We’ve got ourselves an old-fashioned standoff.

…borrowers won’t repay…

…so $crvUSD won’t repeg…

…so interest rates keep going up…

…to force the borrowers to repay…

…but (go back to the first step)

The cycle will continue until somebody blinks. And Curve is the unambiguous winner until such time.

Third place is not too shabby, especially since DefiLlama is good and actually calculates fees accurately, unlike some other sources.

The question now is why don’t users repay their loans?

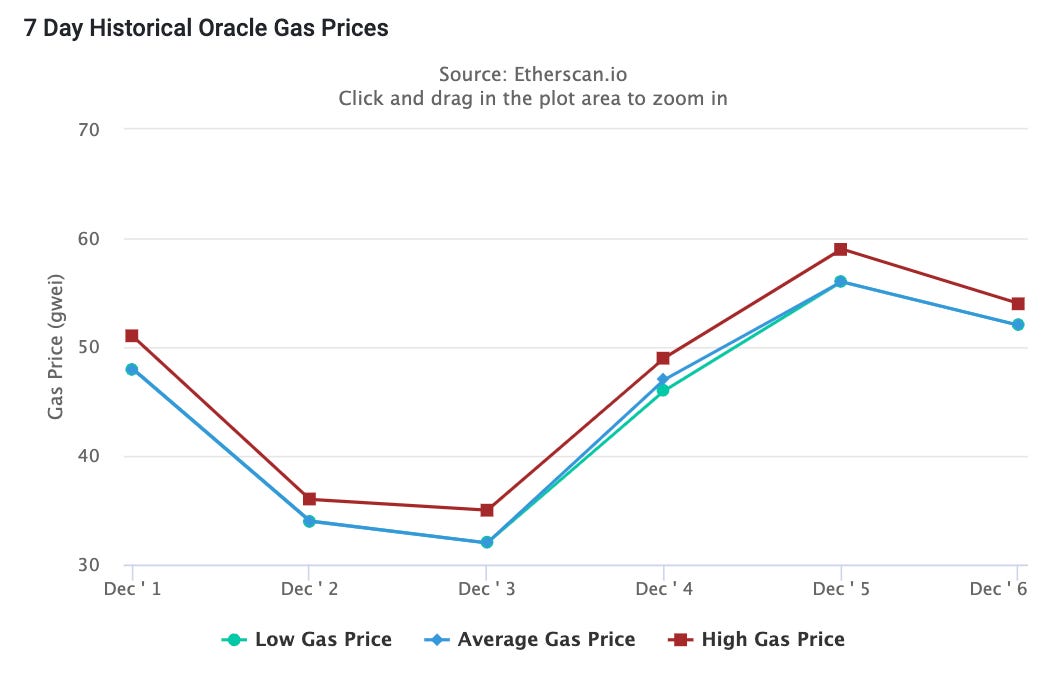

We’re sure some smaller positions, trapped by high gas prices, may just be gritting their teeth and hoping the pain will pass.

Yet the bulk of $crvUSD is fueled by whales, and all available evidence suggests whales ignore gas prices (or even make greater FOMO moves during high gas prices).

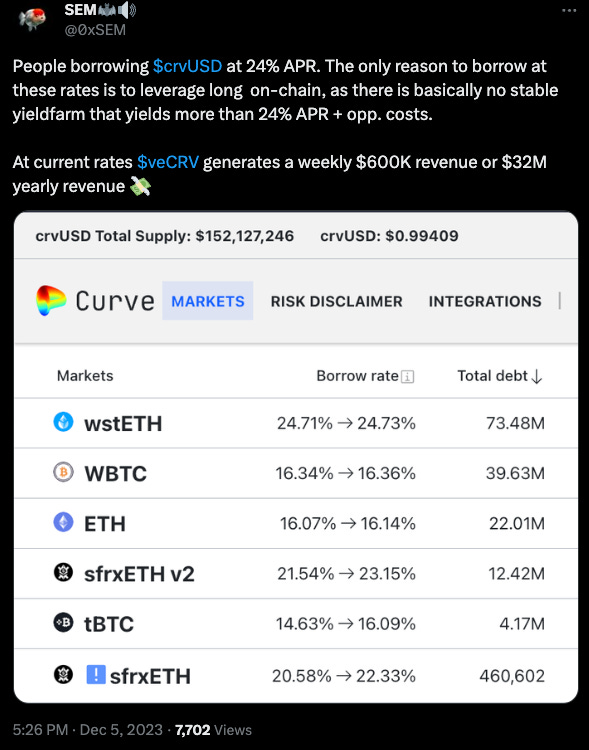

It’s a prohibitively expensive game of chicken. One theory is that they are leveraging long…

Which kicked off a healthy debate

We do happen to believe that the anti-liquidation protections of $crvUSD is far superior to other lending platforms, but we’re not so bold as to argue that it’s so comfy that users would lose money for the privilege.

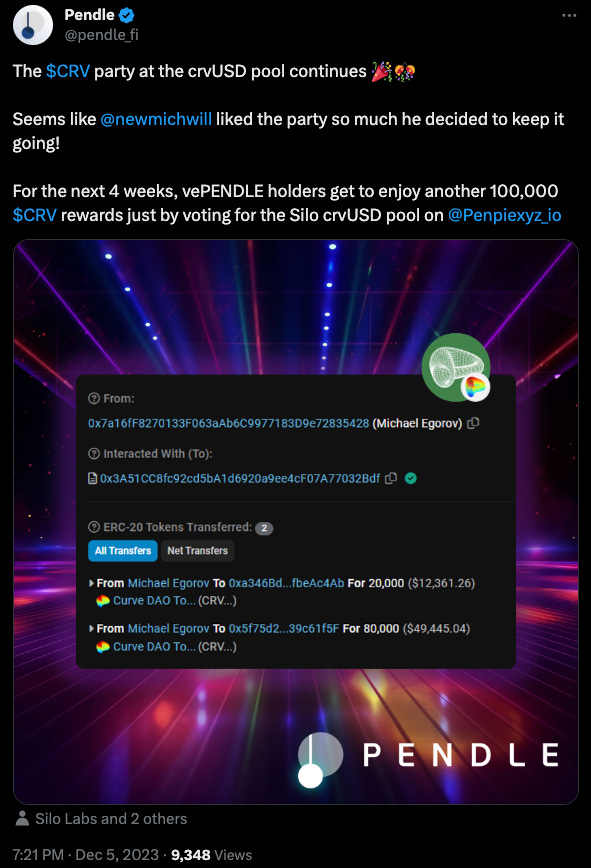

We do know that the $crvUSD rewards that do exist will persist, given that Mich is teaching a masterclass on how to bootstrap liquidity.

It’s good timing for a potential resurgence in DeFi for a change. TVL is finally up!

And lest you think this is just a product of wrapped Bitcoin appreciating in value due to the ETF frenzy, it’s also clear that stablecoins are on the rise, per DefiLlama.

That said, there’s still a decent argument that stablecoins print mostly to pump crypto.

Ethereum and ERC20 tokens have largely sat out this pump, leading to some misgivings. The copium adage states that in all previous cycles BTC pumped first, then ETH, and final alts.

True? Ask us again in a year!