We’ve been working with the OPEN Stablecoin Index project to prepare a governance forum post. Unfortunately, the Curve governance forum remains offline due to DNS issues!

Given that we’ve pre-scheduled a Llama Party today to discuss this proposal and field any questions on a livestream, we’re posting our draft here for advance visibility. If you have any questions, please join us at 10 AM PT / 1 PM ET for a livestream addressing live questions, or via the comments section!

Embracing Curve with OPEN arms

Gauge proposals for OPEN Stablecoin Index and SQUILL

Let’s OPEN the floodgates to Curve dominance!

The OPEN Stablecoin Index celebrates the ascendancy of $crvUSD and aims to cement Curve’s foundational role in leading a new generation of decentralized stablecoins.

Built with direct input from Curve maximalists Michael Egorov and CurveCap, $CRV was deliberately enshrined as a core asset in the genesis basket. OPEN’s successful launch was powered by Curve’s permissionless infrastructure—and reflects the same ethos of composability and decentralization that defines Curve itself.

This document outlines our plan for how Curve can benefit from scaling OPEN—and proposes adding gauges for two new pools to deepen alignment and further these plans.

1. What is OPEN?

OPEN is an onchain, equal-weight index of eight fully-decentralised stable-asset networks (CRV, AAVE, SKY, RSR, ENA, FRAX, LQTY, INV).

OPEN aspires to become the benchmark basket for next-generation “crypto-native dollars,” giving users single-asset exposure to a diversified set of censorship-resistant stables.

Curve alignment from day 1:

CRV was included in the inaugural basket—a tangible commitment to Curve’s long-term success.

Primary project liquidity venues include Curve pools (OPEN/WETH, SQUILL/WETH).

OPEN is built on the Reserve index protocol, a top 5 CRV governance ecosystem contributor

2. Tokens

OPEN

The OPEN ERC20 token (0x323c03c48660fE31186fa82c289b0766d331Ce21) can be freely minted and redeemed via Reserve’s Decentralized Token Folio (DTF) interface.

Purpose: Index token tracking eight decentralized stables

Supply: Elastic (mint/burn at NAV)

Risk Mitigation: Reserve DTF audits by Cantina, Trail of Bits, and Trust Security

Governance: vlSQUILL via Reserve Governance Module

SQUILL

The SQUILL ERC20 token (0x7ebAB7190d3d574ce82D29F2FA1422f18E29969C) exists as the governance token for the OPEN Stablecoin Index, managing quarterly rebalances and the addition or removal of tokens.

Purpose: Governance + fee-share for OPEN

Supply: 10 million max (1,776,000 circulating from first phase of airdrop). The first phase of the airdrop targeted the Leviathan SQUID community, with future airdrops expected to further promote decentralization by distributing to the communities of the basket of 8 governance tokens.

Risk Mitigation: Squill is a fork of the commonly used Snekmate ERC20 Vyper 0.4.0 implmentation

Governance: 2/3 multisig to manage the airdrop phase, after which governance to be delivered to vlSQUILL control or relinquished entirely

3. Gauge Summary

We request community feedback on adding the following 3 gauges to the Gauge Controller:

Motivation: Deeper liquidity lowers rebalance slippage and supports money-market integrations

