Curve remains the DeFi kingmaker! Two new protocols popped up recently promising to extend Curve functionality.

Just last week, a new Twitter account popped up with no followers, no documentation, little activity… mostly just a Twitter bio.

They spread like wildfire, piquing the attention of Curve and several big name Twitter accounts. Armed with just an elevator pitch, a star was born.

What exactly is Curvance and why so-much… interest (pun intended)?

It’s still too early to say exactly what the final implementation will look like. The beleaguered team got attention about a month before they were even ready to launch, so they don’t have much in the way of documentation just yet. Their gorgeous webpage was slapped together to keep up with the surge of interest.

Still, it’s easy to see their direction. At launch, they promise to let you lend against your rewards stake. In other words you can borrow against your LP position in Curve, Convex, and Yearn as it continues to earn rewards.

By all indications, it appears you can borrow stablecoins from your deposits. The existence of such a service would allow for the most reckless apes to engage in highly leveraged Curve farming.

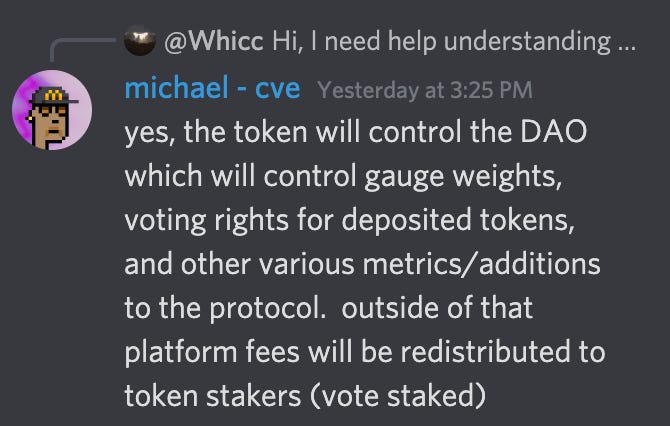

They also are planning a $CVE token within their tokenomics, which would earn platform fees and voting rights.

Theoretically this could make them a major participant in the Convex Wars depending on how the platform evolves.

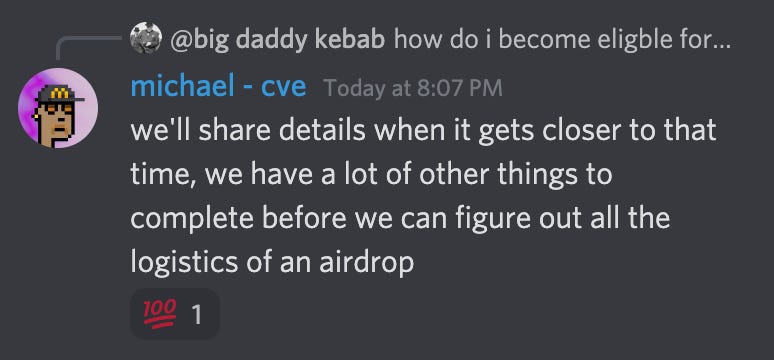

They are also discussing an airdrop of said $CVE token, but no details have yet been announced and this looks to be some distance on the horizon, so don’t hold your breath.

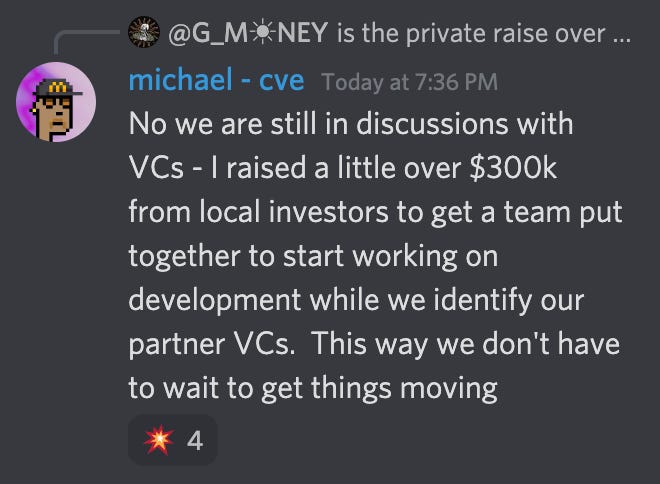

One common question is about the project’s funding, for which they appear to be going the VC route.

IM[Idiotic]O, seeking VC funding is the only red flag for this project 🚩🚩🚩

From my observations in the Bay Area, VC funding is the most successful predictor of startup death. Projects can survive a terrible team, concept, and execution, but miss just one basis points on a predatory VC’s absurd growth projections and you’ll be shivved and sold for scrap.

Even in its larval state, Curvance clearly has strong interest. At this point they could very easily raise this cash directly from interested Curve whales. Whale capital could provide them much both better control over their product and more useful connections than obsolete VCs. They have tons of options, let’s see how they ultimately exercise them.

At the end of the day, nobody cares about armchair quarterbacks like me though. They clearly found a niche and should attack it however they see fit.

