August 31, 2022: Do Your Doe Diligence 🦌🕵️

"Curve Reward Distribution + Effects on Convex-Curve Ecosystem" by Diligent Deer

Today we feature a guest post from the author of the Diligent Deer Substack and Mirror

Risk-Reward Matrix for all possible actions on Curve Finance

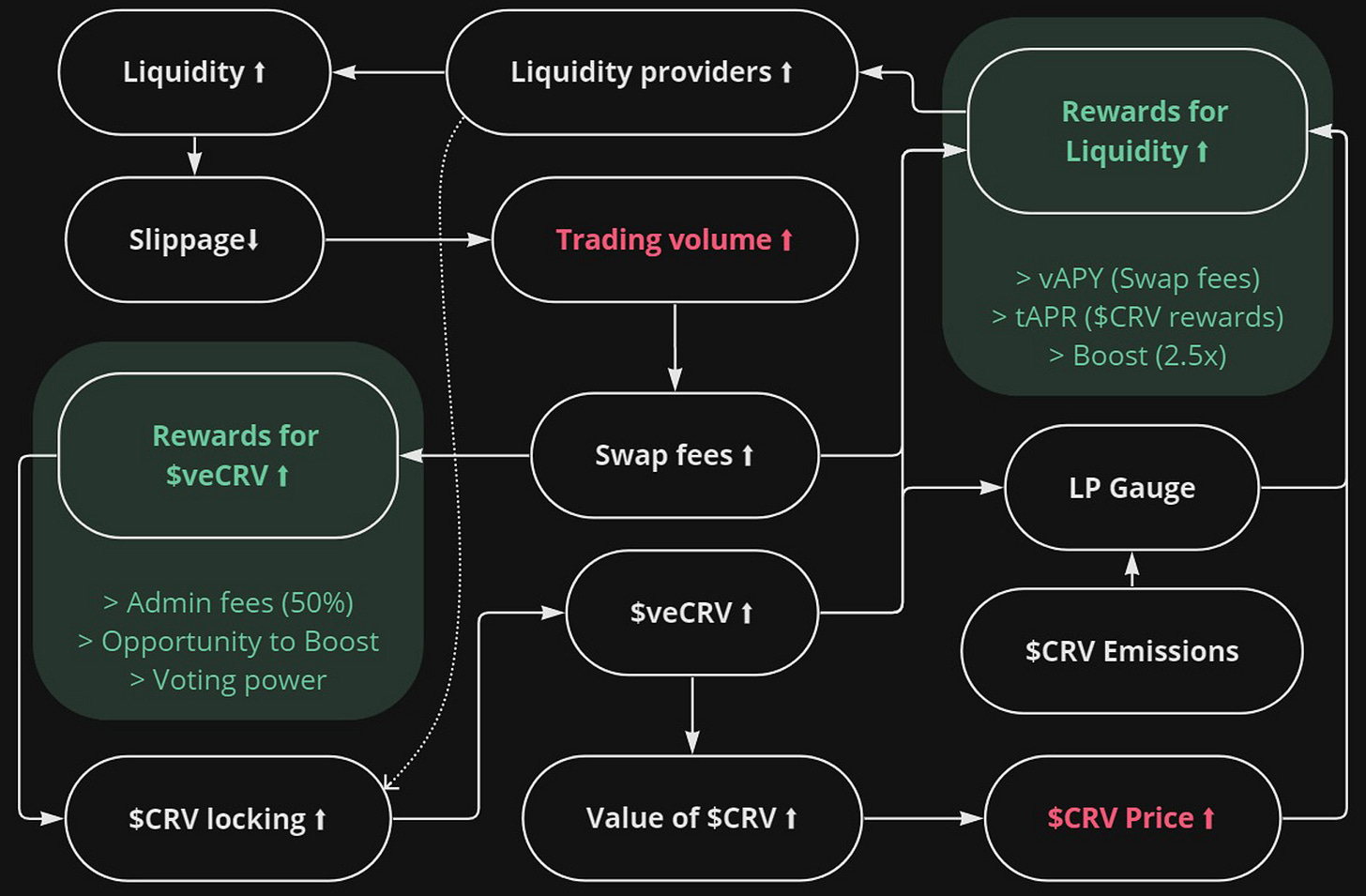

Curve Flywheel

Notable Facts/insights:

Growing liquidity in a pool reduces slippage but after a certain point, slippage reduction by the further liquidity growth does not cater to increasing the trade volume. It just dilutes the rewards originating from the transaction fees. Simple speaking, increasing trading volume is linked to liquidity growth but has a diminishing impact as the liquidity grows more. [Quantatively proved the point in the analysis]

$CRV is being accumulated and locked in order to incentivize a specific liquidity pool/s.

$CRV Emission is decreasing by 15.8% every year, i.e. participants of Curve wars are fighting over fewer & fewer rewards/incentives that drive their favorable liquidity pool.

