February 14, 2024: All's Fair in L2's and Curve Wars 💖🎖️

$crvUSD seduced onto sidechains in supply sink strategem

Help us spread this post on 𝕏!

The Supply Sink

~$40MM, about a third of $crvUSD supply, has currently been enticed onto sidechains.

This is excellent news, and may be playing right into Curve Founder’s sinister (?) plan…

For $crvUSD to scale, the biggest need is supply sinks. What is a supply sink? Think of any utility which creates demand for $crvUSD… i.e. integration with lending protocols, Conic omnipools, or… you guessed it… bridging to sidechains and L2s.

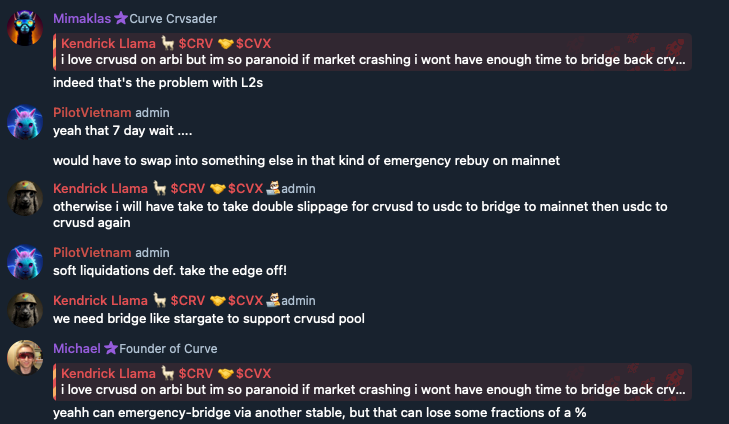

Any $crvUSD bridged to L2s keeps the authentic Ethereum $crvUSD locked up in some sort of bridge contract, while the cloned version gets utilized throughout the L2 until somebody bothers to bridge back. At the moment, bridges are often quite slow and rickety, so few bother to bridge back unless there’s strong need.

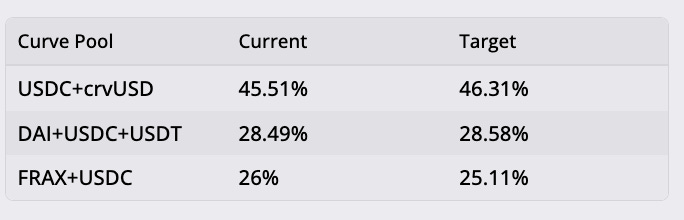

$crvUSD borrow rates rise when users take action that cheapens $crvUSD, actions like trading it through the Peg Keeper pools for $USDC, or depositing single-sided into said pools. Cheap $crvUSD means rates shoot up, to incentivize borrowers to acquire $crvUSD to repay their loans.

In the earliest days of $crvUSD, most of the $crvUSD was deposited into Conic. Conic deposited this single-sided into the Peg Keeper pools, causing $crvUSD price to drop and rates to soar.

Fortunately, so far the relaunch of Conic is not imbalancing the pools so markedly. The main Conic stablecoin market of $USDC also gets deposited to the associated Peg Keeper pool, keeping more of a balance.

