We don’t ordinarily talk about “price” in this blog, but forgive us, because we’ve never otherwise had such a good opportunity to observe about how $CRV wrappers handle the rare uptrend in $CRV price — it feels like an astronomer getting the opportunity to witness a rare comet.

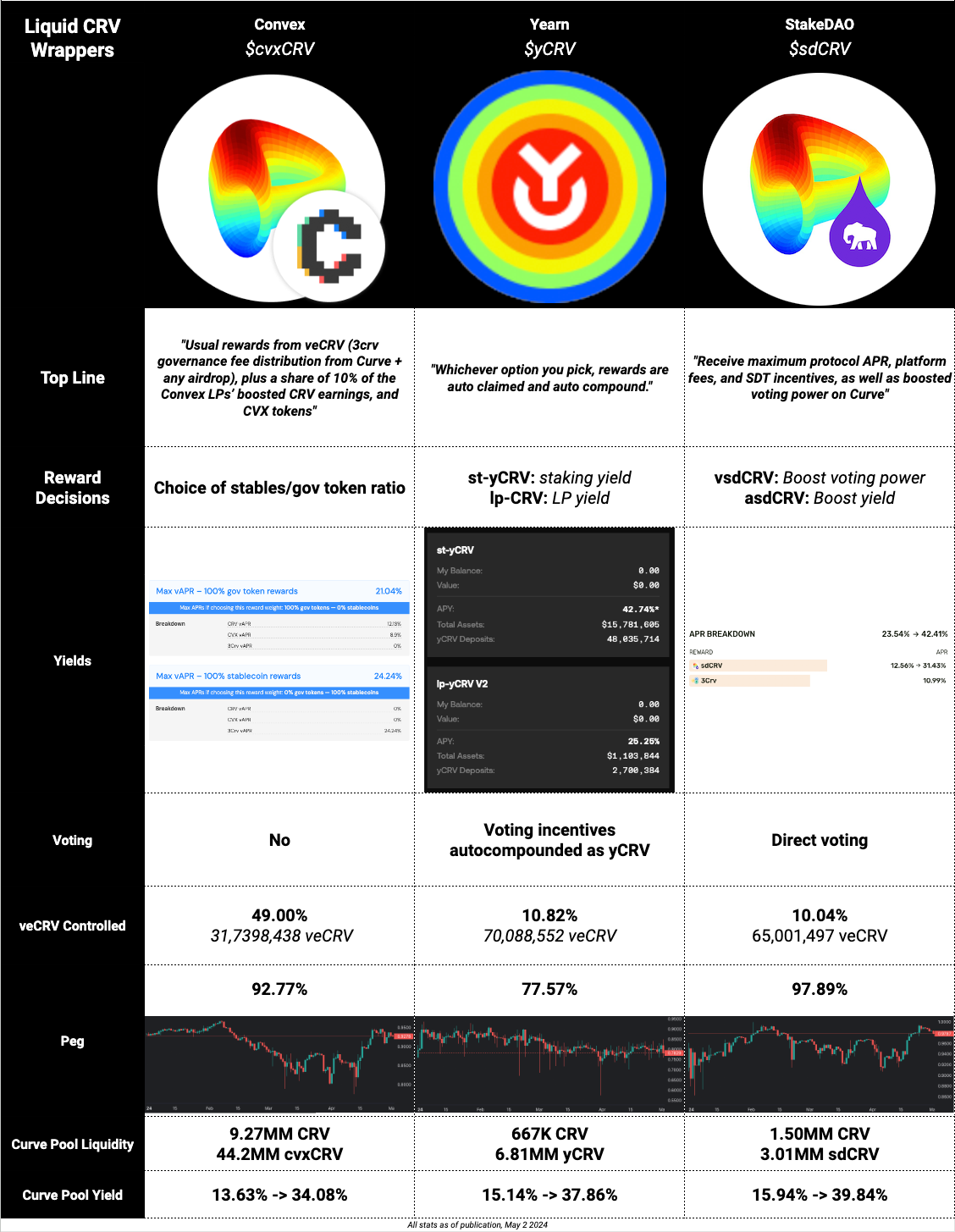

We spent the bear market more or less converting $CRV into all the various wrappers. If you’re not terribly familiar with the Curve wrappers, here’s a cheat sheet from a prior article:

So how are our favorite wrappers holding up? Oof…

These charts look like… well… pretty much $CRV price charts anytime over the bear market.

Meme check everybody! Show your memes…

There’s a bigger brained take on this, as always courtesy Scoopy of Alchemix, who sees it less as a “depeg” and more as a fair market pricing of a 4 year lockup relative to short-term bullishness.

If you held through the bear, congrats, but how should you play this?

As always, we require you pass basic means testing for such idle yapping… (of course, what follows is not financial advice).