February 14, 2021: 😍❤️ Practical Hyperbitcoinization: Flippening Companies 🏢, Nations 🇺🇳 & Planets 🪐

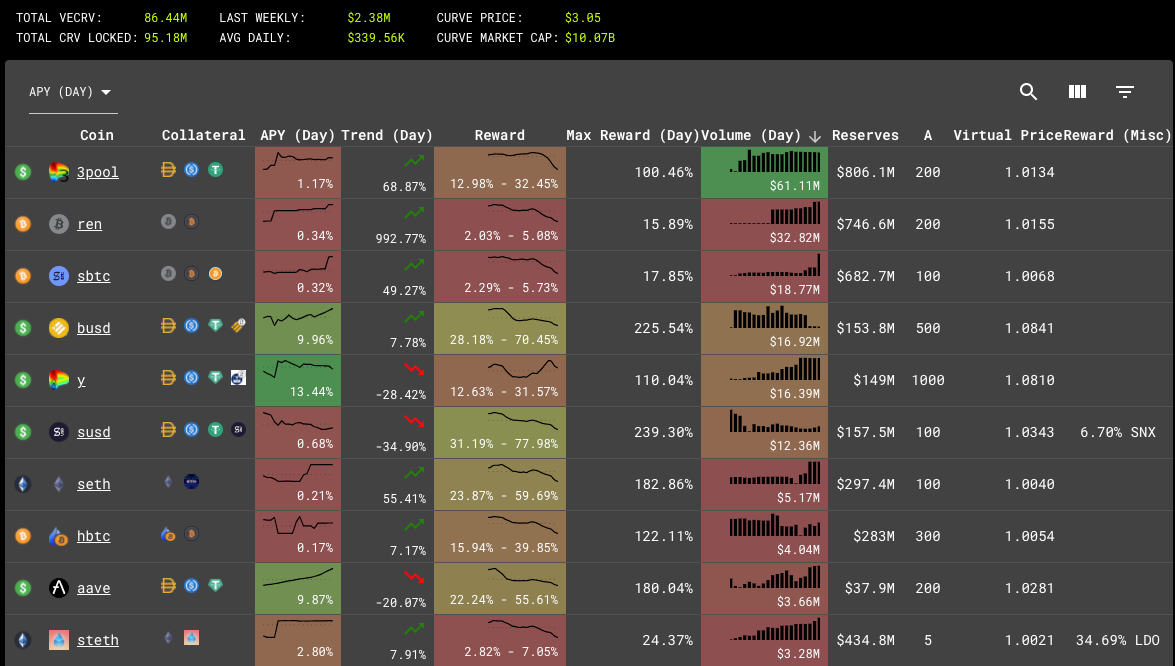

Curve Market Recap

This Valentine’s Day, we introduce our multi-part series with a look at the collective ledger of our affections, Bitcoin. With prices scraping $50K, we’re kicking off a practical discussion about “hyperbitcoinization.”

To our knowledge, nobody has attempted a rational discussion of what hyperbitcoinization actually means in practice. The debate currently resembles a troll fight. On one side, Bitcoin maximalists claiming it will deliver all your wildest dreams, however vague they may be. On the other, some bitter perma-bears who aren’t having any fun staying poor. So what, exactly, is the halfway point between the moon and rat poison?

What if a hyperbitcoinized world looks… hear us out… almost exactly like our current world? Throughout our series we’ll argue that in a world where Bitcoin gains mass adoption, some observable factors will change with each 10x price jump, but the macro trends of poverty, censorship, and war will all persist into the brave new world. People will still go to work, eat food, and pop out babies just like before.

Indeed, there’s a reasonable case hyperbitcoinization is already here. Bitcoin is now the 6th largest currency in the world. Bitcoin is worth more than the two largest payment services, Visa and PayPal, combined. Bitcoin is already widely held, globally accepted, and universally known. What more do we need? Maybe the real moon was the friends we made along the way.

Nonetheless, we think there’s a few more 10x’s left in Bitcoin’s Katamari-esque rollup of the financial system. Our series will be looking at the pattern of previous 10x jumps and using it to extrapolate what we might expect should prices jump to $500K, $5MM, or beyond.

For example, one claim history can arguably debunk is that Bitcoin buys freedom. From trough to peak, over the past year Bitcoin has 10x-ed. Have human rights increased 10x since early 2020? Or have they in fact decreased? Where is there any evidence of correlation between Bitcoin and freedom? To advance this claim, you’d have to argue that “freedom” is a somehow an emergent property only beyond a certain price threshold.

To be sure, early adopters got a great degree of financial freedom. Yet we doubt the mass of future wage slaves will feel any freer laboring for satoshis instead of dollars. In fact, if previous cycles are any indication, poverty is very likely to worsen in a hyperbitcoinized world.

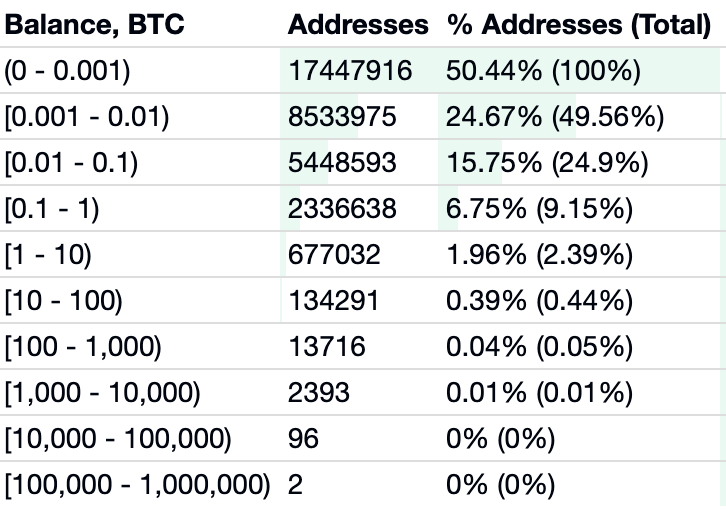

Estimates of the Gini Coefficient for the Bitcoin range from around 0.877 to 0.95. This is roughly in line with the global Gini Coefficient calculated by overall wealth (.885) and far higher than the calculation by total income (.486). Whatever measure humans use to denominate wealth, it always tends to fall into a power law dividing a small number of “haves” with a larger number of impoverished “have nots.”

We’ve observed six 10x periods on Bitcoin’s path from $0.05 to $50K. Properties that have occurred at various scales among these jumps are the properties most likely to occur in the future. For instance, mining has moved from laptops to rigs to farms, so we can expect mining operations will become far grander in the future. Similarly, we can look at ideas that failed in the past due to lack of scale as being likely to emerge in the future.

Our series will be released in three upcoming parts, whenever other DeFi trends are sufficiently quiet.

Flippening Companies: Our current phase — we are presently seeing companies hoarding Bitcoin and losing in the talent wars against the broader cryptocurrency ecosystem.

Flippening Nations: If you thought the block size debates were ugly, wait until the first Bitcoin wars get fought.

Flippening Planets: Both general relativity and the Kardashev scale provide theoretical ceilings for Bitcoin, and a hint at the endgame.

Until then, we’re interested in hearing your thoughts so we can get them into our discussion!

Speaking of Bitcoin… how about REN with 674 BTC volume over the past day!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV staker and perma-bull.