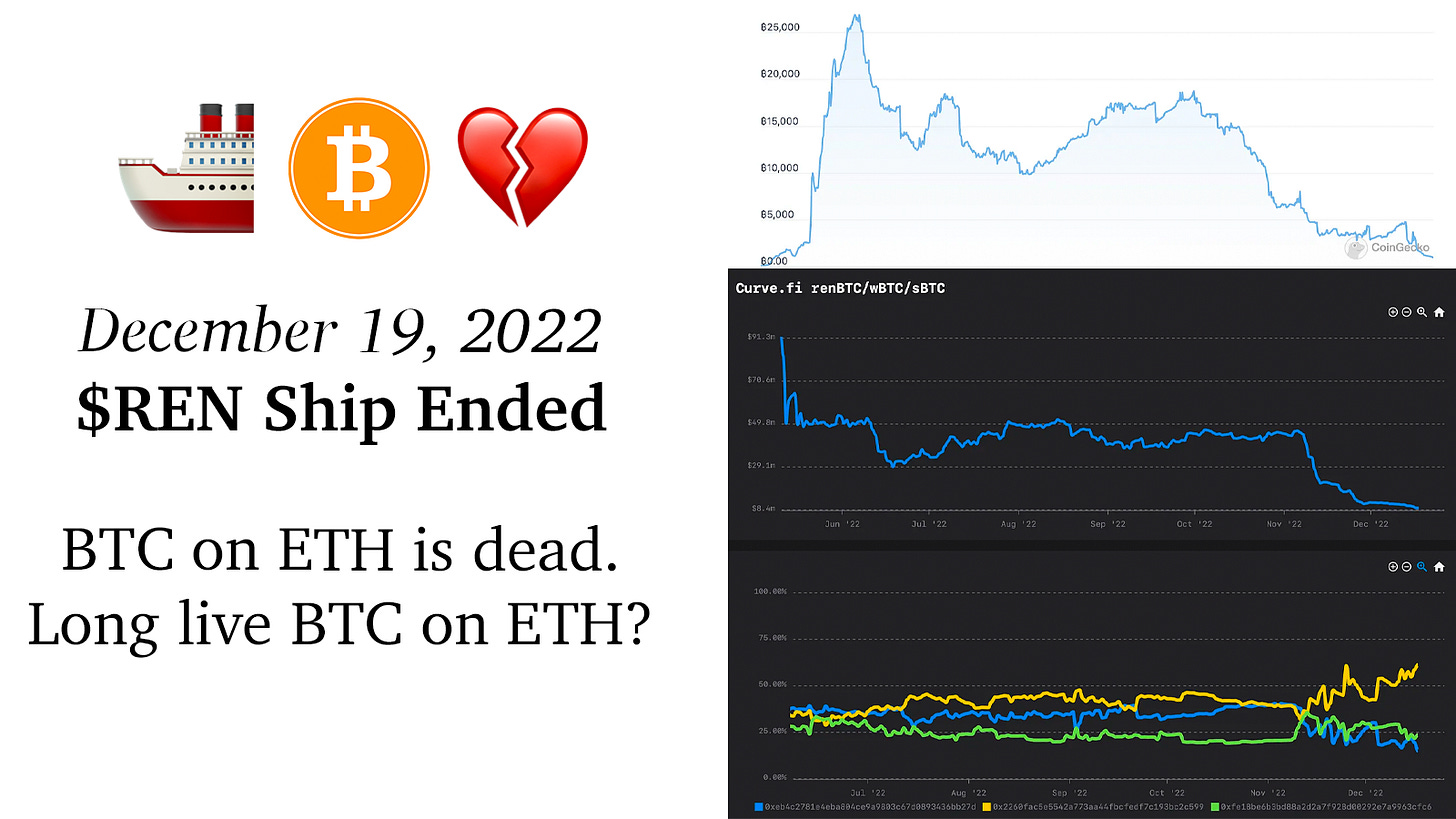

In 24 hours, $renBTC will lose its bridge from Ethereum back to Bitcoin.

The overall supply of $renBTC has thankfully mostly disappeared already, but about 915 BTC remain on Ethereum and may wind up orphaned.

We don’t know what exactly is going to happen to the ~$15MM worth of $renBTC still on Ethereum — perhaps a bridge back will eventually be established at some point?

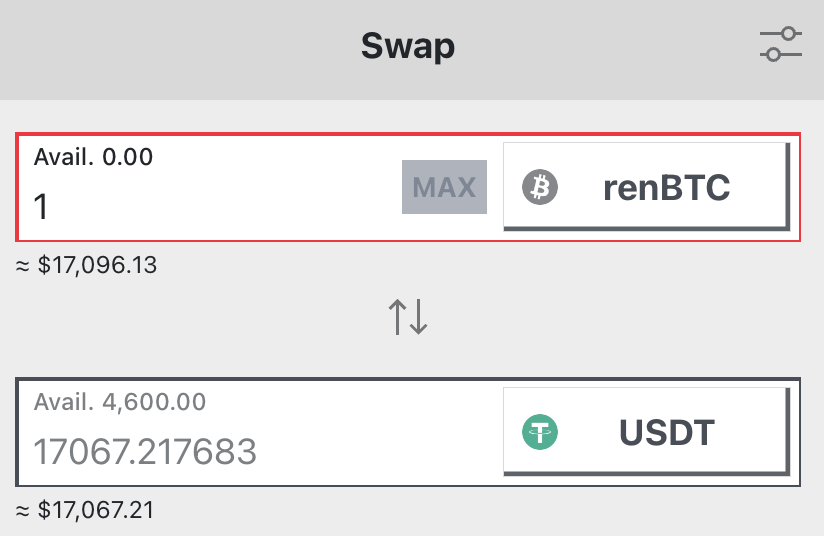

As the supply of $renBTC has dwindled, the token is trading at a slight premium on Curve pools, which could make for some interesting trades.