Eventually, protocols/DAOs would need to spend more to incentivize the users to provide liquidity to their favored pool. [Early adopter/accumulators would have an edge]

Claim: $CRV price is the can fuel the system where LPs are rewarded with noticeable returns on their provided liquidity in spite of increasing pool TVL.

Analysis

What should be the $CRV price in the future to get a constant APR on the liquidity supplied, taking TVL growth into consideration?

Basically, the LPs are getting two types of rewards when they stake their LP tokens

vAPY: 50% of Transaction Fees generated by the pool.

((Volume * Fees) * 0.5) / TVL gives rewards from trading volume per liquidity supplied

tAPR: $CRV inflation based on gauge votes and relative liquidity.

For simplicity, we can assume $CRV inflation / TVL as rewards coming from emissions per liquidity supplied across the pools/platform.

We will need the following to gauge the required $CRV price for a constant APR.

Forecast TVL Growth

Forecast Volume

Emissions schedule

Curve trade fees approximation

Computing the price

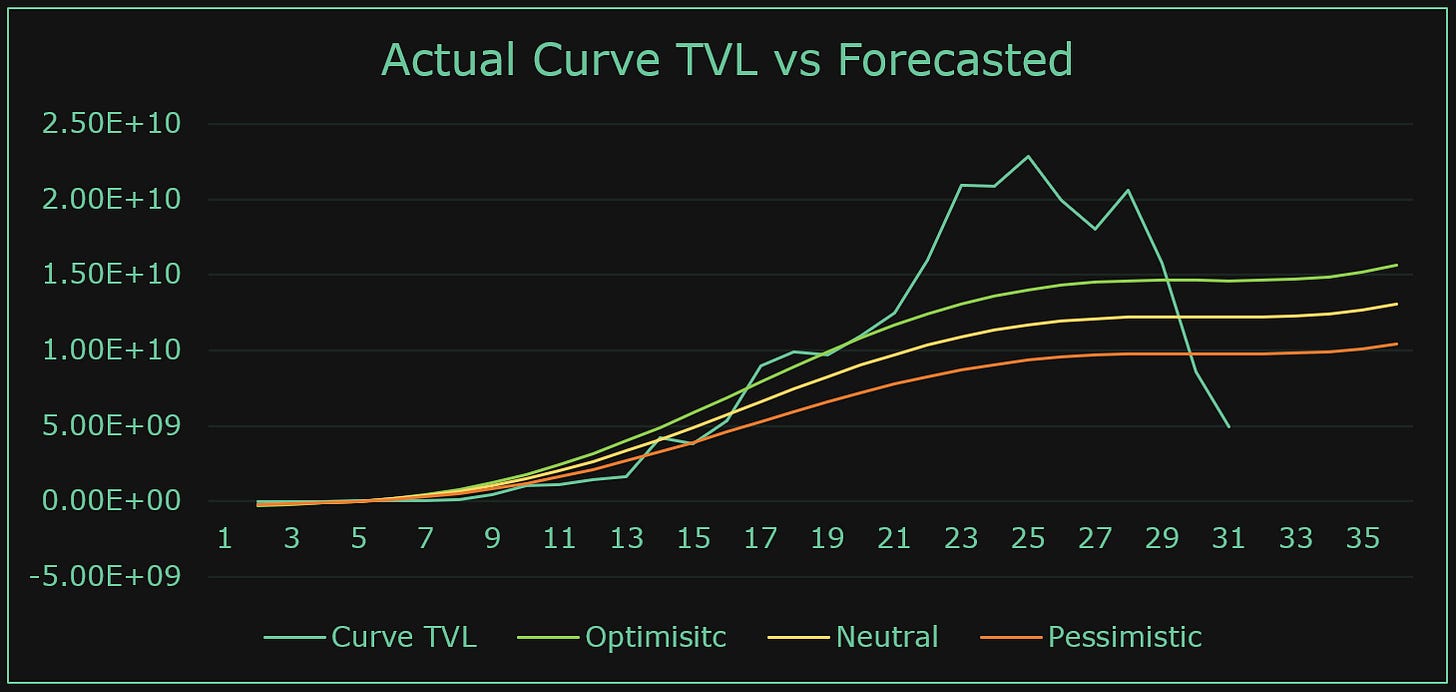

Forecasting TVL Growth

Curve TVL is highly correlated with the DEFI TVL; DEFI TVL is highly correlated with the BTC price.

BTC Forecast: Regression model with cyclicality.

Forecasted Curve TVL: Raw Data

Forecasted Curve TVL: Performance with actual data

Forecasting Trading Volume

The data need some adjustments to get rid of low probable volume spikes and valleys.

Adjusted vs Actual

Forecasting model: Polynomial, Neutral, and Linear

The neutral model is just an average of these two.

