August 6, 2024: Soft Liquidation For Dummies 📚🤪

The single biggest misconception about LLAMMA soft liquidations

Today we’re clearing up the single biggest misconception about LLAMMA soft liquidation.

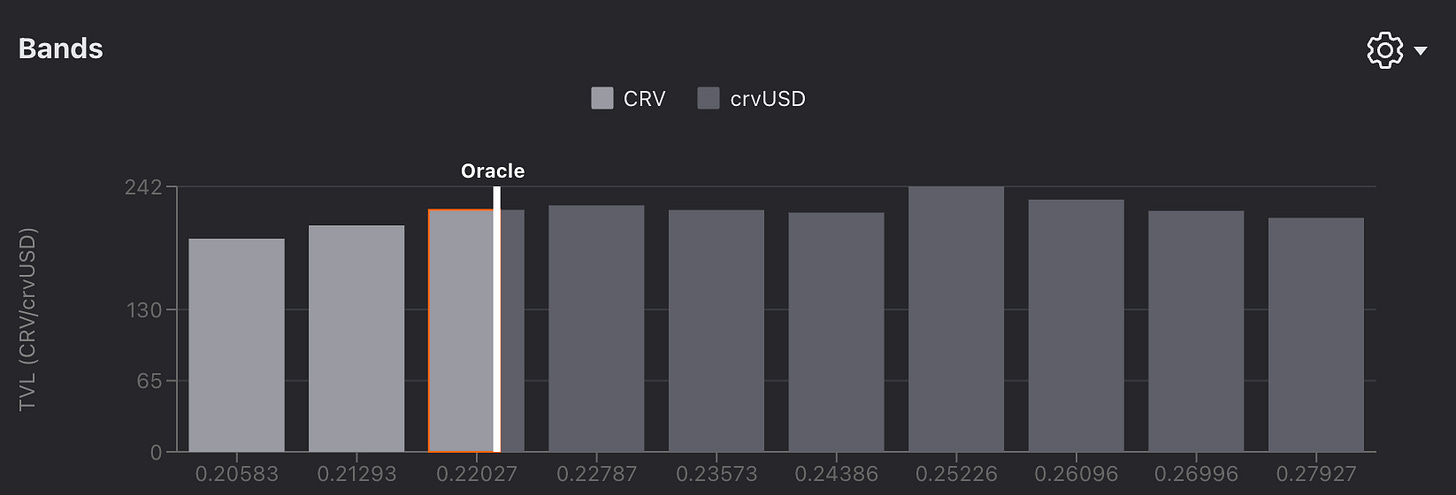

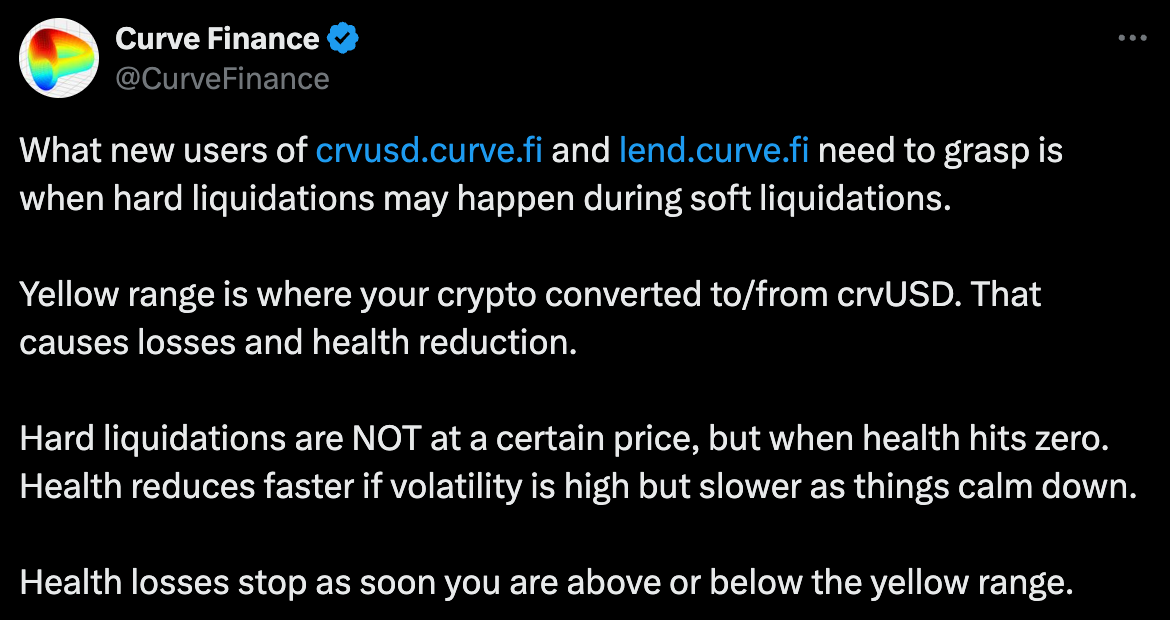

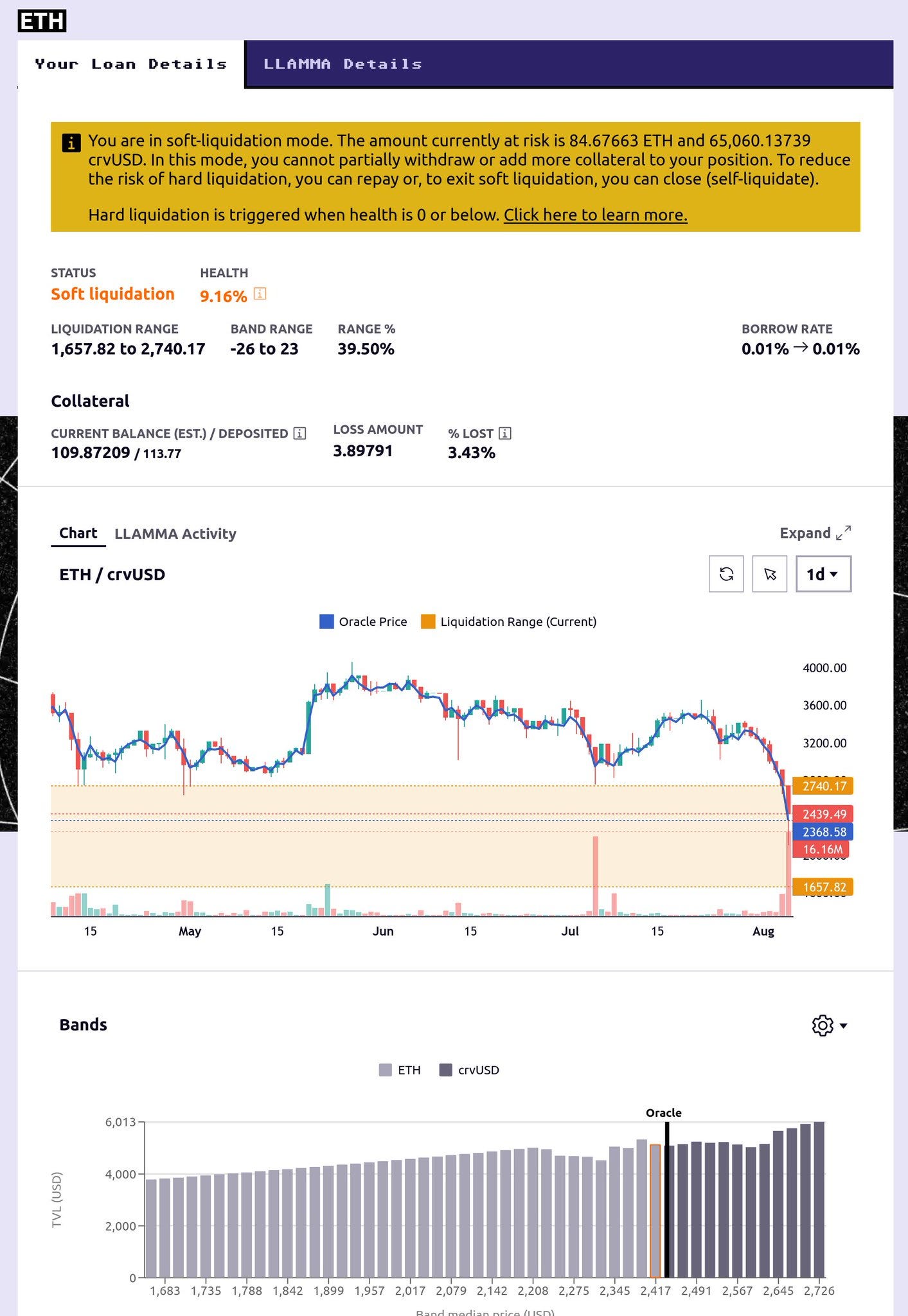

MYTH: “I will be liquidated when the line reaches the bottom bar.”

