Another weekend where decades happened…

We’ll just briefly touch on the macro state of affairs, then zoom into crypto, DeFi and our core competency of Curve.

Most importantly, events like this weekend are a prime example we always advise that you should definitely NOT be playing around crypto unless you’re playing with money you can absolutely afford to lose.

If you did happen to ignore this advice and got yourself irredeemably rekt and feel life is hopeless, do not do anything rash. The wider crypto community still here do care deeply about you, please reach out for support!

Macro

You’ve got so many great resources at your disposal that are better able to cover macro trends than our newsletter, so we’ll give the subject intentionally short shrift and instead link some better threads.

The short version is that conditions everywhere were already precarious, and the situation out of Japan provided the spark to let the world burn.

If your financially disinclined frens ask you what happened, we recommend to read up on the “carry trade” via this great thread.

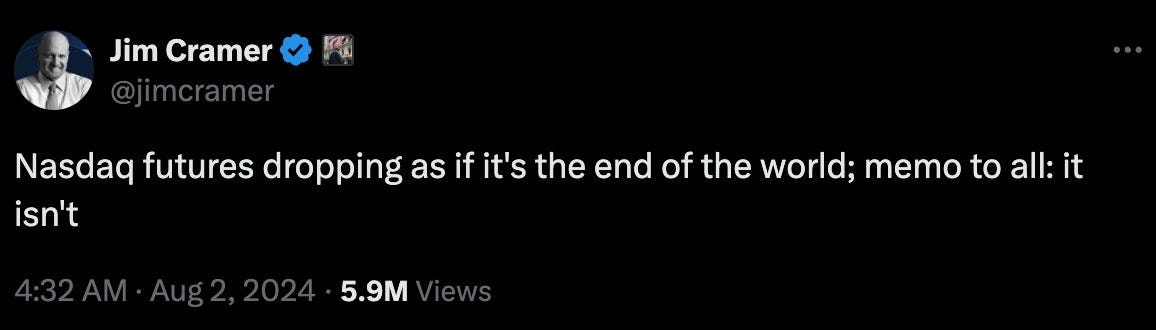

As the newsletter goes to print, Asian markets have widely halted trading following massive losses. US markets have yet to open, but futures are in the toilet. Talking heads are not debating if rate cuts are likely to happen, but rather wen and how much.

With all these questions, Polymarket remains a great resource to snapshot the state of the world and calibrate your expectations against reality. Or if you really strongly happen to feel you know better than Polymarket traders, then you can make money counter-trading.

For instance, at the moment traders are not betting on an “emergency rate cut” but expect several rate cuts this year with a 50+ bps decrease by September.

The carnage in the markets comes amidst wider concerns like growing civil unrest and a powderkeg in the Middle East. Traders on Polymarket are mostly betting against the worst possible events.

Then again, the saying always goes that you should always buy the “threat of global apocalypse” market crash events. If it turns out it’s not a thermonuclear armageddon, then you expect a bounce up. If it is in fact the end of the world… well… your speculative investments won’t do you much good anyway.

Not financial advice, of course.

