Glad you asked! Some background…

With all of this, remember we’re not offering anything like financial advice. We’ve often observed high yields are transient and come back to earth as degens take advantage, and we’ve not done a full accounting of the risks. Talk to your registered financial advisor.

DEATH SPIRAL

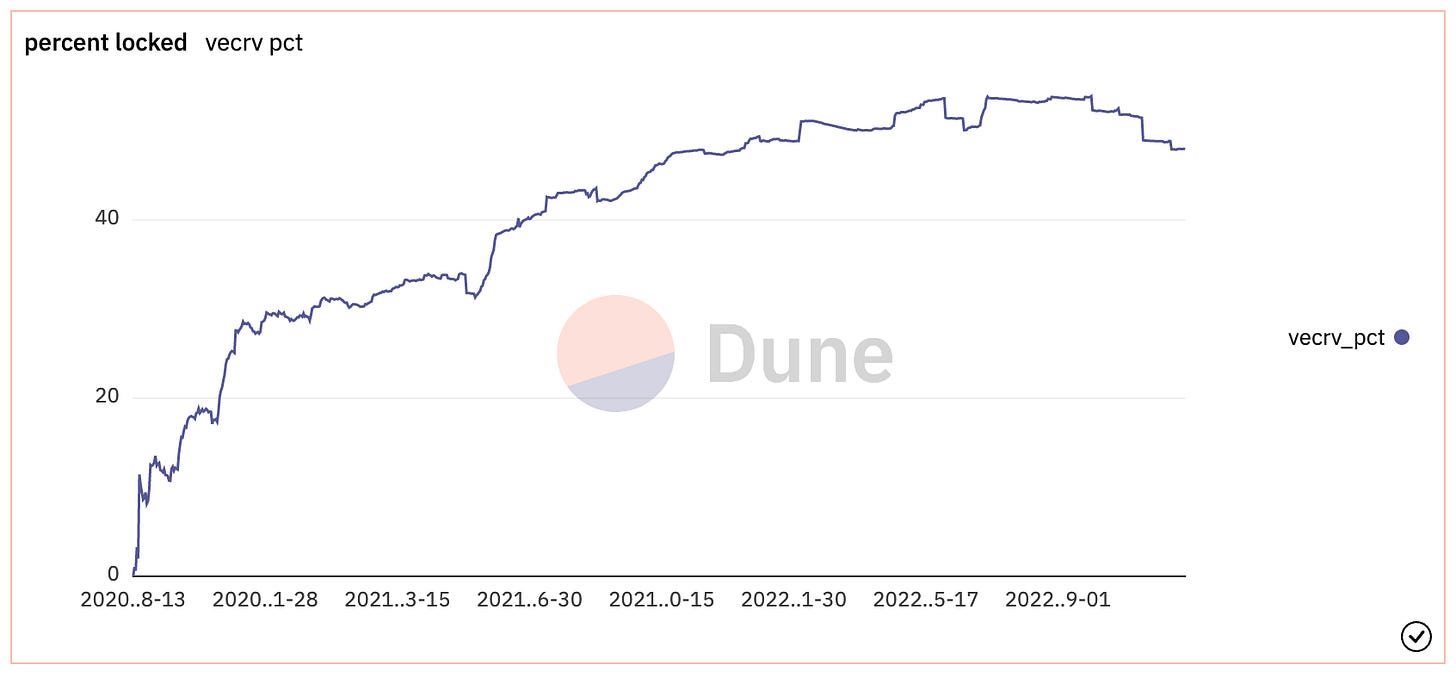

Good news for rainbow drawers and death spiral000rs… the veCRV locking rate has trended down the last few months.

What’s going on? Possibly, per one analyst’s detailed research, the problem stems from a dastardly combination of extreme stupidity and mental illness.

