August 9, 2022: Tornado Chasers 🌪️ 🇺🇸😳

The World Laughs at America's Futile War on Encryption and Privacy

America’s Tornado Cash sanctions can only be described in one way: utter embarrassment.

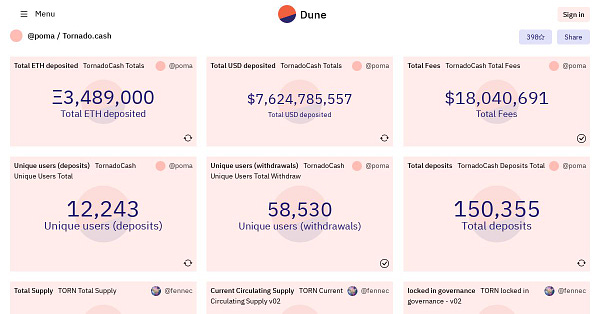

The Treasury Department yesterday placed stringent sanctions on several bytes of computer code, unlawfully and unconstitutionally seizing the funds of thousands of users, simply because bad actors also used these services.

One wonders if the US Dollar could come into existence in today’s repressive environment. The US Dollar’s strong intrinsic anonymity and privacy features have made it the currency most in vogue on the black market. Thankfully the US hasn’t proven so stupid as to blacklist cash just yet, but given the low caliber IQs of those in charge, it may well happen soon.

It’s important to remember that President Biden has a long and terrible track record on the subject of encryption. In the early 90s, the formative years of the Internet, the then Senator attempted to insert a provision into a counter-terrorism bill allowing email surveillance. His overreach inspired PGP (Pretty Good Privacy,) the open source protocol by which email is secured.

In 2022, the government appears eager to prevent common sense encryption mechanisms from getting a foothold within cryptocurrency. It’s a shockingly hostile move. Decent encryption protocols enabled the Internet to flourish —it took several years to convince regular users it was safe to type a credit card number into a website. Only when they were assured of a decent track record of privacy could e-commerce dominate. Why do you need privacy if you have nothing to hide?!?!?

Similarly, basic privacy tools for cryptocurrency will be necessary for users who wince at their entire transaction history being fully public and on display. The average person doesn’t necessarily want to advertise that they cheated on their diet with a candy bar, or purchased a subscription to a trashy TV show.

Just as Starbucks does not need to know my entire transaction history to sell me a cup of coffee, Starbucks likewise doesn’t want me to know every customer with whom they’ve sold a cup of coffee. Trade secrets used to be a prerequisite for doing business. Today it’s being rebranded as a criminal urge.

The insistence on linking privacy with nefarious behavior is downright odious. Why bother with curtains, doors, or even basic clothing, if you have nothing to hide? Good grief. The burden should be on the opponents of privacy to decide why something must be exposed publicly, with privacy the default assumption.

This need for privacy within cryptocurrency is best articulated by Chainlink’s unparalleled developer advocate @PatrickAlphaC, who capably describes the real harm that could be suffered by this insane movement.

Further reflections…

In the interest of neutrality, here’s a counter-argument:

It’s a fair point, although given the choice between a centralized and decentralized manner of doing the same action, I’d previously have always recommended the decentralized method out of habit and trust. Centralized exchanges simply have an abysmal track record.

Full disclosure, though. I’ve never actually used Tornado Cash. But don’t worry, I’m still a fully degenerate and despicable human being in other respects

“The Internet interprets censorship as damage and routes around it.”

— John Gilmore

The particularly depressing ramification of the entire fiasco is that the government’s censorship efforts will ultimately backfire, as always happens in such instances. We’ve known since the above quote was first recorded as far back as 1993 that the internet doesn’t particularly care about attempts to censor it. Technology just laughs and keeps expanding, to the benefit of all who embrace it and the detriment of those who attempt to fight it.

Ergo, the United States is only attacking itself and its citizens with this shortsighted maneuver. Our country’s sustained onslaught against software developers and pioneers has already presented the fertile US development community with two unsavory options: renounce citizenship or build anonymously. It’s notably ironic that attacks on privacy protocols have only necessitated stronger efforts at privacy

To be clear though: we advise all burgers comply with the sanctions, to the fullest extent outlined by the DeFi Education team. The type of sanctions wielded by the US are among the most serious. Nobody holding a US passport should dare to engage in any shenanigans, however hilarious they may be in theory.

As an optimist, we pray that perhaps the government’s actions here actually have some credible information backing up their stringent actions, intel they’ve not disclosed as yet. We have to hope they wouldn’t otherwise take such a seemingly inane and imprudent action.

However, DC’s sloppy rollout does not inspire confidence. The evidence presented thus far better resembles a Grandpa Simpson broadside against newfangled technology than an honest parsing of facts. The initial announcement from Secretary Blinken incorrectly described the Tornado protocol as being run and operated by an enemy state.

The evidence publicly presented to corroborate their assertion is an uglier mess. An elementary school teacher would swiftly fail any student who so severely cut corners doing their homework, but in this case the remedial students are running the show.

The sanctions they’ve levied, which have the effect of criminalizing not individuals but the execution of particular lines of code, create an impossible legal morass.

The legal ramifications are so bizarre as to essentially render all of cryptocurrency impractical to operate legally. Probably the point.

The likely intent is to establish the precedent of blocking access to unwanted computer code. The severity of this overreach cannot be overstated. Successfully prohibiting access to specific contracts is the end of cryptocurrency as we know it. Given our governments’ relentless inveighing against cryptocurrency, we imagine the slope towards banning crypto protocols en masses is particularly well-lubricated. It won’t be long before most cryptocurrency addresses are prohibited in the US, while the rest of the world chortles at America’s downfall and pushes onward into the future.

