It’s the year of the “0x” — so send all your 紅包 to valid ETH addresses!

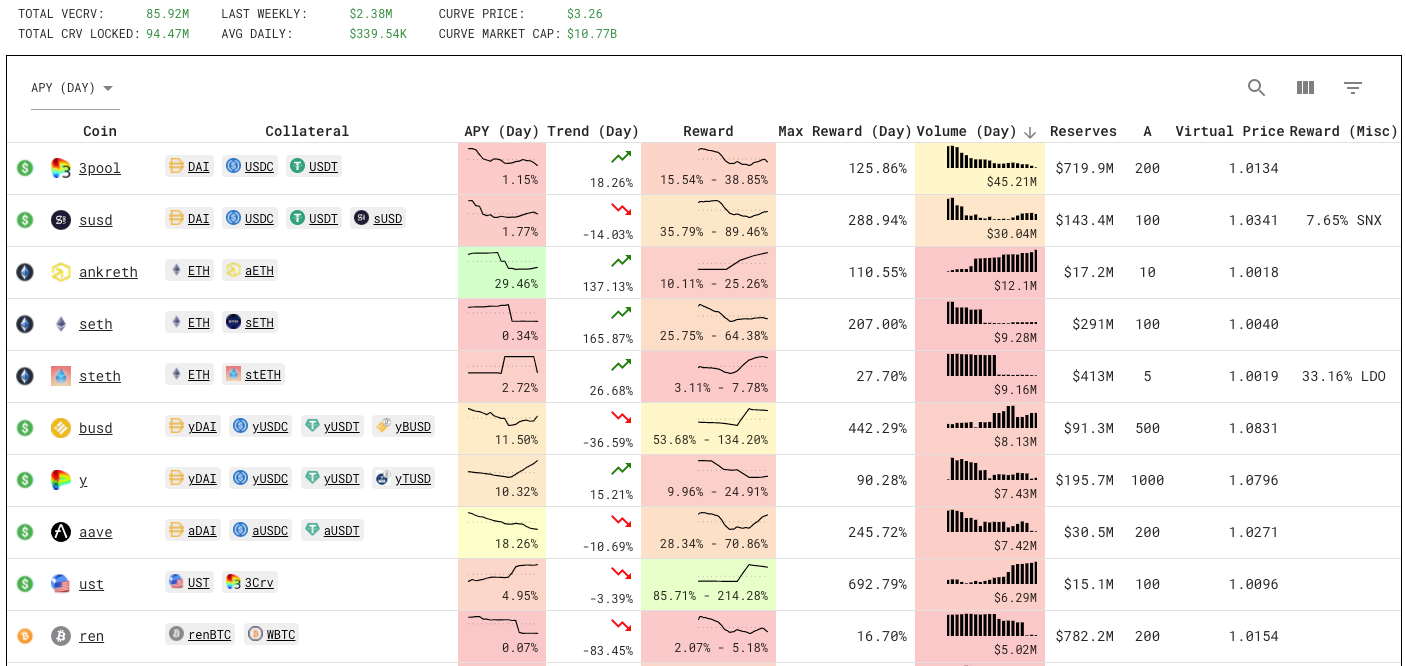

Here are today’s trends to watch from Curve Market Cap

We ring in the lunar new year with a lot of activity on Curve’s governance forums, the best way to see and influence the upcoming direction of Curve.

The DAO vote on CIP #49 opened yesterday, a massive update to improve the efficiency of the burners. Many of you may never directly interact with the burners, but it is the process by which admin fees are efficiently converted to 3pool veCRV.

We endorse this proposal, although this endorsement is basically irrelevant because it looks to already have such a large “Yes” vote margin it would make Saddam Hussein jealous.

Burners currently cost a lot of gas because they convert synths inefficiently. We all know gas is too expensive. The changes look non-controversial. Plus it adds rewards to Iron Bank and USDP, a nice bonus. Burn some gas today voting for this and you can save gas in the long run.

$FRAX

Elsewhere in governance, we witness the conclusion a pair of metapools signal votes.

Seemingly more controversial is sCIP#30, a nail-biter of a signal vote to deploy a FRAX metapool, running at a spicier 99.8% to 0.2% margin.

