Bitcoin permabull Anthony Pompliano triggered the Ethereum community with his investment announcement in Sovryn BTC.

DeFi on Bitcoin? Rudy Gobert called, he wants his dunks back.

DeFi on Bitcoin has historically been a bit of a punchline. Once upon a time Bitcoiners simply mocked DeFi. Nowadays Bitcoiners are starting to take it more seriously.

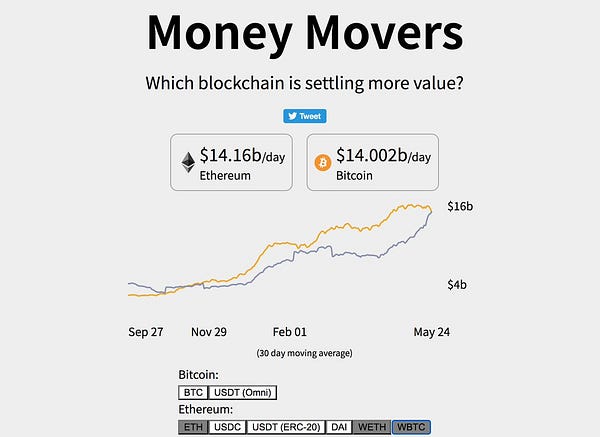

Is it too late? Stablecoins settlement value on Ethereum is already larger than BTC settlement value on Bitcoin.

Today we handicap the opportunity of DeFi on Bitcoin, and the challenges it would face.

Opportunity

Should DeFi actually make it to the Bitcoin chain in any serious form, it could be quite substantial.

Today we have ample evidence that DeFi has little defensive moat. Ethereum remains the king of DeFi. Yet when congestion was at its worst, DeFi users showed no particular loyalty to Ethereum.

Earlier this year, Binance Smart Chain’s lower costs looked on pace to threaten Ethereum dominance until BSC start hitting scaling issues of their own.

According to DeFi Llama, Ethereum has $81.6B worth of USD locked into DeFi protocols, with Binance at $16.6B. Ethereum remains quite dominant, but clearly competitors can enter the market and grab significant volume.

Another advantage Bitcoin would have by launching late is that Bitcoin developers wouldn’t need to innovate, they could just copy. BSC ginned amazing growth by simply copying Ethereum’s best DeFi protocols and backstopping it with money. This formula has proven effective at creating a robust DeFi ecosystem very quickly.

The strongest case to be made for Bitcoin threatening Ethereum is simply the market cap of Bitcoin. Bitcoin has a $722B market cap as of this morning, with Ethereum second at $314B. Hypothetically, if a robust DeFi ecosystem launched on Bitcoin, it would have a lot of dry powder ready to deploy.

Of course, wrapped Bitcoin already exists on Ethereum.

We see just under $10 billion worth of BTC on Ethereum. In the range of about 250,000 BTC, my rough math gets me to about 1.3% of the total Bitcoin supply on Ethereum.

Bitcoin also constitutes a significant chunk of DeFi on Ethereum, even if the yields are not as great as other assets. If all $10 billion is locked into DeFi, this would be as high as 15% of DeFi in Ethereum. Looking at stats on Curve, we’re in the right ballpark. Most Curve money is in US tokens, with ~34% in ETH, and ~10% BTC.

Many people will prefer keeping their Bitcoin on BTC. If about 10% of Bitcoiners locked their BTC into DeFi, this would bring Bitcoin to parity with Ethereum. This would be a significant leap though — of the 150 million+ Ethereum addresses, 2.5+ million use DeFi, about 1.7%. To rival ETH, you’d have to make the argument that Bitcoiners would adopt DeFi about 10x more than Eth-heads. Perhaps arguable because there’s nothing else to do on Bitcoin and Bitcoiners have a holding mentality?

The Obstacles

The opportunity described above represents a Bitcoin with a fully functioning DeFi ecosystem. The biggest challenge is simply the architecture that would need to be put in place.

We would argue DeFi cannot exist in any serious form without stablecoins. Most crypto assets return very low yield. In a subsequent piece we’ll lay out the case that fiat money is actually the riskier asset to hold, ergo it returns higher yield. DeFi offering 20%+ returns on dollars gets people excited, and DeFi is dominated by the dollar.

To our knowledge, the only Bitcoin native dollarcoin is $ROC offered by Money on Chain, which has a flaccid $250K worth of dollars wrapped onto Bitcoin.

Now, perhaps if Bitcoin develops all sorts of decentralized exchanges and currency pairs this would see an uptick? At the moment, though, Bitcoin smart contracts are quite primitive compared to Ethereum. Bitcoin development largely consists of defunct IDEs and a mess of OP codes. Developer tools within Ethereum are robust and user-friendly. In order to catch up, we’d expect the Bitcoin development community would need to really amp up the smart contract capability.

We couldn’t find exact stats on the number of devs within the two communities, but anecdotally most people agree the Ethereum community has the most coding firepower.

Finally, we’d likely need to see DeFi activity largely on Bitcoin’s Lightning Network. Although Bitcoin’s slower block time may be technically possible for users planning to sit and HODL, but sophisticated traders like to engage in higher frequency front-running activity that would be more fun on Lightning Network. The challenge is that Lightning Network remains underutilized, although robust DeFi offerings could spark some activity.

Verdict

Could Bitcoin jump through these hoops? Certainly it’s possible. A lot of smart and motivated developers still exist around Bitcoin, and they are now wealthy enough to never need jobs again. If they knocked out these challenges in the next few months, it’s about 50:50 that Bitcoin could rival Ethereum dominance of DeFi.

However, Bitcoin has been historically much slower than Ethereum, somewhat of a victim of its own success. Taproot is Bitcoin’s only major innovation in years, and it seems relatively pedestrian compared with the frequent adjustments made to Ethereum.

In no case could we see Bitcoin destroying Ethereum DeFi. In any industry where one party is first mover, they generally tend to win the majority of the market unless they mess up badly. Ethereum is clearly first mover on DeFi and still making the right moves, so we expect it to hold onto its crown.

If we had to guess, we’d guess that Bitcoin DeFi takes over a year to launch with any significant volume (>$50MM) and ends up claiming no more than about 20% of the overall DeFi market.

Unpopular opinion… whatever happens, Bitcoin and Ethereum are both still wonderful. Whether Eth-heads like it or not, the value of Ethereum is heavily correlated with Bitcoin. It really is in everybody’s best interest for both chains to succeed wildly.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a Curve maximalist, also holds Bitcoin, Ethereum, and dollars.