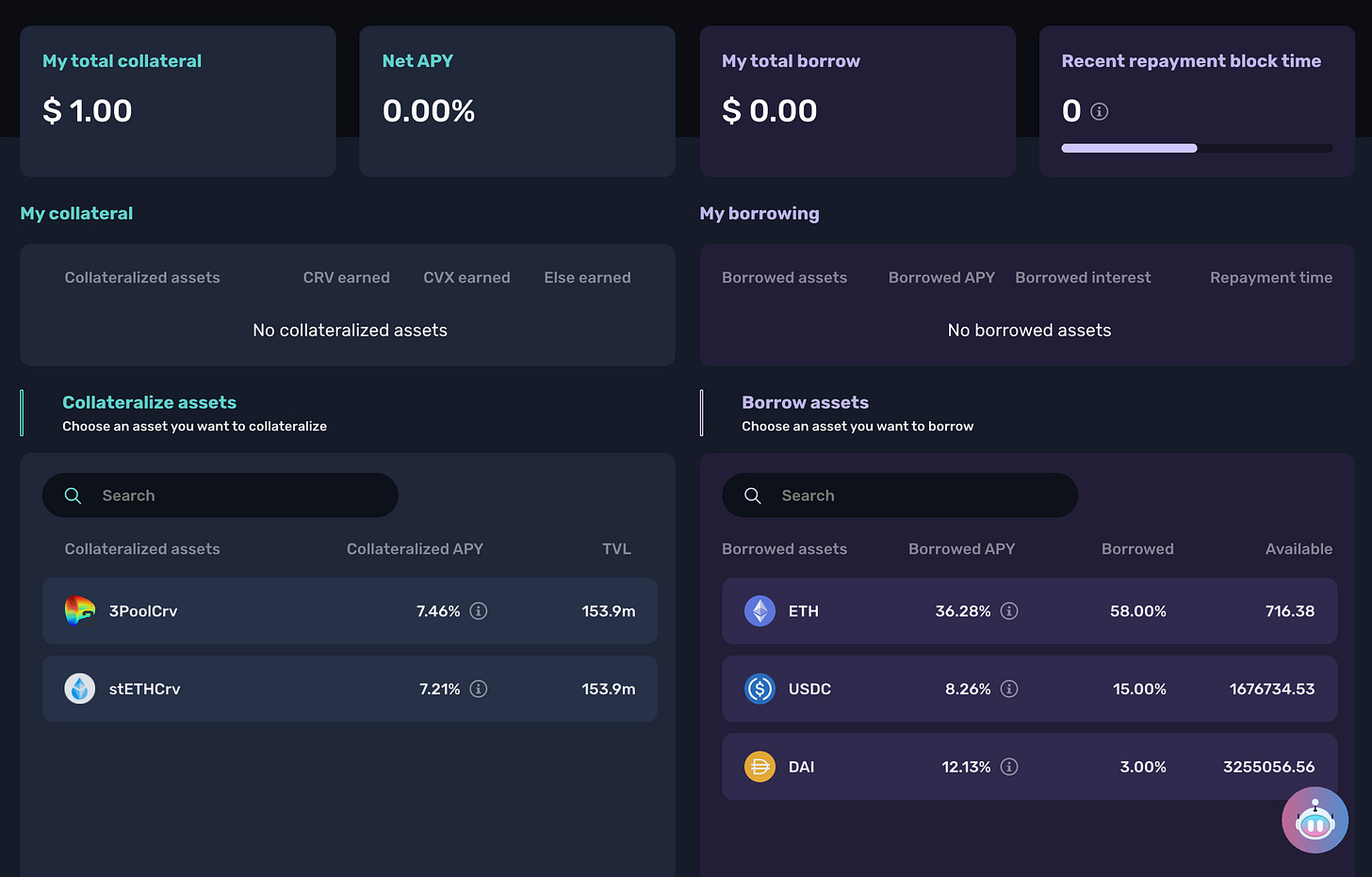

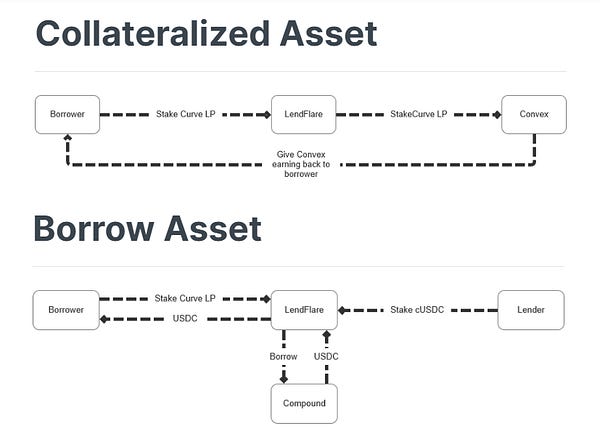

They also may have some competition. LendFlare also jumped onto the radar recently, even predating Curvance. LendFlare’s offering uses cTokens for their supply asset, connecting Curve and Compound.

For collateralized assets, Lendflare plans to stake deposits via Convex in a way that maximizes profits for users. Users continue to earn rewards until the point they repay the loan in full. Lendflare has no commission fees, and users retain all rewards earned throughout the borrowing period.

Borrowed assets will have to place a 0.1 ETH liquidation fee upfront, which is used for liquidation if the user does not repay immediately. Borrowers must overcollateralize any asset at 150%, and loans come in terms of 3, 6 or 12 months. Borrowers can only borrow the same pegged token (ie 3poolCRV for DAI, USDC) in accordance with their goal of minimizing risk.

The interface is viewable as the program is finishing up an alpha test of 2000 users on Rinkeby.

Since Curve does not have any testnet deployments, this was tested against a mock token representing a Curve token.

Lendflare also has outlined their airdrop, which promises to share up to 1% of total supply to early testers. The alpha period has passed, from which 500 users will randomly be selected to receive an airdrop. In their upcoming beta test, this will be expanded to 1500 users.

Lendflare also provides rudimentary documentation and a video describing the service. Their documentation also describes a handful of tokens, although these tokens do not articulate any governance rights.

What’s it like for Curve having the future of finance built on its architecture?

Disclaimers! Author has no affiliation with Lendflare or Curvance.