Lately there’s been a lot of chatter about liquidity utilization of various Curve pools.

Since most of the world has slowed down for the holidays, it was a great opportunity to run some data analysis I’d been meaning to do for a while, but stalled out because my scripts to scrape Curve data have been long broken by Curve’s relentless innovation. Meaning I have to pull the data manually or fix my scripts (I brute forced it manually).

I grabbed data on the pools’ previous 24 hour volume, liquidity utilization, rewards, and reserves. I also grabbed pool type (‘factory’, ‘meta’, or ‘classic’) and the basis (‘usd’, ‘eth’, ‘eur’, or other/‘mix’) but didn’t do much with this data. I wanted to grab “A” data, but the crypto pools concept of “A” is very different from classic pools, so it went straight down the hatch.

In particular, I wanted to simply see how a KNN would cluster the various Curve pools into different types based on these different usage patterns. After all, we’ve seen a ton of pools getting created, what are the basic flavors of Curve pools these days?

This was a rather quick cut, so I share the notebook and raw data in case the Llama Airforce or other organized number-crunching militias want to attack this problem more rigorously.

In this case, I opted to break it into 5 clusters based on the fairly natural break we see at this value.

This gets us the following 5 clusters:

My analysis as follows:

Cluster 1: Pegholders

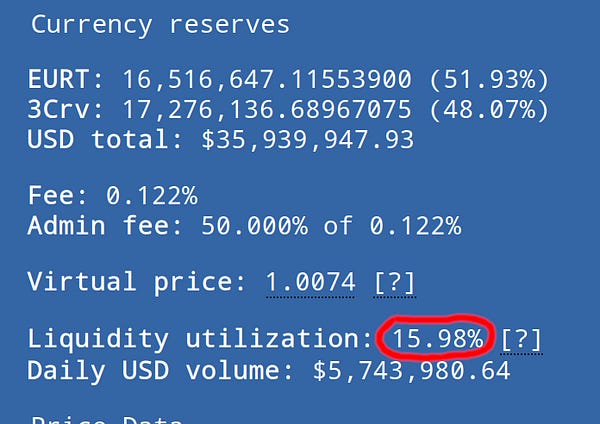

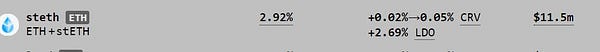

Hiding in the back corner are the two dark blue dots that belong to the classic 3CRV pool and the stETH pool. Both of these pools are indeed quite similar. Both have very high reserve volumes but very low liquidity usage.

In both cases, these pools do a fantastic job of pegging together assets that need to hold a peg. For the case of 3CRV, it’s propping up all of DeFi. For the case of stETH, it’s a key factor in stETH holding its peg, although the team has an unorthodox strategy when bribes are en vogue.

Arguably FRAX pool looks to be heading in this direction, with moderate reserves but low liquidity.

Cluster 2: Smolpools

The batch of smaller, fairly typical Curve pools all have decent liquidity on lower reserve, lower volume pools. The rewards here span the gamut from low to moderate. Basically this batch encompasses most Curve pools that aren’t distinguished in any other special way.

Cluster 3: Hotshots

Heavy rewards, heavy liquidity, and extremely high volume on below average reserves. It’s just TriCrypto and two MIM pools.

The plot above doesn’t do a good job of showing where these three brown actually fall in the spectrum of things. If I’d had time to overlay vertical line dropdowns onto the 3d plot it would make clear what outliers these pools actually are in terms of high rewards and relatively low volumes.

Cluster 4: 뭐야 씨발??

Not really sure what’s going on with UST. It’s sporting near 82% liquidity usage the past 24 hours on microscopic rewards. It’s possible this was just a weird snapshot, and that the pool may better belong in cluster 2 or 3 under normal conditions. As it stands, it’s a completely unique pool.

Regulators also want to know what’s going on, having perviously served founder Do Kwon at a large NY conference. Since then, Terra has countersued, as the world is moving ahead while the US sits in a corner peeing on itself.

Cluster 5: Jackpot

The 3-Euro factory pool and CRVETH pool stand out due to their very high rewards on good liquidity. It’s possible they are over-rewarded given what significantly outsized rewards they return, but you gotta spend money to make money.