Feb. 28, 2022: A FRAX-ious Time ☢⚖

Potential $FXS-$cvxFXS Arb Opportunity While Planet Distracted by Nuke Threat

Don’t look now, but this is when fortunes are made!

A quick story… sometime around mid 2020, I noticed everybody I knew was obsessed with doomscrolling news about novel viruses, spending nearly every waking hour studying the subject.

Having recently recovered, it struck me as a silly use of my time to give this topic such overwhelming attention. So I vowed to do the opposite. I took a risky bet (for the time) and aggressively ignored the topic. I filtered my news alerts. I unfollowed accounts that would push it too heavily into my timeline. I refused to discuss the subject or associate with people who did.

It turned out there was still a vast and fascinating world to enjoy. I found people who didn’t have a sickness mindset, which turned out to be a healthier and more interesting set of people to have around. Pretty quickly I rekindled my interest in cryptocurrency, at a time when DeFi was just taking off. I zigged to crypto, where everybody else zagged towards a junk diet of news. With the benefit of hindsight I made the right choice.

I bring this up only because the same show appears to be playing on repeat. Everybody has moved towards a myopic obsession on the events out of Ukraine. While my sympathies are certainly against Russian aggression, I also can’t think of a less productive use of my time than trying to peruse social media to sift out real news from the swaths of misinformation. How does my life benefit from a sharper understanding of this subject? (If you’re presently in Ukraine, of course, YMMV.)

As I see it, there’s two binary outcomes for me. Either myself and the planet get nuked to smithereens, or I live. If I get nuked, I won’t care much. If I don’t, I could make substantials gains if I spend the duration improving myself in other areas.

If you take this current period to focus on self-improvement while other people focus on consuming war reports, you have an opportunity to make outsized progress relative to everybody else. What an incredible opportunity for those who can focus smartly.

Accordingly, this newsletter will remain focused on DeFi, with relatively few column inches devoted to the conflict, except where it directly affects global markets.

What you may find is with so many people distracted there is phenomenal opportunity. Look at the recent situation with $FXS-$cvxFXS for example.

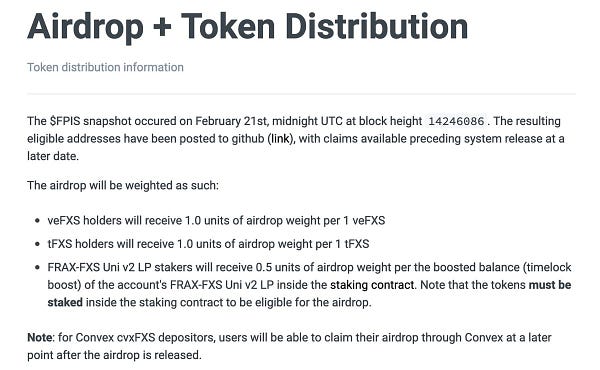

By way of background, Convex has been moving recently to subsume FRAX like it did with Curve. As part of the process, there’s been a recent airdrop to hand out $FPI, a stablecoin that adjusts for inflation. The airdrop is being given out to users who hold $veFXS, staked FXS akin to veCRV, as well as $cvxFXS, the Convex wrapped version of $FXS which has similar mechanics as $cvxCRV.

So what happened? Here’s some quick maths. There’s a total of about 100MM $FXS, and as of publication a total supply of 6,378,241 $cvxFXS. In other words, about 6% of the total $FXS supply was wrapped into $cvxFXS, presumably by users interested in this airdrop. Not bad!

Now, what does one do once they wrapped their $FXS into $cvxFXS? Well, there’s not much at the moment. Like $cvxCRV, it’s a one-way street. One can mint always mint one $FXS into one $cvxFXS, but there’s no reverse route. Also like $cvxCRV, the peg is going to be held through the use of a Curve pool. However, the analogy diverges a bit at this point.

The $CRV-$cvxCRV pool was deployed as one of Curve’s v1 pools. For a v1 pool, it assumes both assets are pegged, but if the pool gets imbalanced it is assumed the peg is strained and you can get a discount. Typically the $CRV-$cvxCRV peg tends to hold pretty strong, but when markets get crazy (like now), you can see some discount — at present you can get a 4% discount going from $CRV to $cvxCRV if you take the chance it will repeg over time. Not bad! Then you can stake your cvxCRV and earn flywheel yields.

