In the 24/7 world of crypto. CRV and CVX are great for anybody who occasionally chooses to get 3+ hours of sleep. A four month to four year lock protects against the urge to constantly check prices. When life gets in the way, you can log off knowing that when you log back online, not only are your Curve bags productive, but so is the entire Curve ecosystem.

The last two days this newsletter sadly went dark on all the Curve action. Been very distracted by all the shenanigans going on around Washington DC. Meanwhile, Curve just keeps pouring on the gravy! Here’s a summary of all the action we missed while we were getting all hot and bothered.

Bearslayer

For three consecutive weeks, Curve fees round to over $2 million (million with an m, not a b, thx @irvinghanes)! Even just a few months back, that third comma was elusive. Now it’s commonplace.

Did anything happen three weeks ago to push Curve to new peaks? Could be many things, but it’s worth recalling fondly that three weeks ago BTC was above $60K and ETH was well above $4K. Curve as the bearslayer is the real deal.

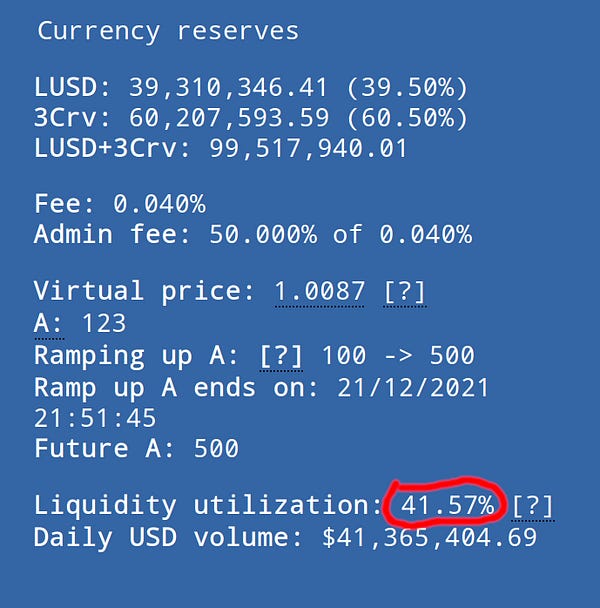

One prime example of this effect is Liquity’s USD.

The strongly decentralized stablecoin is minted by depositing ETH. Whenever ETH weakens against the dollar, users at risk of liquidation need to rush to the LUSD pool to pay off the digital loan shark. Curve’s modest 0.04% fee really adds up during a bank run.

Cross-Chain

Another big reason for Curve’s uptick in volume is the heavy L2 presence. Per DeFi Llama, about a third of the value locked in DeFi now sits outside Ethereum mainchain, a number that’s been steadily climbing for months.

Fortunately, Curve has already launched on most of the major sidechains. On Avalanche alone, Curve has crossed the emotionally significant $1B TVL marker.

We also recently observed REN launch their new Host 2 Host service, allowing users to move CRV and LP tokens across chain much easier.

Their web demo shows off how easy it is to fire up and interact with a staking and minting portal.

Why might you want to move off the classic L1?

If you send your $CRV to Fantom, you can now explore farming options at Geist Finance.

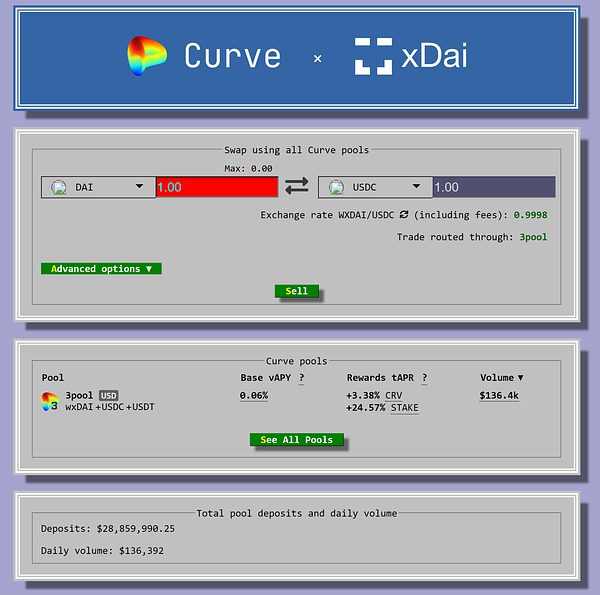

On the other hand, Gnosis (nee xDai) may see its juicy rewards disappear this week. If you are in this pool you should follow their account for details on any next steps:

Number Crunching

The best part of Curve is being part of a community that places a high emphasis on math and analysis. Since USDM was revealed as a scam, the Curve community has stepped up its efforts to stress test pools, especially pools that seek Curve rewards.

For instance, last week RAI hit the governance forums seeking a gauge. In this time we’ve seen extensive scrutiny and analysis of the pool.

For the case of RAI, it passed this higher level of scrutiny.

If you are a coder, take time to check out the scripts being developed by @bout3fiddy for the purpose of gauge risk assessments. His keen analysis has already flagged Ramp Defi for further scrutiny before receiving a gauge.

While we’re heaping praise, it’s also worth highlighting @bout3fiddy’s on-chain analytics notebooks. If anybody hires him at any price, they’re getting a bargain!

The development community is one of the most important drivers of Curve’s growth. Curve has not only open sourced all its smart contracts, it implements them in a very developer-friendly fashion. Coders can easily get started on the protocol. Thanks to ready code samples like the aforementioned notebooks, the next generation of finance is being built on the foundation of Curve.

Curve After Dark

Of course, sexuality is deeply intertwined with Curve. Ladies… Gentlemen… anybody who earns Curve yield f—-s. What else would you do with your time if you’re printing money all night long?

Yet if you really want to pay for the privilege, you may soon have a place to go to scope out some luscious curves (lowercase c).

We wonder… is this the list to get into the club…?

Disclaimer! Author f—-s and has a stake in $LUSD pool.