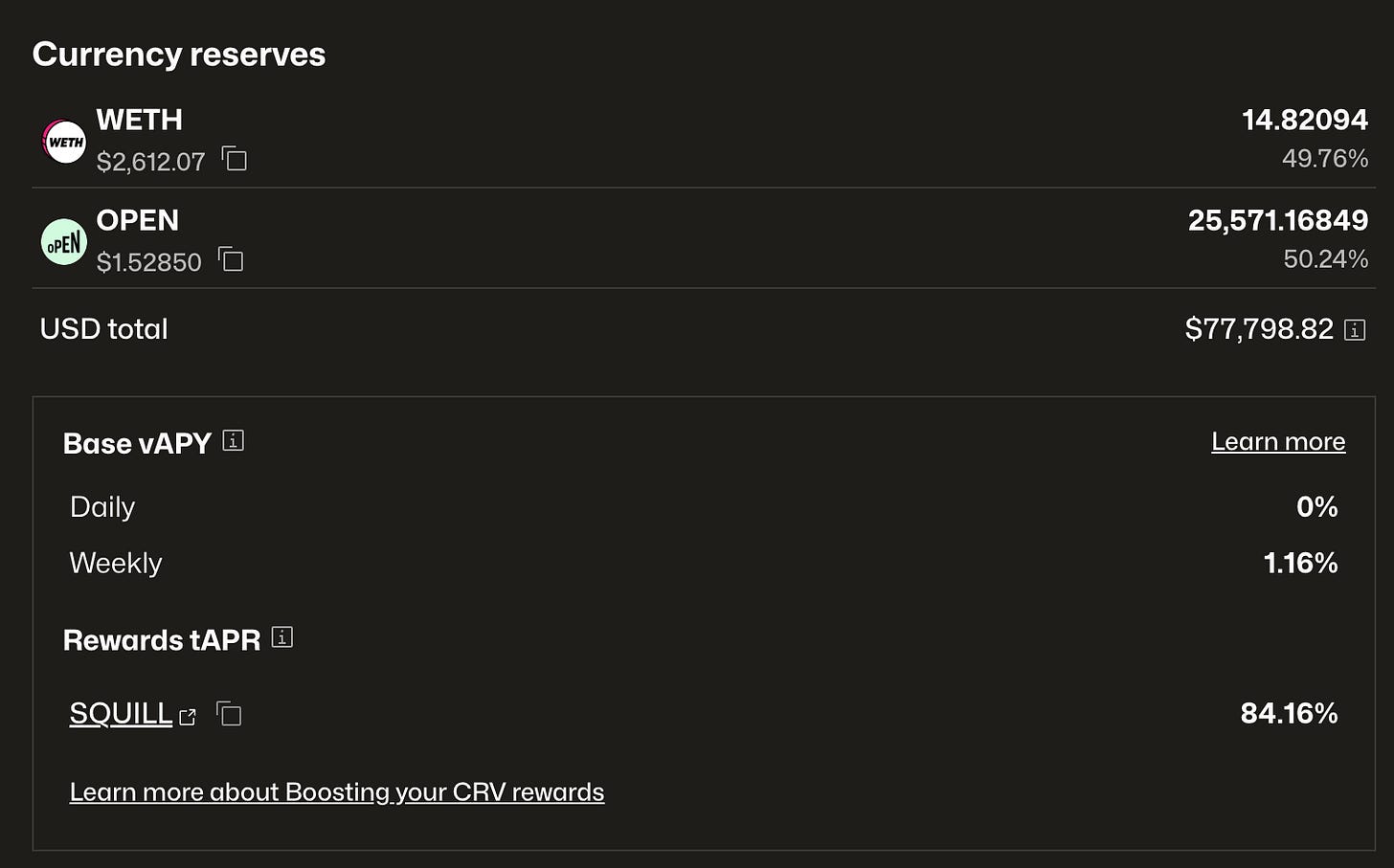

The OPEN / WETH CryptoSwap pool serves as a major liquidity hub for trading between the OPEN ERC20 token and WETH. This pool is easily arbitraged against a similar Uniswap v3 OPEN / WETH pool, which is plugged into the native Reserve DTF infrastructure.