This is FALSE, FALSE, FALSE! Don’t be trapped in the mental prison of liquidations.

$crvUSD does not have a fixed liquidation price.

REALITY: “While my position is in soft liquidation, my health will decrease. When it reaches 0, I can be liquidated.”

Got that? It’s by far the number one misunderstanding about LLAMMA style soft liquidations.

If you understand this, you’ll be in a better position to survive the craziness of crypto markets.

Best Practices

OK, I understand this. How do I use this to my advantage?

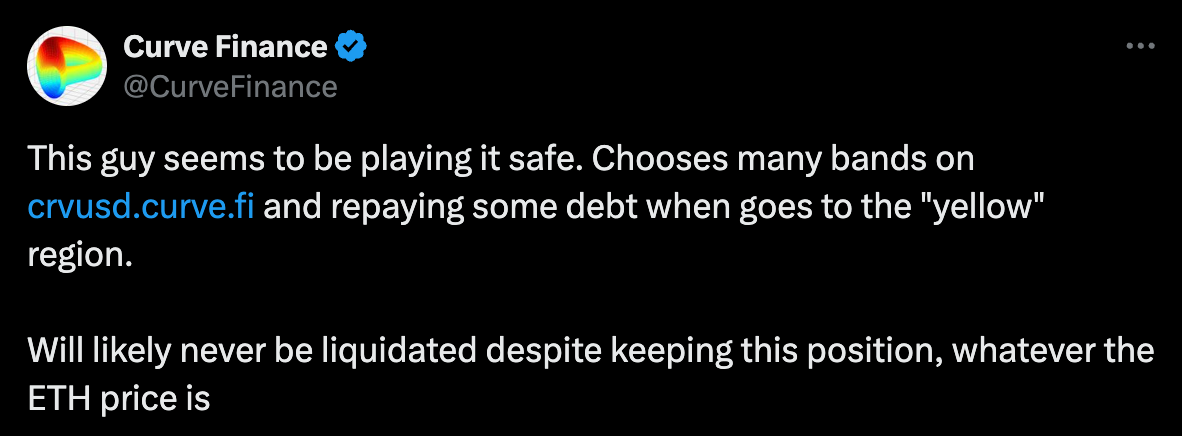

When you take out your loan, make sure you pick a larger number of bands.

Make sure the highest band is far away from the oracle price, so you never fall in the yellow zone.

If you do fall into range, then repay some of your debt.

Keep these tips in mind, and you’ll be safer.

Help, I fell into soft liquidation! What should I do?

Don’t panic. You cannot adjust collateral, but you have two good options:

Decide if you want to keep your loan or quit

OK, I decided I want to keep my loan

If you want to stay in the game, try to repay. The price probably has to go back through the yellow zone, which means your health is likely to decrease.

Repaying even a small percent of your loan makes a big difference!

OK, I decided I want to exit my loan

If you want to quit, try self-liquidation to close your loan. You’re probably lower than you started, but it’s non-zero. In this case, “soft liquidation” served as a stop-loss, preventing some losses.

