crvUSD FAQ ❓📄❗

The following is a proposed draft for a $crvUSD Frequently Asked Questions page to be added to the documentation. We’re circulating this here for comment — in 24 hours we’ll address all comments and file a final copy as a pull request to the resources.curve.fi page. Enjoy!

General

What is $crvUSD and how does it work?

$crvUSD refers to a dollar-pegged stablecoin, which may be minted by a decentralized protocol developed by Curve Finance. Users can mint $crvUSD by posting collateral and opening a loan within this protocol.

How does the $crvUSD liquidation process differ from other debt-based stablecoins?

$crvUSD uses an innovative mechanism to reduce the risk of liquidations. Instead of instantly triggering a hard liquidation at a specific price, a user’s collateral is converted into stablecoins across a smooth range of prices.

The benefit of this mechanism is that most cases will result in a loss of just a few percentage points worth of value, instead of the total and instant loss suffered by the hard liquidation process common to most debt-based stablecoins.

What is the mechanism behind $crvUSD's pegging to a dollar value?

$crvUSD maintains price stability through a combination of an on-chain variable Borrow Rate and a series of Peg Keepers, which maintain the peg by minting or burning $crvUSD based on market demand.

Can other types of collateral be proposed or added for crvUSD? How does that process work?

Yes, other collateral markets can be proposed for $crvUSD through governance. Contact the community support channels for additional information on the current process to recommend new collateral types.

Liquidation Process

What is my liquidation price?

When you take out a loan of $crvUSD, instead of a single liquidation price, you deposit your collateral over a range of prices. When the price falls within this range, your collateral begins being converted into $crvUSD, a process that helps maintain the health of your loan and can prevent a hard liquidation in most circumstances. Thus, you do not have one specific liquidation price.

How do I understand or adjust the range of prices at which my collateral is deposited?

This price range can be adjusted when initially creating a loan. In the UI, look for the “advanced mode” toggle which, will provide more information on this range as well as an “Adjust” button that allows you to fine-tune this range.

What happens when the collateral price falls into my range?

Each $crvUSD market is attached to an AMM. When the price falls into your range, this collateral can be traded in the AMM. In most cases, arb traders will purchase the collateral for $crvUSD. This has the effect of leaving your loan collateralized by stablecoins, which better holds value and maintains your loan health.

NOTE: This process was originally referred to as “soft liquidation,” but this term is being phased out to avoid confusion with the harder liquidation process in which a loan is closed and collateral is sold off.

What happens if the collateral price recovers?

The entire process happens in reverse, and your position is traded from stablecoins back into your original collateral. Due to AMM trading fees, you may find you have lost a few percentage points worth of your original collateral value on the round trip.

Under what circumstances can I be liquidated?

When your loan health drops below 0% you may be subject to hard liquidation, in which your collateral can be sold off and your position is sold. Although $crvUSD’s collateral conversion mechanism can protect against hard liquidations in most cases, it may be unable to keep pace with severe price swings. Borrowers are recommended to maintain their loan health, particularly when prices fall within their range.

How can I maintain my loan health if the price drops into my range?

When the collateral price falls into your range, you can no longer add new collateral to protect your loan health. If you want to maintain a healthy loan you should repay $crvUSD. Even small repayments of $crvUSD at this level can be helpful at preventing hard liquidations.

What is the difference between self-liquidation and repaying a loan? When is each option more beneficial?

Self-liquidation is a process by which the user closes out their loan, while repaying a loan involves the borrower paying $crvUSD to maintain their loan and improve their health. In the event the collateral’s price drops significantly, the loan may be collateralized by $crvUSD sold off at a higher collateral price, and in some cases self-liquidation may actually be done at a profit.

What happens to the collateral in the event of hard liquidation?

In the event of a hard liquidation, all available collateral is sold off by the system to cover the debt.

How is the 'liquidation discount' calculated during hard liquidation?

The 'liquidation discount' is calculated based on the collateral's market value and is designed to incentivize liquidators to participate in the liquidation process.

Peg Keepers

Is $crvUSD always pegged to a price of $1? If so, how is this achieved?

Yes, $crvUSD is designed to be pegged to $1. This is achieved by automatically adjusting borrow rates based on supply and demand, and by the Peg Keepers, which are authorized to burn or mint $crvUSD based on market conditions.

Under what circumstances can the Peg Keepers mint or burn $crvUSD?