Crypto

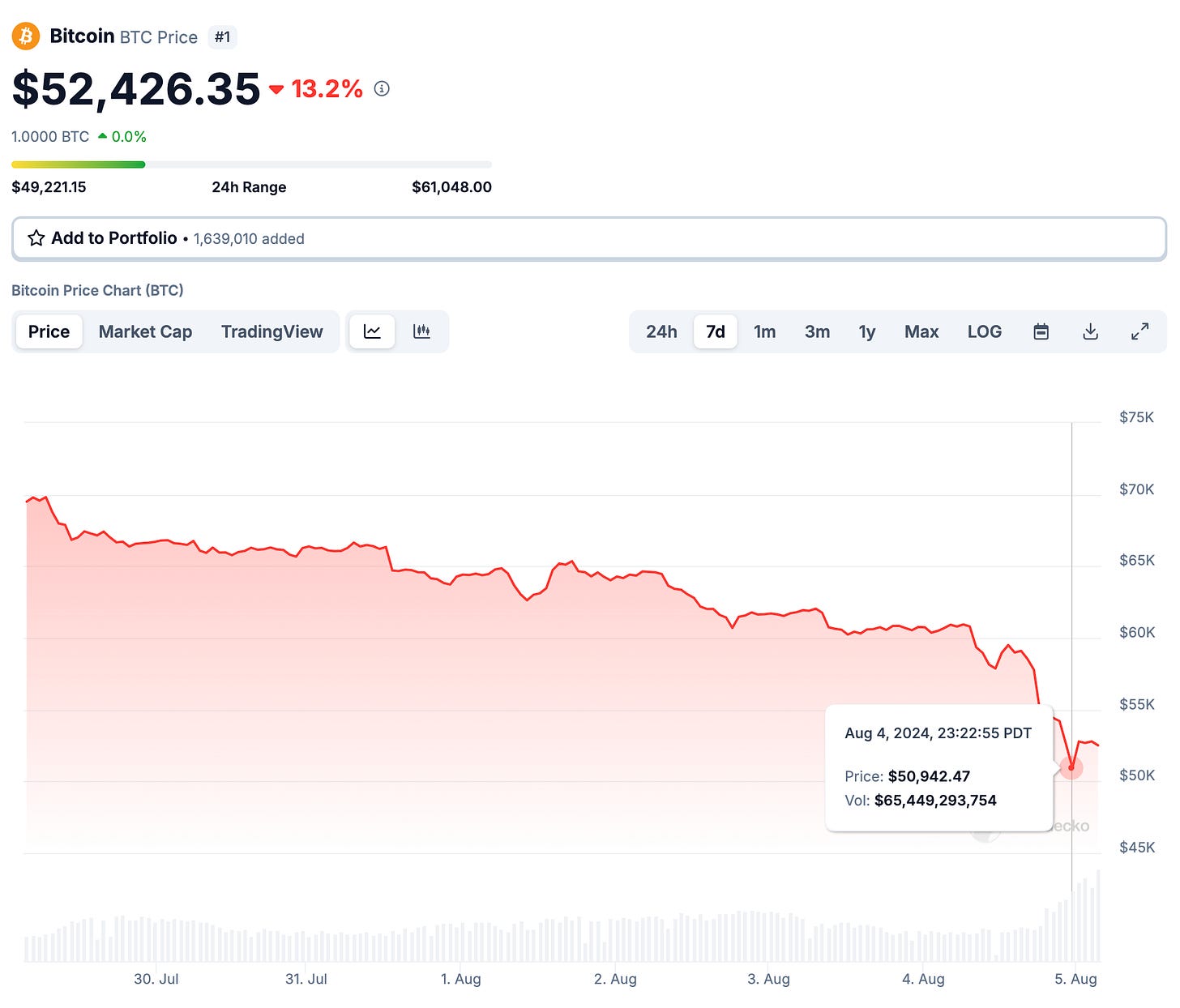

Yet again, crypto has not been a good store of value to hedge against these type of black swan type events. Bitcoin was at $69K just one week ago, and dipped into the $50K range during the past 24 hours.

Ethereum’s faring worse, touching almost $3,400 last week, but dipping into the $2,100 range over the past day. This dropped the ETH/BTC ratio to its lowest rate in a year.

Rumors spread widely that much of the carnage in crypto markets was due to a major liquidation of Justin Sun, rumors that his excellency denied.

Other rumors center around Jump Trading unwinding positions.

We’ve no idea what’s actually happening in the mercenary playground that is the intersection of offchain and onchain crypto shenanigans.