Case Study

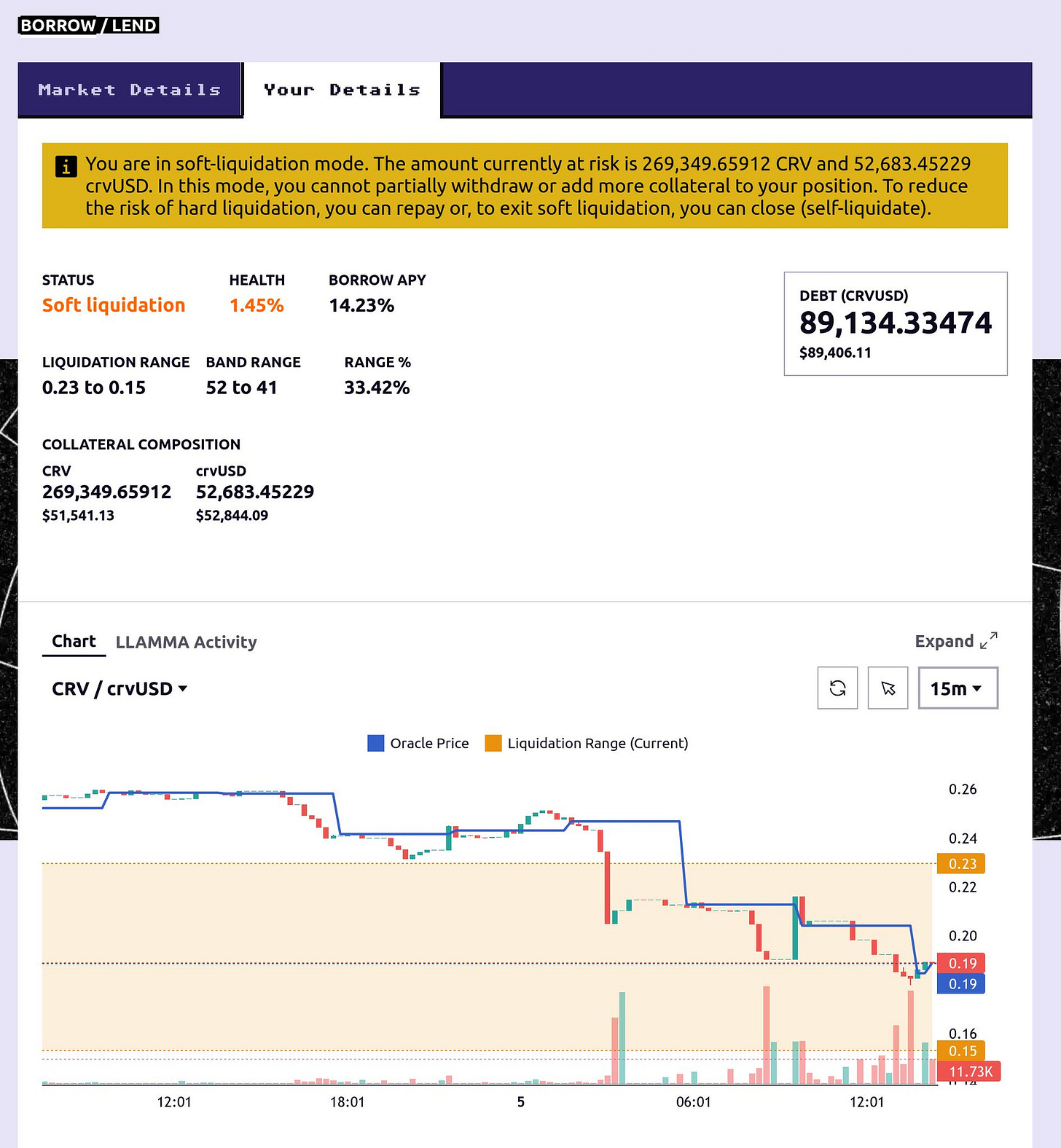

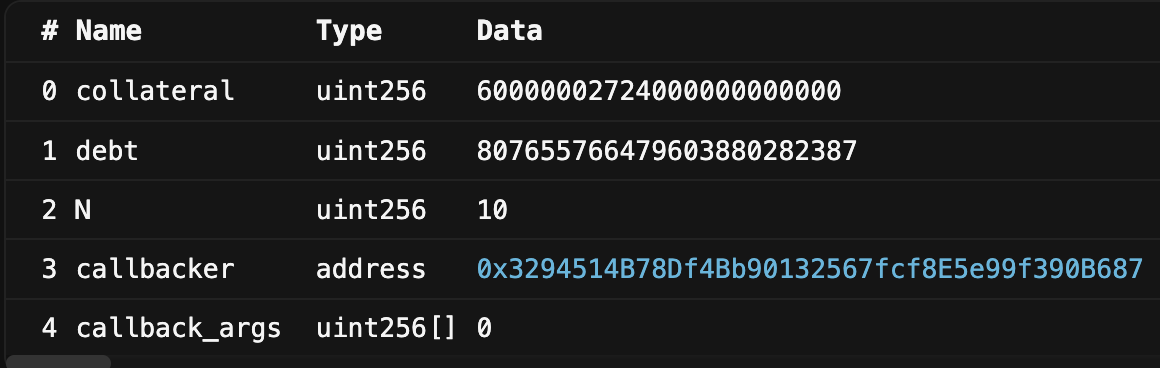

You can see a lot of stories in the Curve Monitor channel. We’re going to pick on 0x8cbcda0cd7Df045CF7fBF4b477DCBDEA3D88746F.

