For so many new people being entering cryptocurrency, there’s too much information and too little time. Once you get to studying, though, you may start to learn a few things.

Scaling projects keep bumping into the same exact challenges.

To every challenge, Curve already engineered mathematically elegant solutions before you even knew these problems existed.

This is becoming clear in the question of governance. At the outset, people couldn’t figure out why Curve had such a funky governance token mechanism. All these locks, disabled transfers, depreciation, LP tokens… why not make it simple?

Fast forward to today. Everybody is mimicking Curve’s veTKN model.

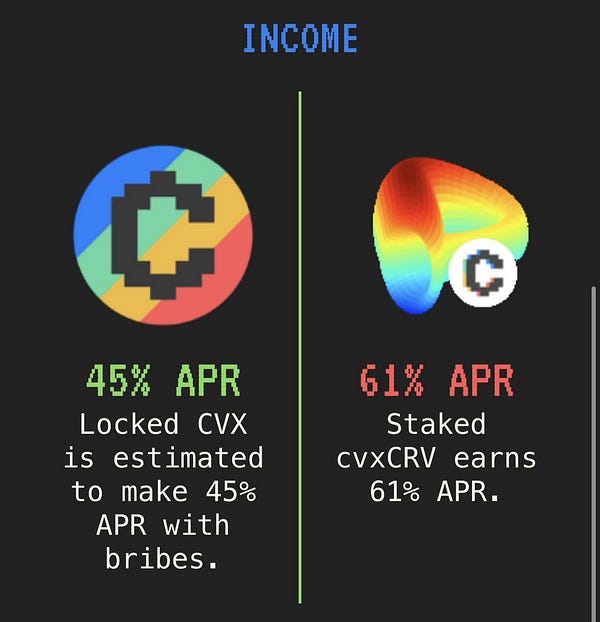

Why is the veTKN model so successful? For the case of Curve at least, this mechanic directly presaged the rise of Convex. Convex launched its multibillion dollar protocol by providing easier staking into Curve in return for aggregating veCRV voting rights and peddling it to earn further yield.

The ascendancy of Convex benefited both new and longtime Curve stakers. Convex is now roughly the same market cap as Curve. Protocols continue fighting over themselves to buy up scarce CVX, with Redacted and FEI recently joining the fray.

Based on some on-chain sleuthing, it’s also possible $CVX is going to be listed on FTX sometime soon.

This morning everybody’s favorite prophylactic pleasured us with the news of FTX redirecting CVX to a new wallet, a behavior that in the past indicated a new listing. It’s entirely plausible this could in fact be short-term bearish if unlocks lead to heavy sell pressure, but who knows. The only advice we’ll ever provide here is to consult with a registered financial advisor and ask their opinion.

In this busy AM, we also received news from Convex’s newsletter that they are expanding beyond levelling up Curve to a partnership with FRAX. Notably, FRAX has a veFXS style tokenomics like Curve that makes it a natural integration for Convex’s model.

Those not familiar with the FRAX ecosystem can join the jungle for this in-depth educational primer, for far less than a tx of gas. What makes a better stocking stuffer than learning to acquire generational wealth?

If Convex goes the route of integrating every veTKN model, it find itself very busy. As they note in the morning’s newsletter, the Curve tokenomics are spreading.

“Other protocols have begun following suit, whether that’s launching new protocols with similar token-locking models, or revamping existing tokens to include similar characteristics.”

Recently Yearn concluded several months of study about their tokenomics and recommended a new system involving a veYFI coin.

While you’re busy asking your financial advisor for their accredited opinion, ask them to compare and contrast the trajectory of veFXS and veYFI vis a vis Convex.

For Curve’s sake, the protocol is doubling down on these voting mechanics. A new vote is up to allow for fractional votes (like a delegated protocol would require) and to expand voting to sidechains.

“It is very good to allow more fair voting by projects like Convex (e.g. 51% yes / 49% no instead of 100% yes), and also for allowing voting on side chains and L2s.”

This change is being integrated by 1hive, a community of web3 builders. Worth a follow (of course this is not social media advice — consult a registered marketing agency)

Also, while you’re making the rounds shopping for advice, ‘tis the season to ask your accountant about tax loss harvesting.

More Disclaimers! More Stocking Stuffers!