We know that most of the remaining Bitcoin on Curve heeded the announcement and removed liquidity. Curve’s sBTC base pool, which served as the foundation for most other Curve Bitcoin pools, saw its TVL decline about 80% from its recently steady value around $50MM to about $10MM.

However, $10MM is a surprising amount of zombie liquidity — about $20MM in assets still exposed to $renBTC.

We hope idle farmers note this article and exit before tomorrow. These pools will function forever due to Curve’s censorship-resistant architecture, but we can’t easily predict how the market will react when $renBTC becomes unbridgeable, nor do we want to mess around and find out.

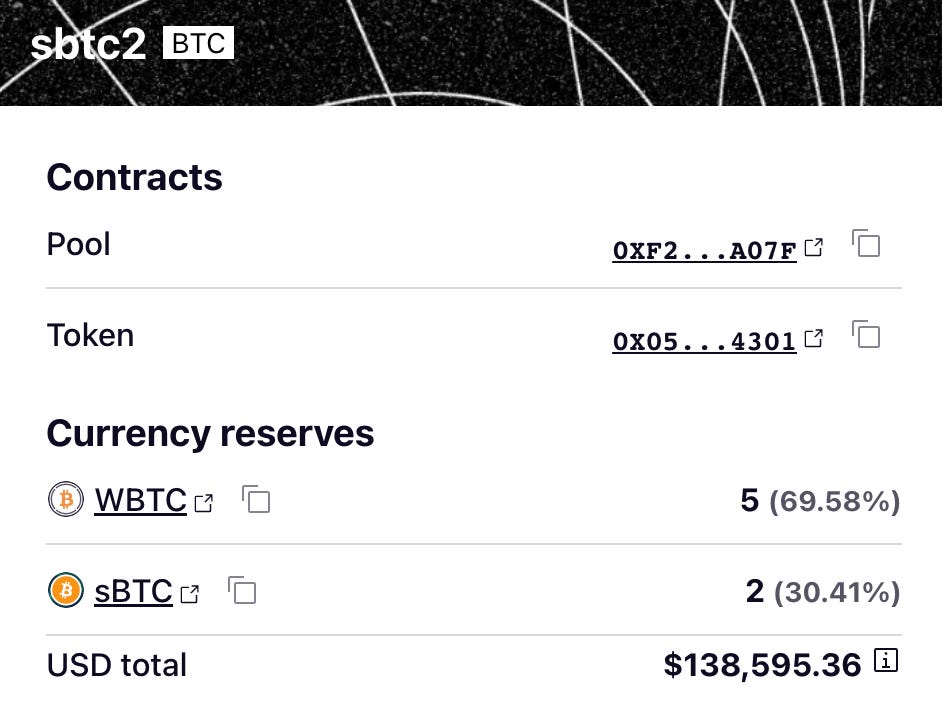

Anybody sitting with wrapped Bitcoin on the sidelines, at least some new yield farming opportunities are on the horizon. A new sBTC2 pool with no renBTC exposure has been added as a base pool. However, very little funds are currently at play, so be wary of slippage if you are depositing.

WBTC is in abundance around the ecosystem at the moment, partly thanks to a spate of WBTC FUD. The best way to deposit to the pool to avoid slippage is to contribute sBTC, however sBTC is in scarce supply relative to WBTC. Some may also find it trickier to mint than renBTC or WBTC. Synthetix has no direct bridge backed by Bitcoin, so sBTC is issued by first minting sUSD (heavily overcollateralized) and using sUSD to transfer to sBTC.

If you’re wondering why such a curious process, read more about the Synthetix ecosystem via the man with the finest threads:

So far two pools have kicked off the second generation of BTC Curve pools built against this new base pair. Multichain (formerly Anyswap) has launched a multiBTC pool that’s already been seeded.

pNetwork’s pBTC also created a new pBTC pool against the base pair. Their two prior pools exposed to $renBTC have about $1MM still lingering.

The ~60 BTC question… is there any appetite for a second generation of BTC pools. The exit of renBTC has left the already battle-weary survivors of 2022 with a poor taste in their mouths.

In the height of DeFi summer, billions of dollars worth of Bitcoin found their way onto Ethereum for its sky high yields. However, with the market down in the dumps and creditors calling, much of the supply of wrapped Bitcoin is depleting. WBTC and sBTC, the other tokens in Curve’s prior base pool, have both seen their supply dwindle over the past year.

We’re down to just about $3 billion in wrapped Bitcoin on Ethereum. Most of this is in the form of WBTC, making it the 23rd largest token on CoinGecko.

Etherscan only bothers to track five wrapped Bitcoin tokens:

Will Bitcoin find its way onto Ethereum? We know from experience that incentives do attract liquidity. Some protocols with $CRV in their treasuries searching for liquidity may have a good opportunity to incentivize Bitcoin onto the chain.

Nor would it surprise us if users opt to simply trade their WBTC for Ethereum. Anybody plugged into Ethereum is probably quite aware of how much more fun and useful Ethereum is than boring Bitcoin. Tough to say how the market will actually function in these crazed times, but we fully expect at some point in the future the ETH/BTC ratio will rip upwards and nobody will be surprised in hindsight (NFA).

tBTC 2.0 launching soon.