The Constitutional malfeasance is particularly clear in this case. The Treasury Department inappropriately seized American funds with this sweeping action, a clear violation of the Constitution.

@Railelujah of the RAILGUN Privacy Project, an expert on privacy if ever there was one, provided the following analysis:

I think this is bullish for privacy because what they'll find is legitimate mega wealthy people use Tornado Cash.

There are honest, American traders with strong connections to the major parties who use Tornado and other privacy protocols on a regular basis. These guys are going to contact Department of Treasury to get their funds back, and if those guys, who are very much not used to being sued, take too long, there'll be legal action against Treasury department. They aren't elected officials, so its actually arguable, especially after SEC recently lost a huge action in the Supreme Court, that the Treasury agency in charge are acting totally in breach of their constitutional authority by seizing assets of Americans in this case.

Essentially, they are acting like a court (deciding guilt or innocence with people’s money) which is against the US Constitution. The Supreme Court destroyed the SEC when they tried to do that earlier this year. It’s going to be great for local US privacy systems who can fill the gap as big people stop using Tornado, and the final result will be BIG clarity and space for privacy users winning a lawsuit or even getting Congressional clarity over use of privacy systems.

Not content to trample on just one section of the Constitution, they twistered their way from the fourth to the first amendment in the pile-on.

It’s an absurd overreach. We indeed hope the courts correct this injustice, though we are cognizant of the fact the Constitution occasionally takes a back seat to national security concerns. Yet the precedent that “some bad people use a service therefore none shall” is unworkable and would cripple our entire system, so we hope common sense prevails.

Again, Americans are encouraged to comply while the situation sorts itself out. The entirety of DC recently opted for numerous brash moves, escalating the “lock-em-up” style tit-for-tat against political opponents recently en vogue, and pushing tax authorities to impose severe extralegal consequences by executive discretion. These moves may cause outrage over the Tornado sanctions to fade from attention. Crypto advocates cannot allow any distractions. The Tornado sanctions are the most severe threat facing our movement and must be solved.

As an American, you may feel powerless, but you in fact have significant power. Have you contacted your Representative and Senator, by phone and in writing, to ask them to express their condemnation at the US Treasury Department’s Constitutional violation? We know that the flood of crypto activism connected with last year’s infrastructure bill moved the needle thanks to organizations. PAC DAO and presumably others are organizing quickly in response.

As for the rest of the world, well, they’re contenting themselves to simply have a good hearty laugh at our expense. China is teaching their kids math and programming. America is criminalizing it. One of these is a serious country.

Sadly, the ramifications will only be amplified globally in the short term. Several countries take their cues from the US, so this is likely to spill over into Europe and other western-aligned nations.

The countries pushing for non-alignment and independence are the likely winners.

Can the US Correct Course?

Well, we have to hope so. We have no other option really.

Encouragingly, despite the fact the “leaders” of our political parties are universally jokes and focused on irrelevant tribalistic trifles, the system as a whole is surprisingly self-correcting. The hope has to be a future administration, perhaps younger and more tech-savvy, simply reverses course. With little legislation on the books, a lot of damage could be undone by executive fiat.

However, America’s reputation for hostility towards cryptocurrency runs deep and would take a sustained effort to rebuild trust. This reputation may suffer more steps backwards as political power shifts back and forth over the course of several years.

It’s undermining any hope at American innovation in the space. DeFi denominated in USD is an undeserved windfall for America. The Treasury Department’s action is direct self-sabotage to our national interest. “USDC risk” emerged overnight as the newest buzzword. Burgers are watching in horror as USDC on the balance sheet shifts from an asset to a liability.

Of course, the trouble is there’s few good alternatives to USDC. Tether is easily compelled to blacklist as USDC. These two coins carry the largest total supply, which tends to be the main concern among traders. Major decentralized attempts at stablecoins also have significant USDC backing, putting them directly in the crosshairs.

The most decentralized alternatives, options like RAI and LUSD, have small supply. Traders simply may not be interested in the lending mechanics needed to mint these coins into existence at scale.

Moreover, any coin - at any level of decentralization - is now at risk of contract-level sanctions in the new paradigm. This problem can only be solved at the political level, not the technology level. This is an historic weakness of crypto, but thankfully one that’s improving recently thanks to organizations like DCG, Blockchain Association, et al.

Meanwhile, overseas innovators are rightly circumspect about working with US-headquartered developers. It’s a suicidal track record and needs to show signs of full reversal before US teams can safely emerge from our foxholes.

The sad thing is that good, smart regulation would actually be welcomed by the space. Nobody doubts that if @ZachXBT were handed the reigns and a staff commensurate with an ossified DC agency, he could do adept work policing the space. Yet while the authorities have so badly polluted their goodwill, trust is appropriately low.

People ask what this all means for their favorite protocols, like Curve, FRAX, et al. The bad news is that any address is presently at risk of sanctions, so literally nothing is safe.

The good news is that there is possibly some expectation that the inside baseball motivating DC policymaking is unlikely to destabilize billions of dollars at a time if such disruption might pose systemic risk to the broader economy. Here a multi-billion dollar TVL can serve as a moat to at least allow some process for orderly redemption before freezing funds. Certainly rougher for up-and-coming startups, but the time to hustle for money is now.

Indeed, the good news is that the technology is, if anything, proving itself robust. Good news for those outside the long arm of US law who may reap the benefits.

The arc of the moral universe is long, but it bends toward justice. And so we continue to build and pray our “leaders” come to their senses before they first drown the country.