Dec. 21, 2022: Curve DAO Politics 🗳️🤝

Who sits on the Curve Iron Throne?

DAO-mocracy in action!

Curve DAO participation is unusually active, and a wonderful example of a protocol successfully decentralizing major operational decisions. We can use the routine operations of Curve to get a snapshot for how DAOs operate in practice. Here’s a quick guide to the current state of Curve governance.

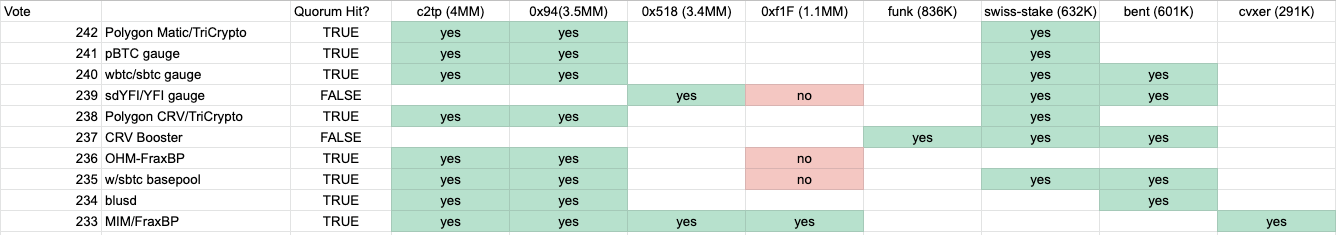

For summary, here’s the last ten gauge votes. All gauge votes require a quorum of 30%.

The average Curve vote is uncontroversial: by averages, 97% vote to support, with 55% participation and 33 unique voters. Nearly every proposal passes under these conditions.

One of these “votes” carries particularly significant voting power: the Convex voting address. This address alone has almost as much veCRV vote weight as every other address combined. Therefore, we also included the Convex voting data for each of these initiatives, since it’s necessary to understand Convex politics to understand Curve politics.

Convex votes are prorated to yes/no votes on Curve based on their internal voting ratio, and these votes only go through if they hit quorum (typically around 7MM CVX).

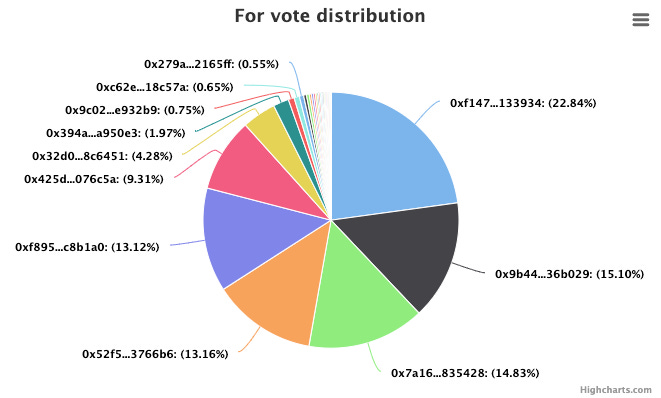

It’s arguably a good thing for the sake of on-chain democracy that Convex doesn’t vote as a winner-take-all system. Here’s the breakdown of a typical vote on Curve, with Convex’s address the large light blue slice:

The Convex chunk is by far the largest chunk of votes. If Convex voted monolithically, all Curve decisions could be predictably manipulated by just three Convex whales.

Convex typically votes in chunks of 240-280MM veCRV. There’s 563MM veCRV in total, giving Convex just shy of 50% of the potential overall vote. Due to the fact participation is not 100% among veCRV holders, Convex’s stake ends up even larger.

Some people misinterpret this to mean that Convex has too much power. It’s representation is not necessarily disproportionate though, because its votes simply pass through.

In fact, since Convex votes get tossed out if they don’t pass quorum, Convex voters are often disenfranchised when too few voters vote. In the past ten votes, Convex voters may have actually been underrepresented in that their votes were not counted. Yet in other ways, they are overrepresented due to their effective vote weight being a bit higher, it’s sort of a judgement call.

Like most DAOs, the politics ultimately boil down to whale fights. The real story of Curve politics is it’s largely a battle among a handful of whales, not a battle of Convex versus everybody else.

For the following, we are looking only at effective vote weight. That is, which addresses actually vote (ie have voted in the past ten gauge weight votes). More controversial votes with better turnout would have different patterns. Some whales may exist that don’t vote regularly.