Forecasted Data

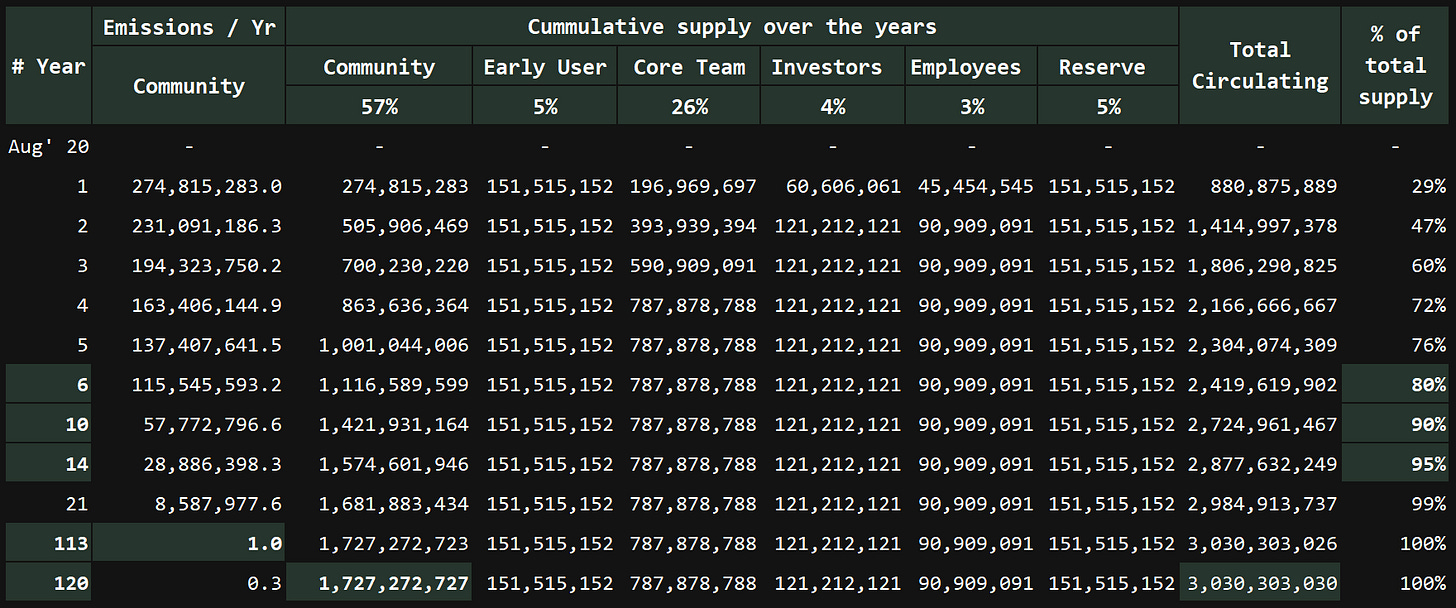

Emission schedule

Curve Trade Fees Approximation

The model is tested with different values to gauge the impact of trading volume on the future rewards per liquidity.

Computing the Price

The trading fees have an almost negligible impact on balancing the APR to a constant value. This is because TVL growth outpaces the trading volume growth and since emissions are also decreasing the rewards required to serve the growing TVL need to come from the price of $CRV.

As we progress in time with this analysis, the burden to deliver returns is heavily shifted to the $CRV emissions factor i.e. $CRV price.

Any activity that supports increasing $CRV demand or reducing $CRV selling pressure reflects in $CRV price and is beneficial to generate better returns for an LP.

Focusing on increasing the volume and limiting the TVL can help balance the APR to an attractive number.

Though the above statement is true from a mathematical standpoint, TVL would auto-balance itself in accordance with the risks and required returns.

Effects on the Convex-Curve Ecosystem

One of the interesting things to notice is regardless of the action, the activities/actions on the Convex platform are designed to accrue value on the $CVX tokens.

Convex being a pseudo LP, it works as a normal LP on Curve finance. The cycle is fueled by the $CRV rewards and ultimately $CRV price. The action is very similar to that of Curve’s and thus same conclusions apply here as well; ROI depends more on the $CRV price.

The trading volume is more or less an independent variable but the $CRV earning potential is directly linked to the $veCRV holding of the Convex protocol.

Convex kind of plays on the fact that not all liquidity providers boost their rewards while providing liquidity on Curve. An increase in these types of LP in the Curve ecosystem enables Convex to gather more $veCRV to support more liquidity for the maximum boost.

For the X amount of unboosted liquidity, there is only Y amount of liquidity that can get a 2.5x boost with Z amount of $veCRV. If the liquidity is increased beyond Y to get boosted rewards, even if we have more of the Z amount of $veCRV the boost will reduce from 2.5x. This is because $CRV rewards for X can never go to zero.

Adding more mechanisms around creating value around the $CVX tokens is the best way possible to create sustainability for $CVX; $FRAX integration is the best example to understand this.

Comment below if you agree or disagree! If you enjoyed this, @DiligentDeer on Twitter, check out the Mirror, and subscribe to their Substack:

If you have written something potentially of interest to the community you think may be a good fit for the newsletter, don’t hesitate to reach out. Haters in particular are welcome!