Dec. 28, 2021: $CRV-$CVX Flippening ⚖️🙃

Convex Hype Intensifies on Votium Growth and $FRAX partnership

Flywheels keep on spinning round…

Convex briefly flippened Curve last week, but the effect was short-lived. Over the past 24 hours, the two protocols have been seesawing back and forth.

Incredible growth for Convex, hitting $20B locked in under a year. Convex is certainly in a mood to dictate precisely which bearhole the bears can stuff.

The most recent bribe round just closed, delivering an unprecedentedly nice Christmas haul. Nearly $20MM in bribes for the most recent round, just under half the GDP of the island nation of Tuvalu.

This totals to $0.90 for every locked $CVX, over 2x the efficiency of the prior round. Anybody who managed to acquire $CVX when it dipped below $2 during the summer crash has already paid this off in bribes alone.

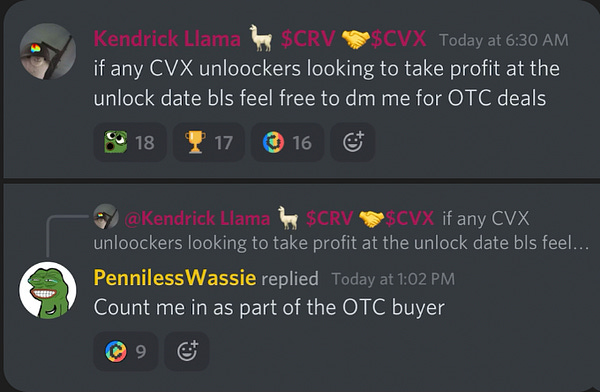

The present concern trolling around $CVX is that this is the first 16-week cycle of locked vlCVX getting unlocked. Will users who earned good money on these bribes let it ride? Or will they paper hands out of it?

Although Convex started entirely within the Curve ecosystem, the recent announcement that $FRAX is getting added to the flywheel has juiced the protocol lately. Absent this announcement, the price of $CVX was theoretically tethered to the value of the $CRV it controlled. With additional protocols falling under its influence, the value proposition of Convex is expanding beyond its influence within the veCRV world.

How would one value $CVX fairly with this new expansion? Valuations in DeFi are screwy so it’s a difficult question to answer. Even if you can arrive at a fair valuation of any protocol, the market is erratic.

However you choose to calculate it, the $CVX supply is scarce and the ponzinomics are bespoke.

Where should interested shoppers purchase $CVX? Curve v2 is now the best destination. In a more minor flippening, the new CVXETH pool has flippened the Sushi pool as the best destination.

Anybody still trying to argue Curve vs Convex are perhaps missing some of the finer points of the flywheel. They’re different protocols working on different problems, and the success of one tends to feed the other. The replies in this thread do a great job of discussing the multi-century outlook for $CRV.

For one example of the balance of the flywheel, Convex incentives have directly stimulated much needed liquidity into the 3EUR factory pool. This pool allows protocols to build forex services atop Curve’s infrastructure. Everybody wins except TradFi.

Where Convex has more of an angle towards optimizing voting, Curve has more focus on architecting and fine-tuning the building blocks of DeFi composability. As would befit this mission, we’re seeing the wonderful rise of Curve’s independent risk assessment team.

Since the attempted Mochi rug, the Curve community really stepped it up with high level risk analysis of Curve factory pools. A great win for community governance.

Relative to overpriced Wall Street “research reports,” this project is also guaranteed to create the absolute best library of content on DeFi, or even the broader cryptocurrency ecosystem.

If for some reason you can only pick one Substack to educate yourself on DeFi, do yourself a favor and unsubscribe my silly zine in favor of this one:

Fortunately most people aren’t artificially limited to just one source of CRV hype, so you can follow a whole ecosystem of smart influencers:

Curve and Convex are complex. It’s worth taking the time to understand how they work. Once you learn it, you can’t unlearn it.

Disclaimers! Author is a flywheel maxi