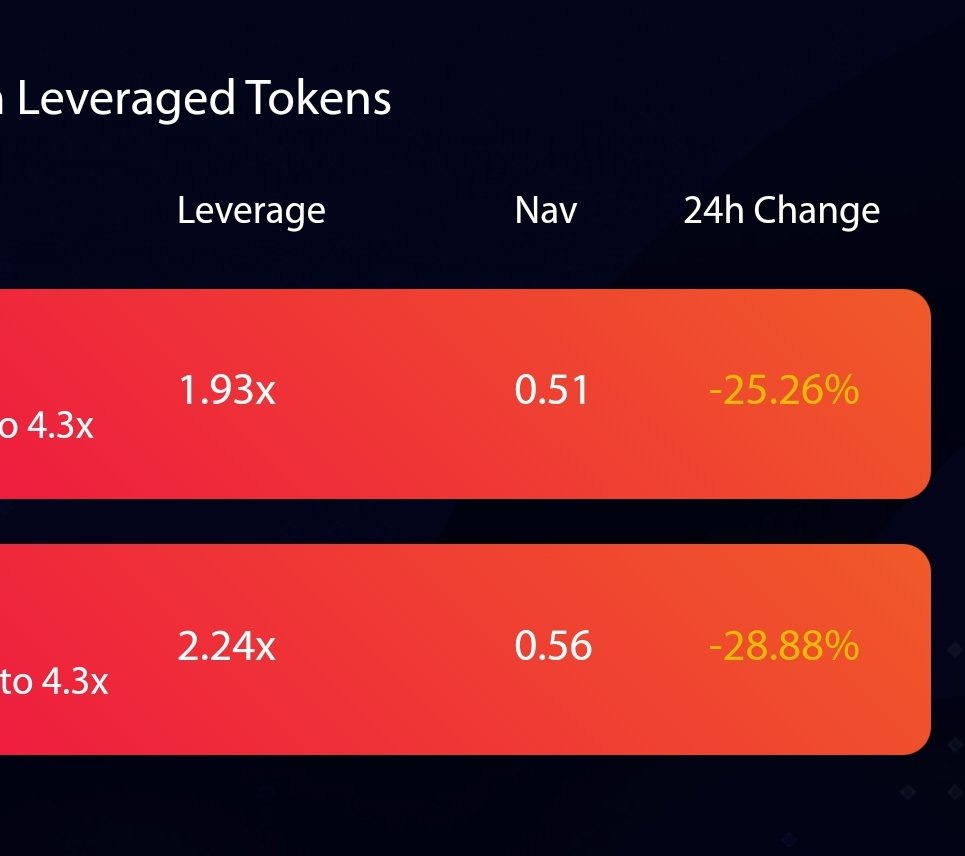

We know total crypto liquidations over the past 24 hours are large, certainly over $1 billion and likely much higher.

During the madness, gas prices went wild, even on L2s.

We have much more visibility onchain. While we of course feel bad for everybody who got harmed, we also find ourselves astounded by quite how soundly our nascent DeFi infrastructure has weathered yet another calamitous market event.

Aave, as usual, had a fantastic day.