Since the condition of stupidity is not generally considered to be curable, Hasu is apparently equating ve-suffixed tokenomics with an individual experiencing a particular double whammy: both an intellectual disability and a mental health issue. Fortunately, against such a lightweight, it should therefore be straightforward for him to formulate a superior counter-proposal for tokenomics, and we look forward to considering it.

Other non-psychological hypotheses we could posit include the lingering effects of our bear market, or possibly disproportionate amounts of $CRV being hoarded by Avi in the run-up to his AAVE gambit. We don’t know though, which is why we keep comments open!

We can at least dissect the symptoms of this phenomenon. Ground zero for the effect appears to be a decline in the stake owned by Convex.

$cvxCRV

We don’t have any particularly good theories about why Convex in particular is seeing market share erode to this degree. We could hypothesize some CeDeFi power user went belly up and stopped farming/depositing $CRV en masse, but that’s just a shot in the dark. We’d be interested in reader thoughts!

A partial explanation may simply be newly that newly locked $CRV is heading to Yearn’s $yCRV and Stake DAO’s $sdCRV instead of Convex’s $cvxCRV. The decline in Convex in the above chart roughly coincides with the ascent of the other two. It’s necessarily an incomplete explanation though, because the decline in Convex’s share is not fully offset by the uptick in the other two.

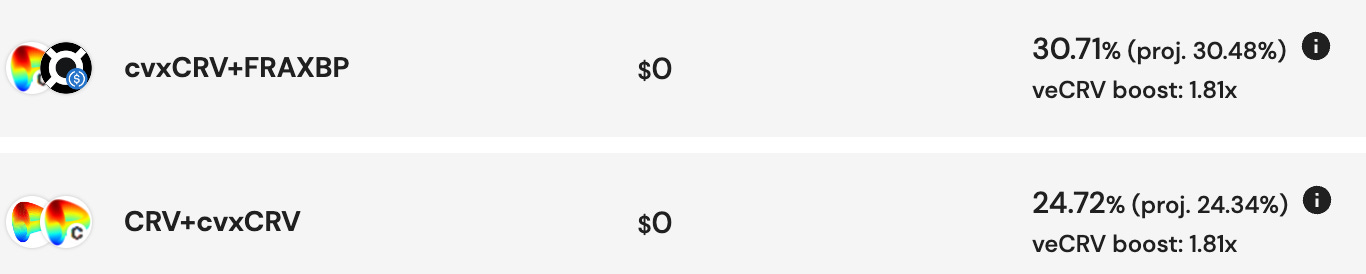

Diving into the numbers, the rewards for staking $CRV as $cvxCRV remain healthy.

The return in 3CRV remains a useful benefit for those looking to hedge their crypto exposure with dollars. People really do alternate between derisively labelling Curve as merely a protocol for stablecoin, while also noting stablecoins turned out the best investment of 2022. Don’t worry, we wouldn’t dare be so callous as to attribute this to a person’s mental health.

The $cvxCRV token also can be staked on other sites to compound rewards automatically. Llama Airforce’s $uCRV autocompounds $cvxCRV returns with low fees to make the process more gas efficient.

Aladdin DAO’s $aCRV is a simple autocompounding wrapper on $cvxCRV, redeemable instantly to $cvxCRV. Long-term $aCRV return is also higher because of autocompounding, though short-term holders may end up underwater from fees.

However, staking $cvxCRV is not necessarily the most lucrative destination for $cvxCRV at the moment. Even if you stay just on the Convex site, simply depositing $cvxCRV into either the cvxCRV/CRV pool or the cvxCRV/FraxBP v2 pool can earn significantly more.

Interestingly, the state of the $cvxCRV peg means that you can get a ~5% bonus for depositing raw $CRV to the cvxCRV pool, somewhat amplifying the benefit, especially if you believe the pool will repeg.

The intent of the $cvxCRV tokenomics is to allow 1:1 minting from $CRV to $cvxCRV, whereas the reverse peg is largely held by arbitraging the Curve pool, and often tends to become imbalanced in extreme conditions.