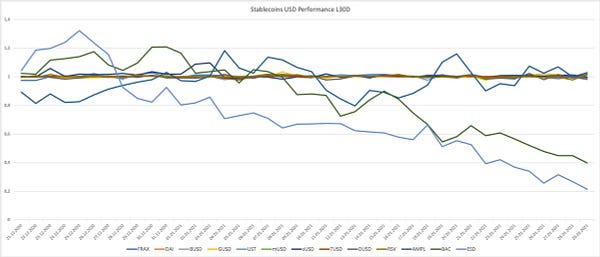

FRAX touts itself as the “world’s first fractional-algorithmic stablepool” — meaning it is partially backed by collateral and partially backed algorithmically. FRAX has been live for several months and thus far it has held its balance.

For more details, you can review their repo or check out founder Sam Kazemian’s recent appearance with Bobby Ong on the CoinGecko podcast:

The signal vote remains open for another day. Vote early, vote often! #DEMOCRACY

$TUSD

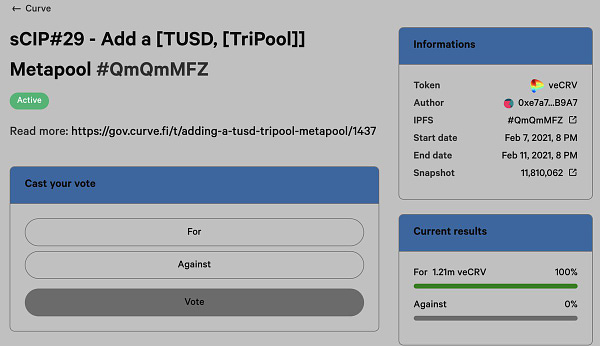

On the flip side from $FRAX’s fractional algorithmic backing is TrueUSD ($TUSD), which advertises its incredibly tight paper trail. Their signal vote to add a $TUSD metapool, sCIP#29, just closed with 100% backing.

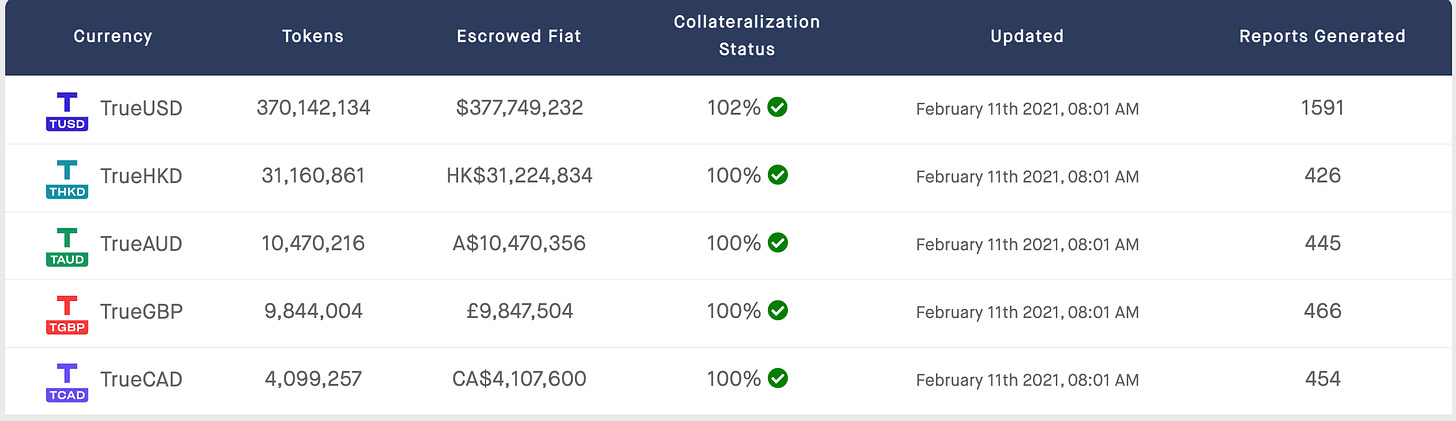

TrueUSD (TUSD) the first and only stablecoin fully collateralized by US Dollars and independently attested live on-chain. The ERC20 token uses multiple escrow accounts and third-party attestations to reduce counterparty risk, provide transparency, and prevent fraud

They also provide a dashboard with live attestations of collaterization:

$TUSD’s audit trail has been cited as shoring up a weakness of $USDT:

With 2020 everywhere in the rear view mirror, we look forward to an exciting year ahead for Curve!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. The author performs development work for Curve compensated partly in $CRV, all content is otherwise independent.