For veCRV, among the past ten gauge votes, Convex votes were three fifths of the votes cast. This is a bit overweighted, in that they have about 50% of the veCRV, but in practice basically meaningless.

The major whales voting using significant veCRV among latest DAO votes:

veCRV

0x989a…ad80: ~258MM (CVX Address)

0xF147…3934: ~41MM

0x9b44…b029: ~27MM

0x7a16…5428: ~27MM

0xf895…b1a0: ~24MM

0x52f5…66b6: ~18MM (Stake DAO)

All identity details here are taken from ENS/Etherscan, so no voter is being doxxed beyond publicly available data here.

Over on Convex, the effective vote share has also been more concentrated than the actual distribution of $CVX.

For instance, c2tp, with 4MM vlCVX is about 4% of the total supply of 100MM $CVX. However, due to how many people actively participate, c2tp gets about 26% of the vote power.

The major Convex whales in the recent votes:

c2tp.eth: 4MM (Convex core)

0x947B…0277: 3.5MM (Convex core)

0x5180…621c: 3.4MM

0xf1Ff…eaE5: 1.9MM

0x9220…CD27: 836K (@seasaltyfunk)

swiss-stake.eth: 632K (@newmichwill)

bentvote.eth: 601K

cvxer.eth: 291K

Seeing who is actually voting gives us a good way to judge the effective power of these voters. When we fold the Convex voters into the original veCRV chart, we see:

The major players in Curve are in fact a few Convex whales, though the entire pie is sufficiently decentralized IMHO. Note swiss-stake.eth is Michael Egorov’s Convex stash, which doesn’t even make the top ten with about 3% total effective influence (but boasts an outstanding voter participation rate!)

BUT WAIT, DOES THIS MEAN FOUR WHALES CAN CONTROL EVERYTHING?

No. Remember, this pie chart summarizes the actual vote weight for a variety of noncontroversial votes with 98%+ support. The theoretical vote weight shoves more slices into the pie as more voters turn out, lessening each person’s share.

For more contentious votes with greater voter turnout, the influence of the top whales shrinks even further. Among the top actively voting veCRV whales, voting participation is about 50% on gauge votes, with some voting regularly and some jumping in only for more critical votes. We also imagine some large whales may come out of hibernation if a truly controversial vote hit.

We can see the effect of Convex as a protocol not having outsized vote weight in the following case study.

Case Study: sdYFI / YFI

A curious vote this past week tells an interesting tale about an unorthodox vote.

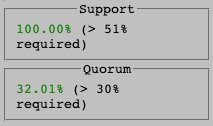

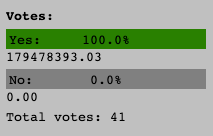

This vote involved a vote for the sdYFI/YFI gauge, a pool for Yearn’s token and its Stake DAO wrapper. The race to lock veCRV has been dominated by Convex, which has near 50%, much more than Yearn and Stake DAO combined.

If Convex had voting power to crush a gauge, this might be a case where they might have incentive to do so, out of sheer vindictiveness or something. Instead, the vote failed to pass quorum. To see why, consider the history of voting patterns among the wales on Convex:

We note the biggest Convex whales (core members c2tp / 0x94) have 7.5MM Convex between them, usually enough to individually pass quorum (7.2MM in this case). They vote very reliably, but for this particular vote they abstained.

By abstaining, quorum becomes a lot more difficult to hit in Convex. Even if the next five whales on this list combined all voted, this would not be sufficient to reach quorum. Here were the actual votes:

In this case, these votes all got tossed out because it did not hit quorum, a clear case of disenfranchisement. The Convex vote came quite close, but missed by a few hundred thousand votes — one whale may have been enough to push it over quorum.

Had it reached quorum, the proposal was trending 72%-28% in Convex. Had these trends kept up, of course the Curve vote would still have passed.

The most sizable “no” vote was 0xf1F, who frequently votes against proposals and usually leaves hilarious comments, here channeling his inner SBF.

Some other gems:

Comedy aside, the votes on Convex were all irrelevant in this case, as they never passed through to Curve governance.

Therefore, the vote took place entirely among veCRV holders. On Curve, the vote passed unanimously, but it would just barely squeak by quorum without Convex’s vote pushing it over.