Convex’s cvxCRV/CRV pool is therefore a critical piece of the infrastructure, and Convex bribes the pool accordingly to make sure this stays the case. With $45MM in TVL, it remains the largest Curve pool for $CRV by far.

However, in terms of raw yield on $CRV, $cvxCRV is not the only game in town. The CRV/ETH pool is a popular destination for LPs who like hedged exposure to $ETH. Other protocol wrapped Curve, such as the $sdCRV and $yCRV pools, provide competitive rates.

Yet even these Convex LP farm yields pale in comparison with what you can get from these tokens outside of Convex. On their respective sites, the opportunity for yield is currently about double for both $sdCRV and $yCRV.

$sdCRV

About 23MM $CRV have found their way into the Stake DAO Liquid Lockers. At a 26.6% base rate, the present yield is already competitive with the aforementioned Convex pools LP yields.

However, if you boost this, you can scrape nearly 60% yield. Just like Curve, maxing out these boosts requires locking SDT for veSDT, which functions under similar veTokenomics to veCRV. Fortunately, with every crypto token sitting around a 90% discount, you could scoop up SDT on the cheap for all your holiday shopping needs.

As the graphic above makes clear, most of this reward comes from Stake DAO’s industry leading command of the birbs game. Note that in order to unlock this chunk of rewards, you must take the additional step of either voting on birbs, or delegating to Stake DAO to automate the process on your behalf. These rewards accumulate gradually on

Mastering the art of bribery has paid off for Stake DAO. Highly recommended for everybody, in particular ve-token holders, to check out their Vote Market aggregator. This page provides a one-stop shop to track all the known bribe markets, including Curve, Balancer, Frax, and Angle.

Staked veCRV by itself earns steady cash flow from Curve trading fees, but the existence of this dashboard makes it simple to compare and extend these earnings. Cash flow in a bear market is a true treasure, and so too is the Stake DAO vote market an underappreciated gem.

The analytics page also provides a great tool for researchers to track the history of any given pool’s bribe. Here we see the bribe history for TriCrypto2, which has become a heavyweight user of Stake DAO.

Some stats from the most recent birbsday.

Shocking to think there’s been under 1K users to date. Is this alfa?

$yCRV

Every so slightly edging out Stake DAO in the yield game is Yearn’s new $yCRV, which is currently offering yield just under the memetically important 69% benchmark.

The Yearn team drastically simplified their prior yveCRV with this new launch. Their y.finance homepage makes the process nice and accessible for low IQ brainlets like myself. On the page you can directly mint $CRV to $yCRV 1:1, or you can transfer to two other popular $yCRV destinations:

Stake it for st-yCRV

LP it for lp-yCRV

The page publishes the current APY for each alternative, and if you find you picked the wrong destination you can easily trade it directly on the page.