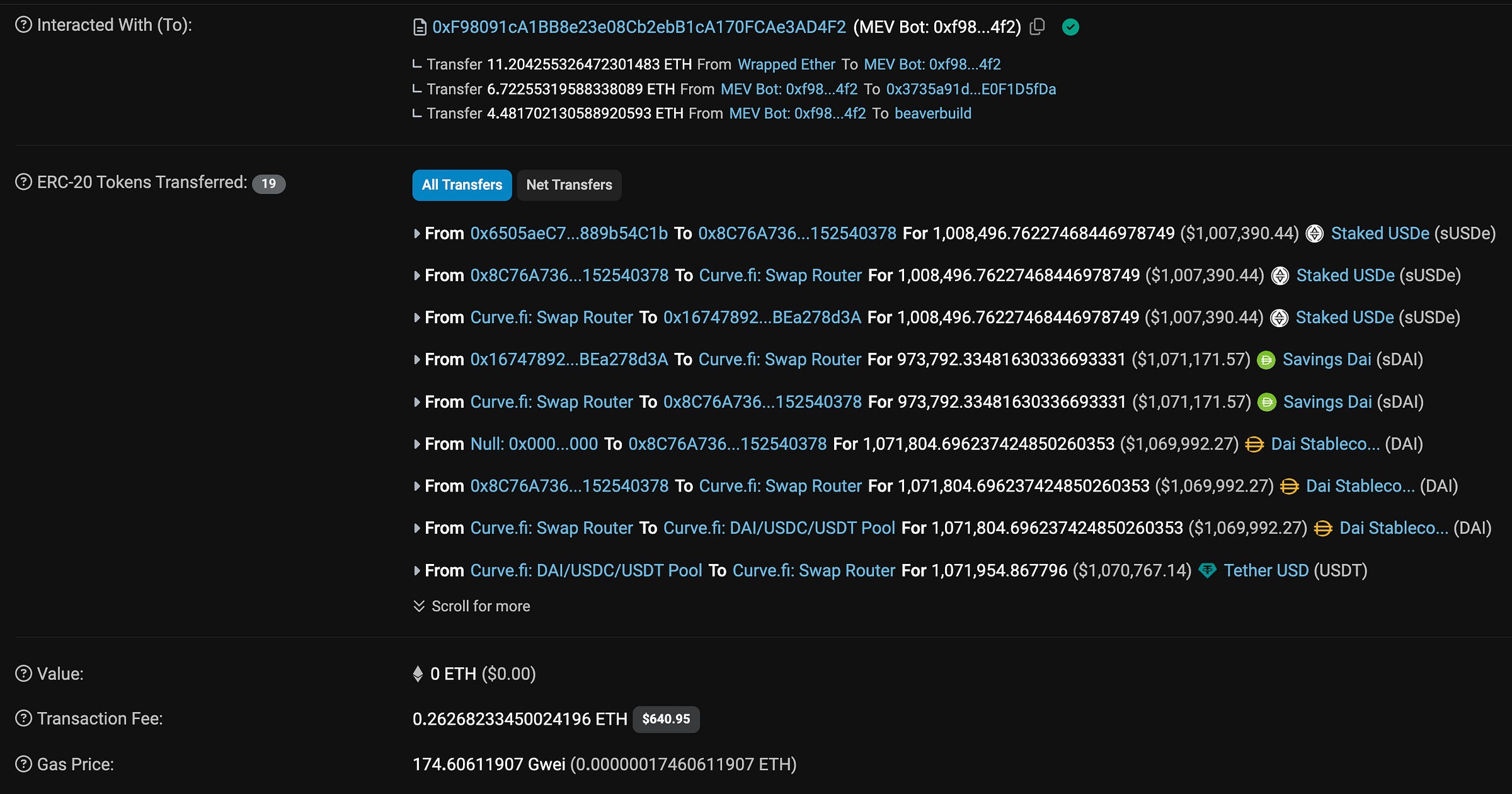

This user created a loan using leverage

This is using $60K in $sUSDe and levered up to a total debt of over $800,000. The loan was fine for almost a month, but during yesterday’s madness $sUSDe price fell into the user’s liquidation range.