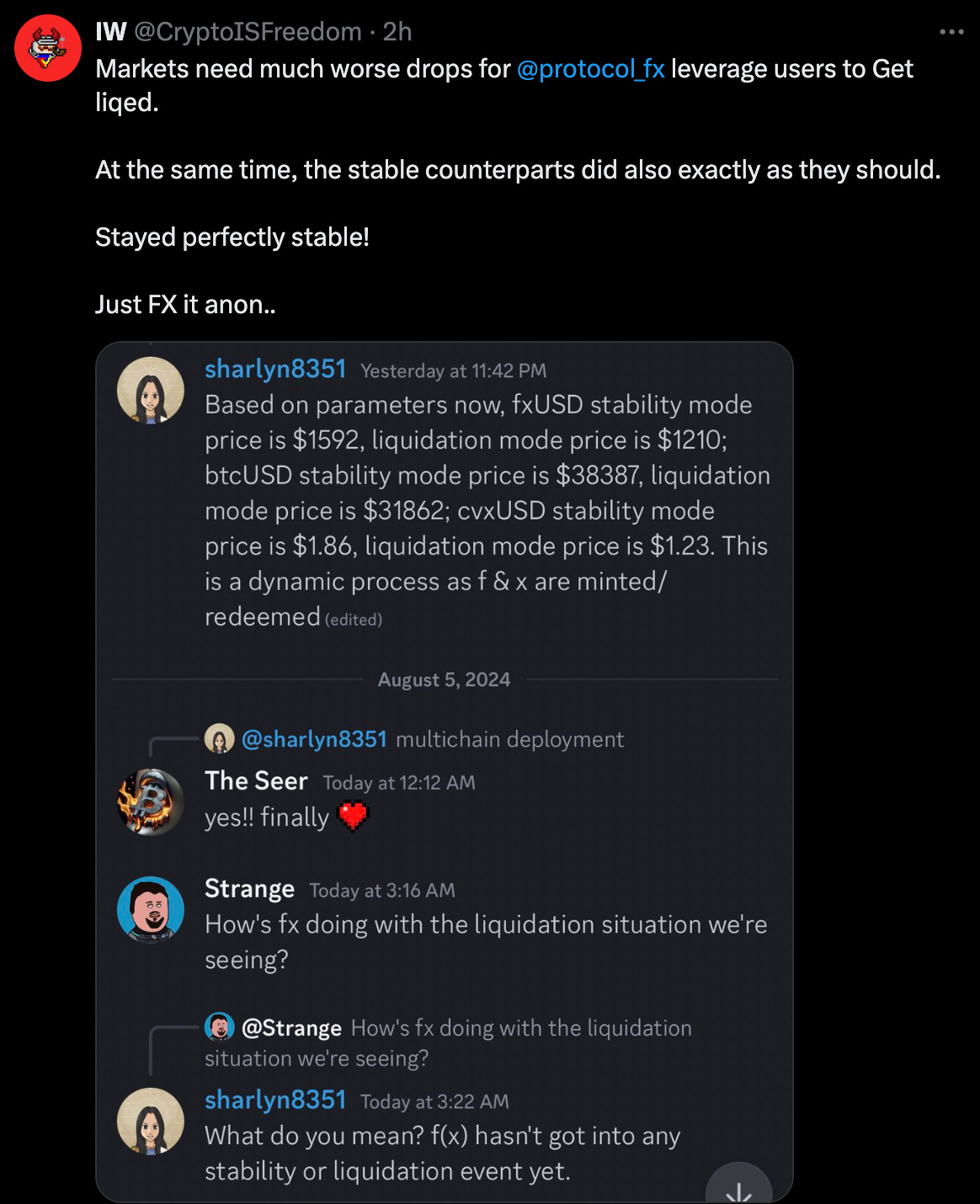

We were particularly impressed by how well f(x) Protocol held up

Lots of eyes were on Ethena, given the relatively newer DeFi heavyweight had been exposed to fewer black swans. The team reported no issues.

Curve

Curve had recently created some Llama Lend markets for USDe and sUSDe. This was the sort of “depeg” style event for which it may have been profitable for traders to buy the dip and place a leveraged bet on a repeg. Here is the snapshot of how these markets held up.

If anything, the stETH chart looked more precarious

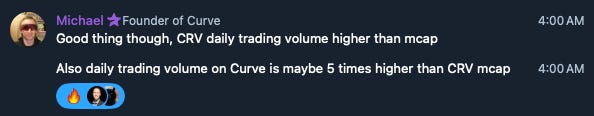

Of course, if you’ve followed Curve for any amount of time, you’re perhaps accustomed to the account cracking wise on 𝕏 while markets burn.

The $crvUSD infrastructure appears to again have survived another major battle test in its second year of existence. In another meltdown, $crvUSD responded by pushing above $1.00 with an according drop in borrow rates.

Peg Keepers were working overtime to throw up some truly interesting numbers

In all, a lot of good.

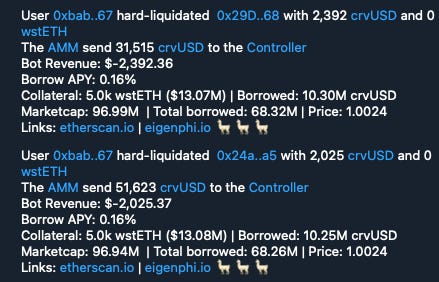

The reference to “ETH” here appears to be due to the fact that the swift drop in the ETH markets coupled with high gas prices appears to have led to ~5-6 figures in debt that was being hard liquidated at a loss by 0xbabe as we went to press

We’re still very much in the throes of volatility. We expect we’ll see more clarity on these numbers as things shake out.

Once again, it’s looking like yet again volatility in crypto redounds to the benefit of veCRV holders, but at the cost of all our speculative bags dropping in price. So it goes…