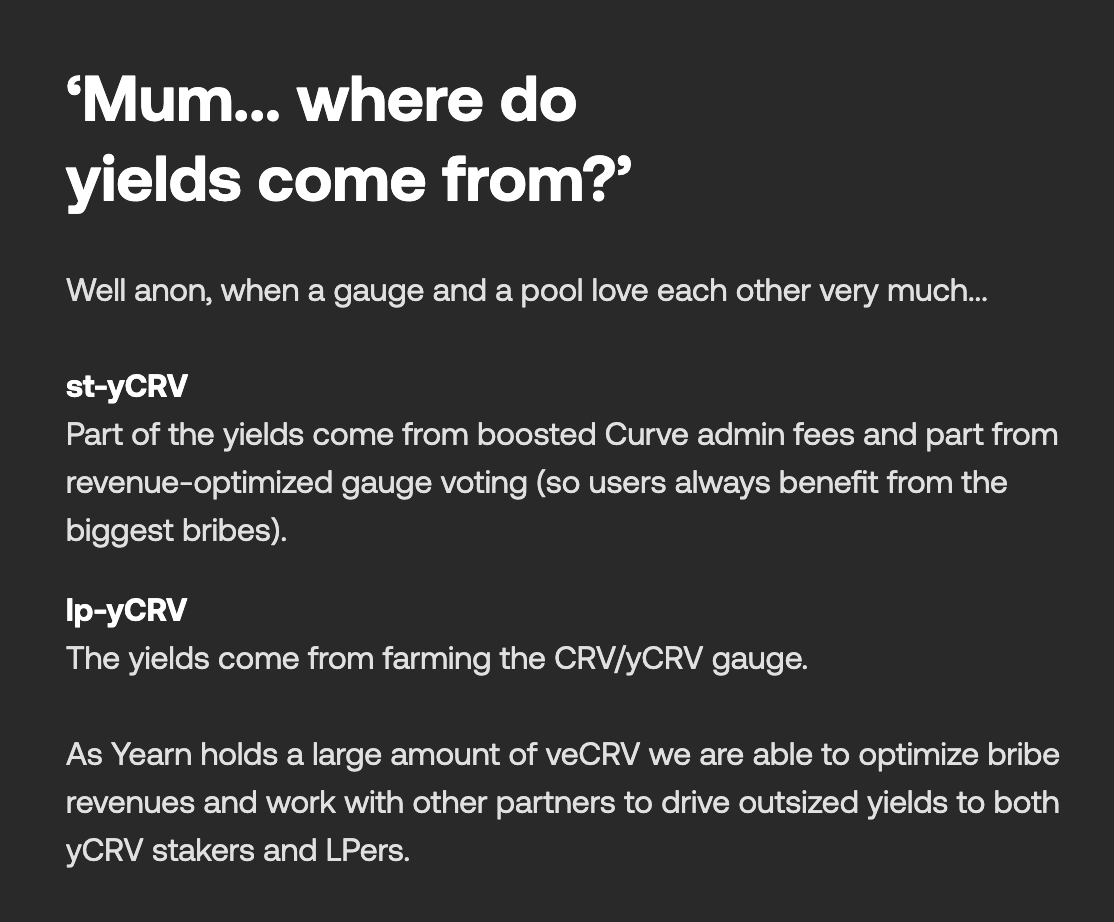

Sky high yields… so you might be asking, are you the yield? If not, where does it come from? Yearn explains…

Their treasury is indeed ample:

Also keeping into the bribes game, Yearn has launched yBribe

For anybody keeping track, yBribe supersedes the original Cronje bribe.crv.finance site. yBribe is also tracked via Stake DAO’s aggregator.

Curve Wars Flaring Up?

Is all this a sign the Curve Wars are turning hot again? Are the zero-sum00000rs correct that Convex and Yearn and Stake DAO are locked into a brutal fight to the death?

Not in our opinion. For starters, the protocols all have a fair amount of interplay and friendly overlap. For instance, consider the new sdYFI/YFI pool. Stake DAO is presently bringing Yearn’s flagship token into their Liquid Locker program, which appears to be a win-win and a bold strategic choice if they were in fact mortal enemies.

Further question… is the relative drop in Convex’s veCRV stake a reason to be bearish on $CVX?

Again, not in our estimation. We remain very bullish on Convex. Disclosure: we’ve never sold a single precious $CVX, and only increased our position through the bear.

At the current rate, it will be several years before Convex need even worry about a flippening by either Yearn or Stake DAO. Convex can use this lead time to bite off opportunities where they make sense.

Everything about Convex’s operations suggest they carefully analyze potential new products, and strike if and when it’s a perfect fit, just as they did with their Frax partnership.

For the influx of new readers (“Welcome! Where did you come from?”), you’ve perhaps surmised our editorial slant is predictable and transparent. We’re recklessly perma-bullish on $CRV and its extended flywheel of assets that touch on its ecosystem.

So far readers who have adhered to this strategy have only lost ~90%. Stick around as we continue trying the same thing and expect different results!

Disclaimers! Author has exposure to every token mentioned in this article.

Love the last paragraph haha!!