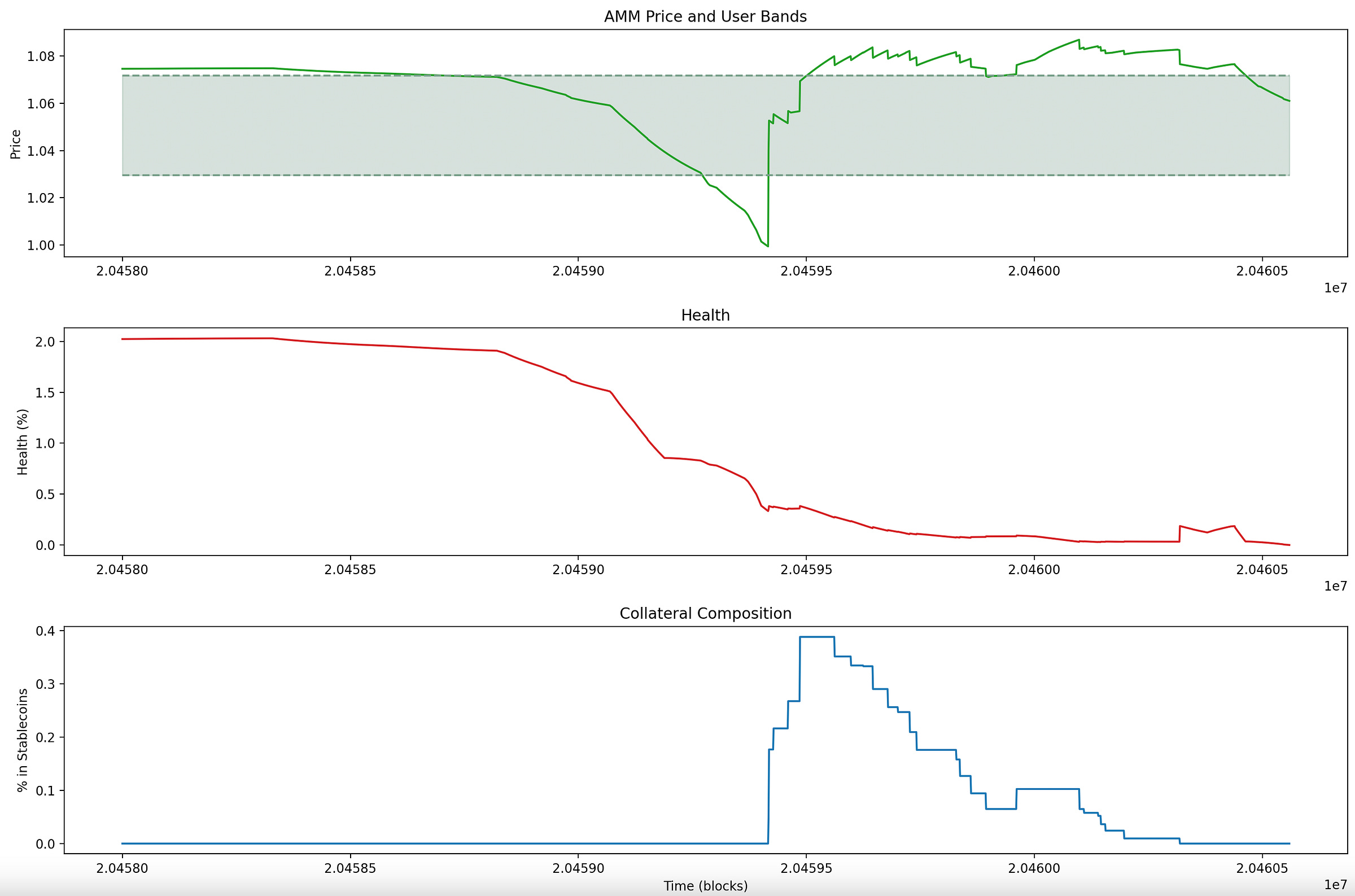

The top graph, in green, shows how the price first fell right through the user’s liquidation range. It then shot back above liquidation range for several blocks.

Perhaps the user thought they would be safe as long as the price was above the low-end of the range, but as you can see the loan ended and the user got liquidated right after falling into the top of their liquidation range.

It could have been avoided if they’d monitored their health…

The second chart, in red, shows the user’s health over the duration. It started at the edge, a mere 2%. By the time the price recovered the first time, it was right above 0%. The slightest drop in health would erase their position, so it would have been a good time to exit the loan or even just repay a bit.

The final chart, in blue, shows off how their collateral had been converted to stablecoin through the soft liquidation mechanism. In fact, on the first trip through the user’s soft liquidation range, there was no such conversion into stablecoins — soaring gas prices made it nearly impossible for traders to profitably run this conversion, so there was no soft liquidation protection during this period. The health fell fast.

On the trip back up, there was some soft liquidation protection as the user saw their position get traded back into stablecoins. Their health stayed fairly stable for its remaining life. But the health was so borderline, it couldn’t survive a plunge back into the soft liquidation range.

The loan was liquidated, costing 0.262 ETH to run the liquidation with gas prices at 174 gwei, leading to a total loss.