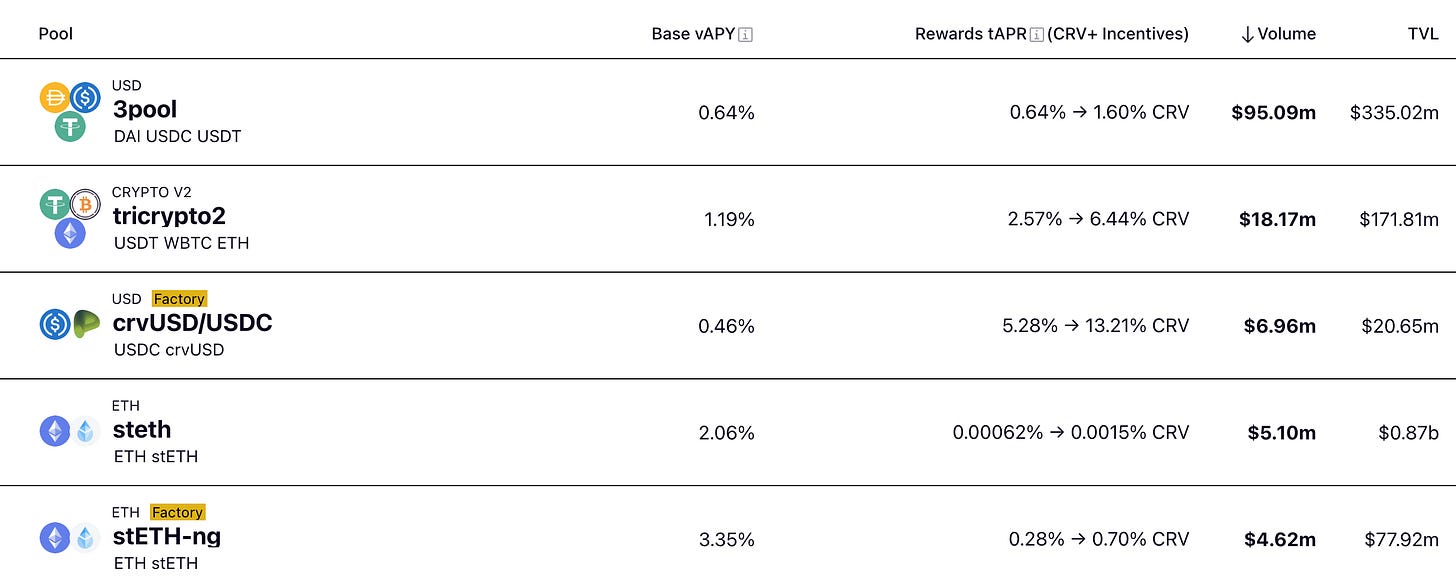

Each Peg Keeper targets a specific Peg Keeper pool, which is a Curve v1 pool allowing trading between $crvUSD and a blue chip stablecoin. The Peg Keepers are responsible for trying to balance these pools by trading at a profit. The Peg Keepers can mint $crvUSD to trade into their associated pools when the balance of $crvUSD is too low, or it can repurchase and burn the $crvUSD if the balance is too high.

What is the relationship between the Peg Keeper's debt and the total debt in crvUSD?

The Peg Keeper's debt is the amount of $crvUSD they have deposited into a specific pool. Total debt in $crvUSD includes all outstanding $crvUSD that has been borrowed across the system.

What does it mean if the Peg Keeper's debt is zero?

If a Peg Keeper's debt is zero, it means that the Peg Keeper has no outstanding debt in the $crvUSD system.

How does Peg Keeper trade and distribute profits?

The Peg Keepers have a public `update` function. If the Peg Keeper has accumulated profits, then a portion of these profits are distributed at the behest of the user who calls the `update` function, in order to incentivize distributed trading in the pools.

Borrow Rate

What is the 'Borrow Rate'?

The 'Borrow Rate' is the variable interest charged on active loans within each collateral market.

How is the Borrow Rate calculated in $crvUSD?

The Borrow Rate for each collateral market in $crvUSD is calculated based on a series of parameters, including the Peg Keeper's debt and the market demand for borrowing.

How does the Peg Keeper's debt affect the borrow rate?

An increase in the Peg Keeper's debt may lead to a higher Borrow Rate, in order to incentivize repayment and restore stability to the system.

Why is the Borrow Rate high even though the price of $crvUSD is close to the peg?

The high interest rate could be due to high demand for borrowing or an increase in the Peg Keeper's debt, even if the price of $crvUSD is close to the peg. For example, if Peg Keepers are emptied as collateral prices rise, then increasing the Borrow Rate is the only way the system can provide stability.

Safety and Risks

What are the risks of using $crvUSD

As with all cryptocurrencies, $crvUSD carries several risks, including depeg risks and risk of liquidation of your collateral. Make sure to read the disclaimer and exercise caution when interacting with smart contracts.

How can I best manage my risks when providing liquidity or borrowing in crvUSD?

Best risk management practices include maintaining a safe collateralization ratio, understanding the potential for liquidation, and keeping an eye on market conditions.

Has $crvUSD been audited?

Yes, you may read the full $crvUSD MixByte audit and other audits for Curve may be published to Github.

Can I see the code?

The code is publicly available on the Curve Github.