August 7, 2024: Surge Pricing 🏪🛒

Algorithmic DeFi benefits by staying open for business during crises

Anybody old enough to remember Monday’s crash?

Issa rigged system… amirite?!?

Perhaps it is the case that the system is being rigged against us by shadowy overlords.

If true, it’s insufficient to simply meme that TradFi is bad and crypto fixes it. In fact, it appears the shadowy powers-that-be have captured DeFi as well, via swampy “out-of-range” errors.

If true, then we regret to inform you that Uniswap has possibly fallen under the control of the demon-lizards too…

Putting on our tinfoil hats… what if it’s not necessarily the case that TradFi is completely captured by lizard people, but rather that order-book style exchanges break down in times of volatility?

A DEX that trades when you need it most. Who’s building this?

As it turns out, Curve built this!

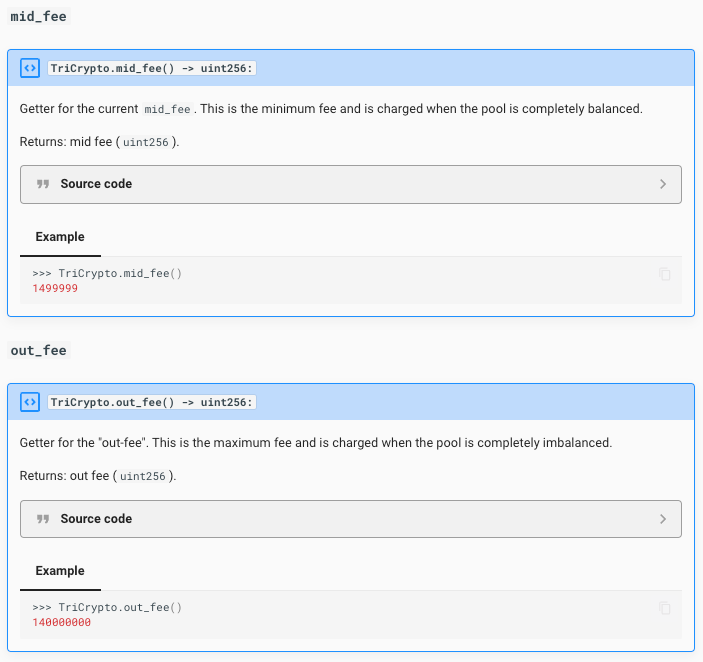

It’s good for Curve and its LPs for several reasons. Not only is Curve the only DEX able to capture business in emergencies, it also happens to be the case that Curve’s “dynamic fee” mechanism happens to kick in. The pools turn more imbalanced under extreme conditions, so the pools tend to charge higher fees.

The purpose of out fee is to serve as a tax on arbitrageurs, who always have guaranteed profit to rebalance the pool. In this emergency case, maybe it functions more like surge pricing?

We asked Curve giga-brained dev Alberto for thoughts on where Curve v2 style pools are going next, and he leaked some good details.

We have a new invariant to implement that seems to behave very closely to the old one, EXCEPT that it can be solved analytically which means it will be cheaper than ever (bye bye Newton’s Method for twocrypto).

Also I basically managed to implement rebalancing donations, this is particularly interesting for the famous Forex market that were being discussed. Basically using the $crvUSD fee splitter we will allocate a part of the revenue to boost $crvUSD pools making them rebalance hyper aggressively, which is the famous FOREX market thingy that was being discussed.

The “Newton’s Method” is a reference to how Curve frequently uses the iterative Newton’s Method to approximate solutions for some math problems, but iterative processes is a challenge for solvers among others

We don’t intend this as a knock against Uni v3 style order book exchanges. Concentrated liquidity has its advantages and its disadvantages. 24/7 uptime is not one of these advantages, so it’s not really fair to knock CEX downtime in emergencies from such a vantage point.

Expect DEX innovation to continue!

It wasn’t just Curve’s DEX business that profited by keeping its shop doors open.

Even if DeFi remains operational during inclement conditions, soaring gas prices can still make it practically unaffordable for anybody but the wealthy.

Curve’s LLAMMA “soft liquidation” mechanism is ideal. In some cases, it’s possible to sit on the sidelines during extreme events, then resurface when conditions improve to tidy up if needed.

Curve’s algorithmic Monetary Policy also happened to offer a sale to whomever was ready to go shopping in the immediate aftermath.

Outside of Curve, lots of algorithmically focused DeFi proved resilient and reaped the benefits. Aave cleaned up of course!

Frax also boasted of its performance during the emergency:

This weekend’s market dump was less volatile than the level of chaos f(x) Protocol has envisioned when architecting its safety fallbacks.

Algorithmically-focused DeFi stayed open for business!