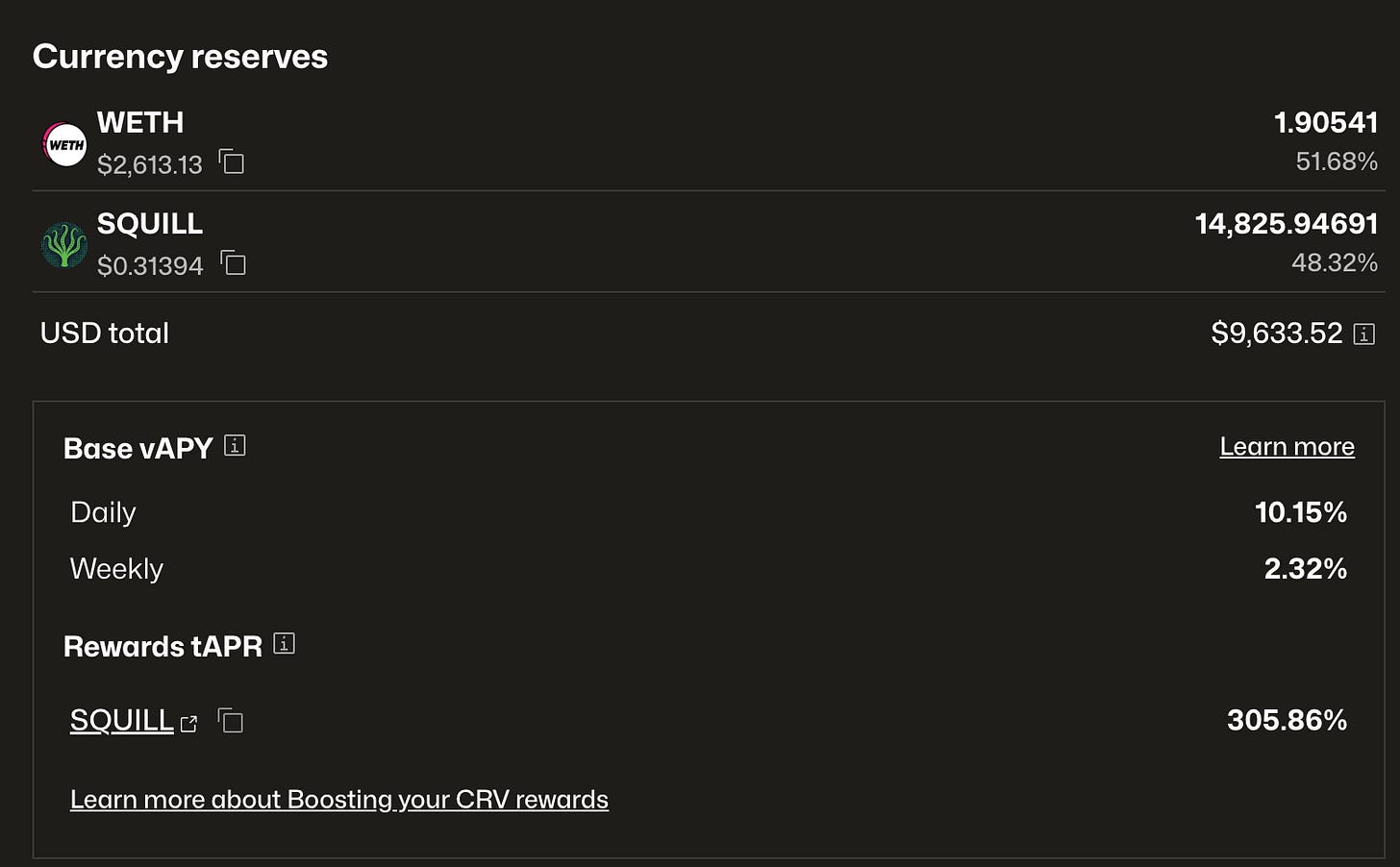

Ethereum Mainnet: SQUILL/WETH (Pool | Gauge)

Motivation: Liquid governance-token market lets new voters enter/exit and arbitrage cross-chain price gap

The SQUILL/ETH pool serves as the primary liquidity source on mainnet for the SQUILL governance token is on Curve, where it trades against WETH.

Fraxtal: SQUILL/SQUID (Pool | Gauge)

Motivation: Maintain alignment with the initial SQUILL airdrop recipients

SQUILL primarily being airdropped on mainnet to the SQUID community on Fraxtal, the OPEN ecosystem has interest in maintaining SQUILL liquidity on Fraxtal. Maintaining a liquidity pool on Fraxtal allows for OPEN and Leviathan to coincentivize this pool by offering rewards in both native tokens.

4. Incentives

The OPEN team has earmarked SQUILL to be distributed to initial LPs in liquidity pools to promote decentralization of governance:

OPEN/WETH: 10,000 SQUILL / week for 12 weeks

SQUILL pools: 5,000 SQUILL / week for 12 weeks

In addition, OPEN earns minting and TVL fees, of which 20% are shared with SQUID DAO which plans to use these incentives to promote liquidity sustainably on a longer term horizon.

Finally, the OPEN community will negotiate with the constituent protocols in the basket to provide long-term incentives for these pools. For one, ABC Labs can provide support with $RSR incentives.

Many of the tokens initially included in the basket are already major players in the Curve ecosystem. Approving a gauge for these pools will make it easier for the protocols that exert influence over veCRV to incentivize these pools.

5. Further Information

Comment Period:

Written comments will be solicited here on Substack, or on the Curve governance forum if the DNS is restored.

Leviathan News is hosting members of the OPEN Community for a “Llama Party” (livestream) May 16, 2025 at 10 AM PT to discuss this proposal and take live questions.

Based on comments, this proposal will be revised as needed. If there are no blocking concerns, the gauges are expected to be submitted for a DAO vote the week of May 19

Further Readings:

Links:

Articles:

Substack:

We appreciate all feedback that helps make these pools a productive part of the Curve ecosystem.

RFS Consulting supports the continued innovation of composable, decentralized stablecoin indices like OPEN. As regulatory clarity increases and institutions explore diversified stablecoin baskets, we believe governance transparency, on-chain risk scoring, and smart contract auditability will become critical. We encourage the Curve and OPEN teams to continue sharing data on basket rebalances, gauge emissions, and the economic security of DTF architecture to foster long-term adoption.