Tallying 179MM veCRV votes was enough to push it barely over the edge, requiring the full participation all five of the veCRV whales we tracked above, and more, to hit this mark.

What if the Convex core team chose violence and cast some hard “no” votes? The current ratio stood at 5MM - 2MM. Presuming these were the only big “no” votes, their 7.5MM would have pushed this to to a 5MM - 9.5MM vote, breaking Convex’s voting bloc into a 34.5%/65.5% yes to no ratio.

Assume Convex votes 258MM veCRV (the average of their last ten vote balances), this becomes 89MM more yes votes and 169MM more no votes, bringing the final total:

268MM Yes

169MM No

About 61% in favor, motion passes anyway. Clearly, the Convex core team don’t independently have the votes to outvote everybody else. Possibly this is the reason they opted to abstain, instead of causing discord with a “no” vote. Or maybe they are genuine in their interest in maximizing the potential of Curve.

If Convex did not vote proportionally, but used a “winner take all” system, the final tally would have been 179MM “yes” to 258MM “no.” Moving to a proportional system did therefore reduce Convex’s political power.

A final note — if you are concerned the system overall is too imbalanced, rather than complain, the bear market prices give you a great opportunity to become a power player. At our clown discounts, a whale could easily buy up over 1% of the entire Convex supply and become fourth largest vlCVX voter for just $5MM, the price of one jpeg.

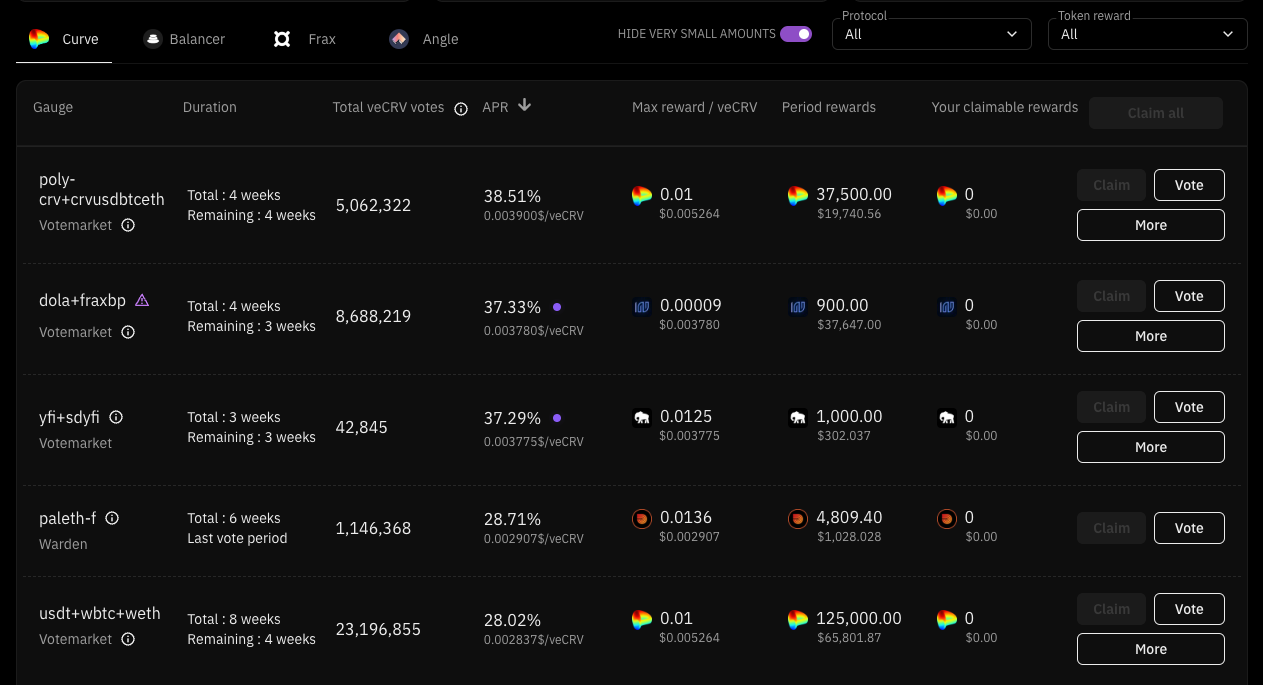

veCRV also proving a good way to yield in the bear market, as birb markets are becoming quite sophisticated.