Here are today’s trends to watch from Curve Market Cap:

DeFi is still digging through the debris of yesterday’s massive pullback, where billions of dollars got destroyed.

Why the big volume drop? We don’t think it was necessarily paper hands rushing out. Curve has a lot of volume locked in BTC and ETH pools, so it’s no surprise that a 20% price drop in USD terms would affect the TVL bottom line. No particular reason to panic.

It was notable to see the heavy volume with BTC pools nearing the top of the charts, including heavy traffic through hBTC ($15MM), sBTC ($11MM) and renBTC ($9MM). Of the three, only hBTC represented a notably large spike in volume:

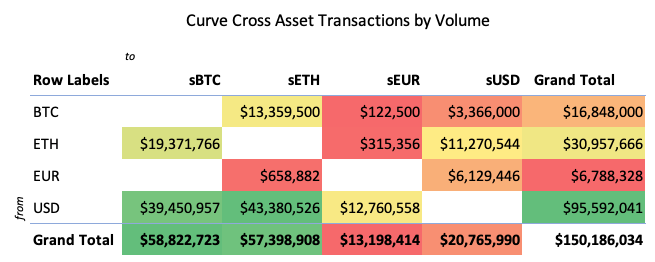

sBTC commonly sees high volume as a consequence of its use in Curve’s cross-asset transactions.

Meanwhile, REN is notable in terms of its many bridges across blockchains lately.

With Eth gas fees brutal lately, heavy traffic is flowing to BSC. REN has jumped all over this trend with their v2 bridge:

Of course, you know who don’t look terribly worried about gas prices? These people!

We’re launching Pool Party to help get people into DeFi at lower gas prices. Stop by and tell us your thoughts on our spec.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Newsletter is an independent roundup of interesting trends in cryptocurrency, never financial advice. Author stakes $CRV, owns no hBTC, sBTC, or renBTC.