The $FXS-$cvxFXS pool is a bit different in that it’s launched as a Curve v2 pool. This means there’s no price peg, but the pool adapts internally to set a price based on the internal oracle. This is a design decision that has some advantages over v1.

Also, this is the only $cvxFXS destination at the moment. In other words, this factory pool is the oracle price for $cvxFXS. Pretty cool application of v2!

How’s v2 holding up? We saw there’s about 6MM $cvxFXS out of 100MM total $FXS. In the pool at publication, there’s 2,008,538 $cvxFXS — about a third of the total Convex-wrapped FXS has found its way into the pool. The other two thirds presumably just sitting in people’s wallets.

There’s also just 519,736 $FXS in the pool, or about .5% of the total $FXS supply. This means the pool is about 75% imbalanced. It shakes out like such:

The pool is going to push into the direction of the price oracle, which thinks a $cvxFXS at present is worth about 83% of a $FXS. This actually tightened already since recently, where it was closer to 70%. It’s back to roughly where it was a week ago, before $cvxFXS got deposited en masse:

The price scale hasn’t budged much in the time, and we may expect the oracle catches back up to 1:1 if things play out as planned.

What does this mean? If you missed the $FPI airdrop, there’s still some free money available for you! A lot of $FXS is still sitting around — some may be tied up in people’s Votium rewards for instance. Up to 6% of the total $FXS supply can find its way into this pool at a bonus.

It’s another asymmetric bet. It’s plausible the peg never recovers. If so, then it’s quite likely we’ll see the cascading failure of Convex, FRAX, and possibly Curve as DeFi as we know it disintegrates. If so, you probably don’t have a lot of good choices to avoid the nuke anyway.

Or you can put your faith into the smartest devs in cryptocurrency and bet that the peg will recover. You can deposit your $FXS into the pool and get a 20% bonus at the moment. The fun doesn’t even stop there!

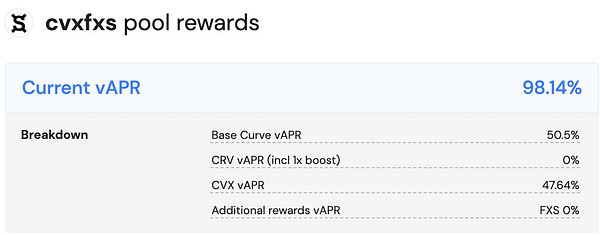

As cited above, this pool becomes the clearinghouse for all rewards. It’s already got Convex rewards hooked up, and this alone is compelling to say the least.

We also haven’t seen Curve rewards get hooked up yet, which will be more gravy.

Need more sauce? $FXS is trading at $21.59 right now, nearly half its all time high set in January. We’re not traders (and this is not financial advice) in part because altcoins are so obnoxious to trade. They always dump with $BTC/$ETH pretty much regardless of their fundamentals, as we also see with $CRV/$CVX now.

If you have a steady flow of dollars, which is a good way to weather bear markets, you might consider buying up some $FXS on this particular dip. You can drop it into the Curve pool and get not just the juicy rewards, but also take advantage of this nice arbitrage if the peg does end up healing.

$FXS is also a generally interesting and productive asset, so it could be worth having a piece in any market.

If you don’t take advantage of this opportunity, there may be other powers who will step in to do this in due time, so it’s possible you may want to move quickly.

Or you can ignore this and watch pictures of explosions in the Donbas. Your move!

Excellent analysis and a very well articulated essay.

I have two clarifying questions –

“The pool is going to push into the direction of the price oracle, which thinks a $cvxFXS at present is worth about 83% of a $FXS.”

#1 – Since cvxFXS and FXS should eventually become pegged/converge to 1:1, does that mean that cvxFXS is undervalued right now?

“You can deposit your $FXS into the pool and get a 20% bonus at the moment.”

#2 – Does it make more sense to deposit $FXS into the LP pool OR is it better to take advantage of the arb opportunity and convert the $FXS into 1.2 $cvxFXS… and then deposit the $cvxFXS into the LP pool?