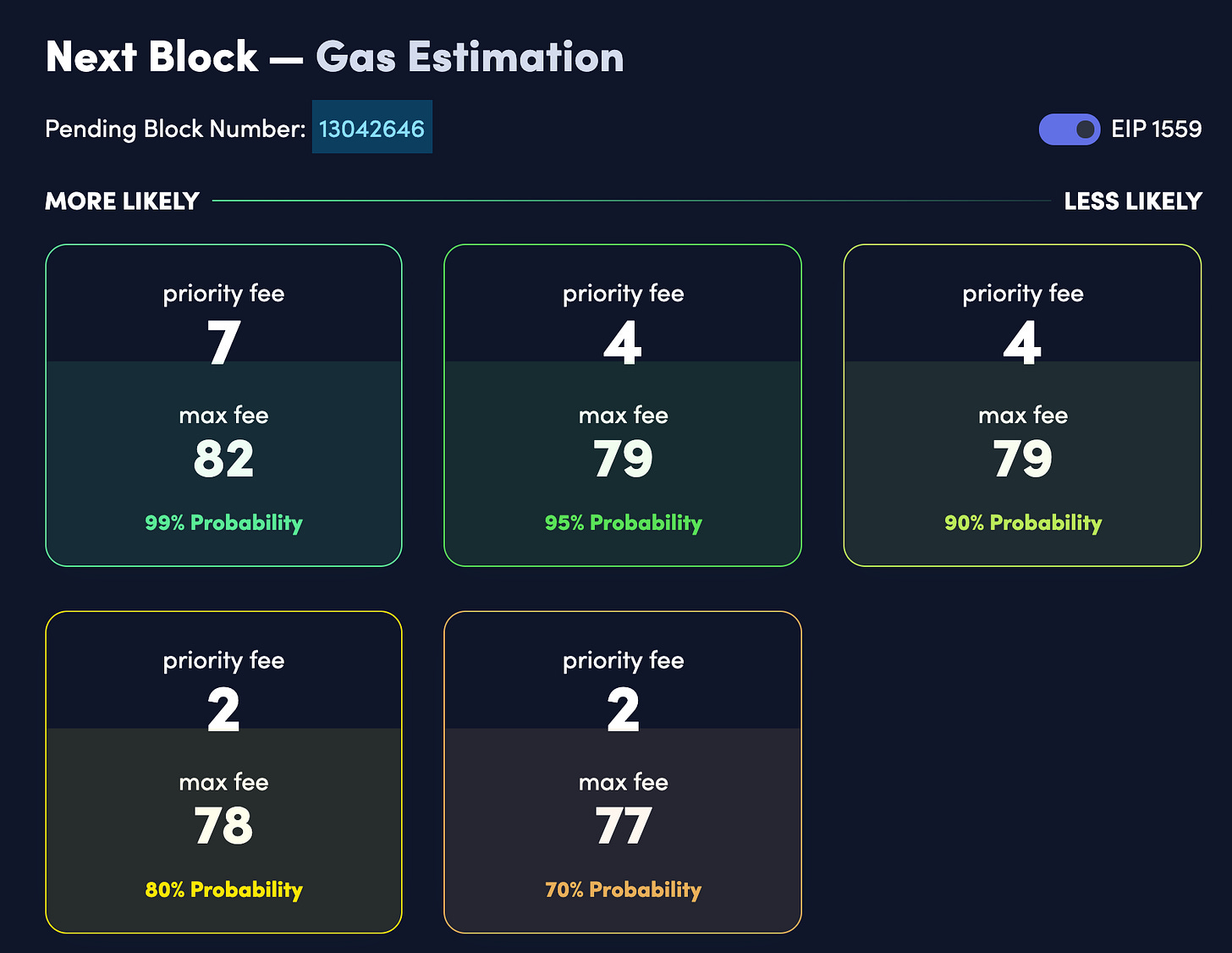

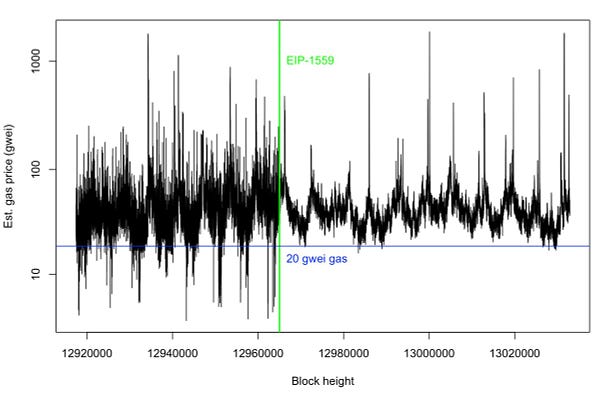

On the plus side, most predictions around EIP-1559 have panned out. The intent of London was not to lower gas prices, but to improve predictability around gas fees: easier estimation and less volatility. This effect is easy to confirm visually:

Block utilization has also improved:

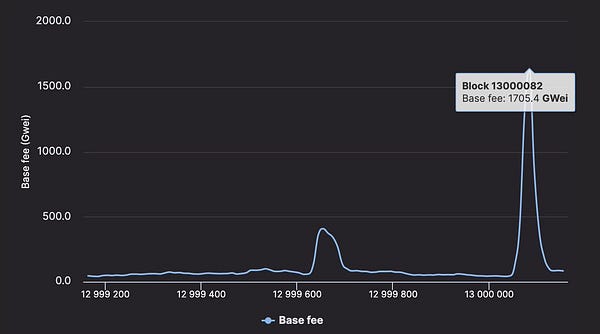

Recovery from gas spikes is also alleged to be faster:

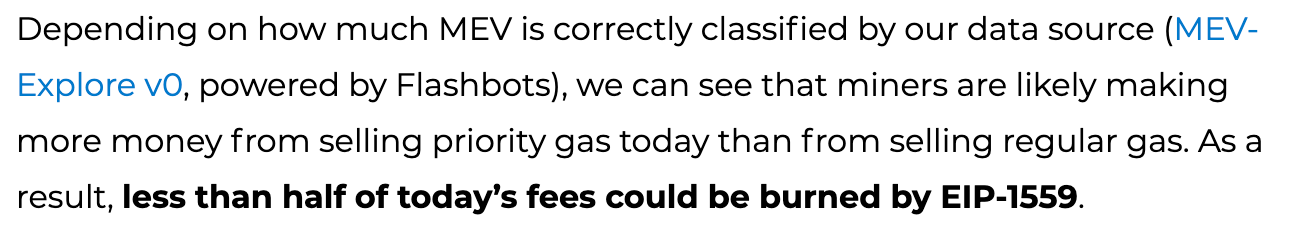

In terms of these intended effects of 1559, the fork has been a success. However, one major prediction that has not yet panned out is a drop in miner fees.

To date, miner revenue has actually increased:

One potential issue is that several wallets, including the extremely popular MetaMask, have yet to support 1559.

MetaMask tends to over-estimate gas prices, and pre-1559 transactions are more likely to pay this excess. For 1559 style transactions, the developer rule of thumb is that a 2 gwei priority fee on top of the base price will usually confirm quickly.

If base fees do indeed come down as more users switch away from legacy-style transactions, that 2 gwei tip would start looking pretty nice.

Another holdover in the 1559 world is pumping other chains every time gas spikes:

The last one is technically true, you can’t have gas fees if you don’t actually have functioning smart contracts…

Despite some pain at the pump, EIP-1559 is mostly proceeding as expected. Hopefully this provides you some peace of mind next time you’re forced to empty your wallet for an NFT airdrop.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and owns some $ETH.