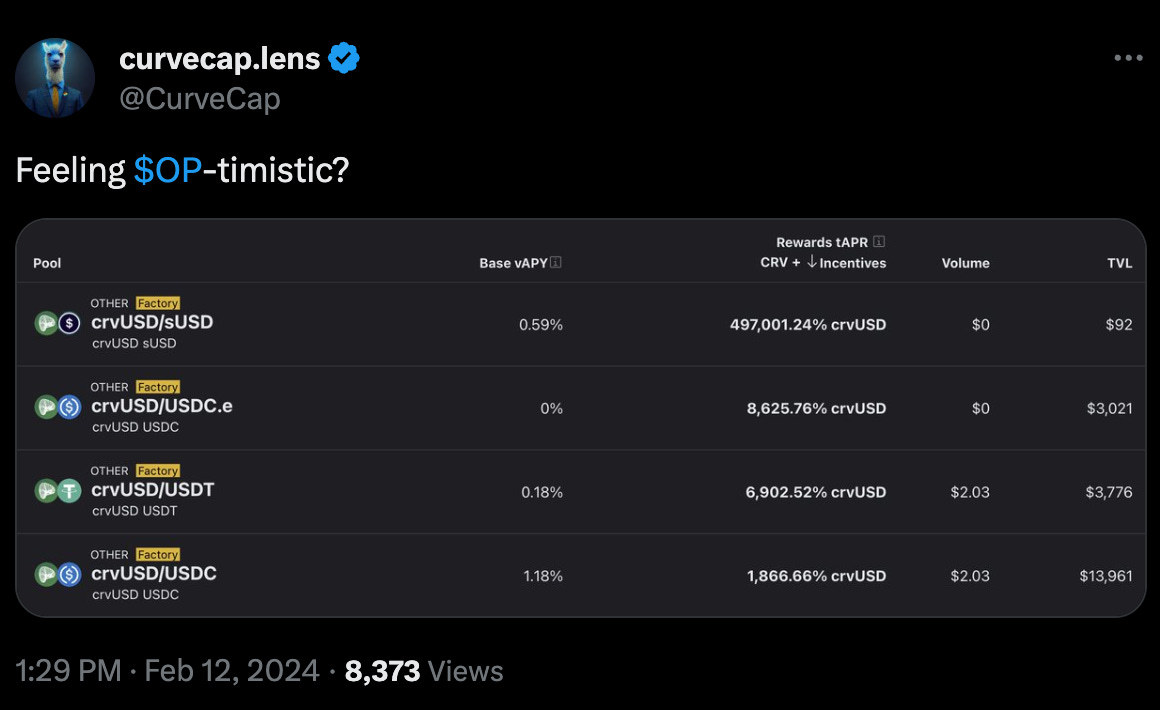

Whenever you see $crvUSD rewards getting showered on sidechains, it’s likely a strategy to attract the stablecoin off of mainnet to turn the chains into supply sinks…

One user with a million dollar $crvUSD loan on a sidechain might well take the time and effort to bridge it back. If a million dollars in $crvUSD is distributed as incentives, winding up in the pockets of ten thousand users holding about $100 apiece, the users might just leave it in their wallets.

If you don’t know where the supply sink is coming from, you are the sink…

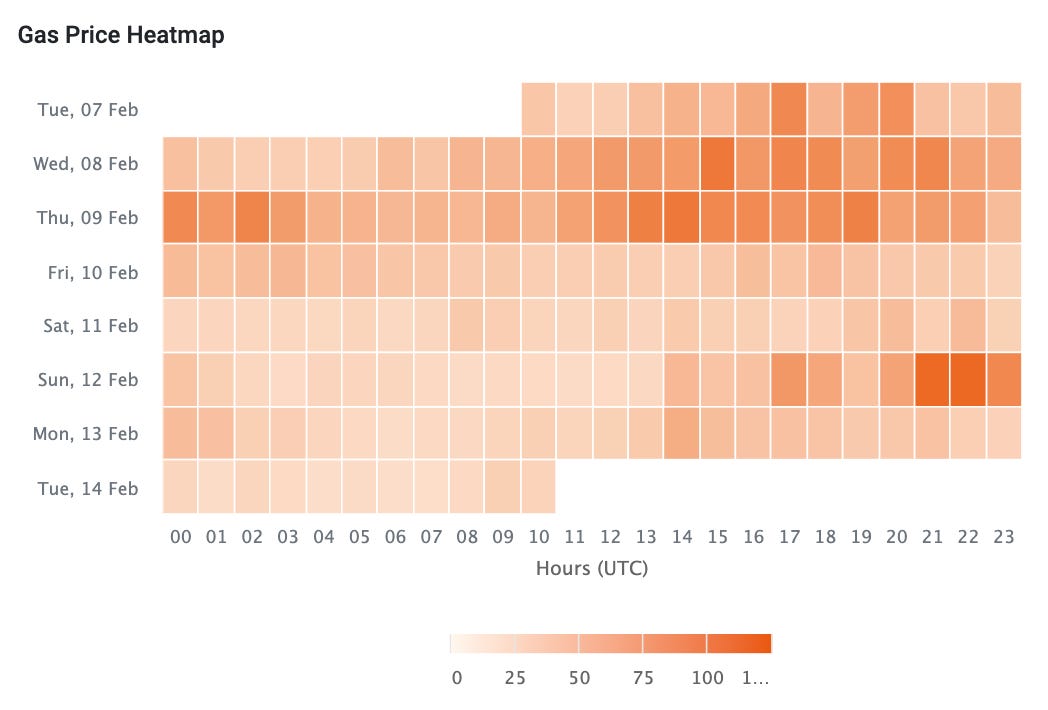

It happens to be sidechain season. The issues have abated recently, but lately Ethereum gas fees have spiked thanks to surging crypto prices. Those of us who patiently waited out the bear market are now finding ourselves priced out of mainnet.

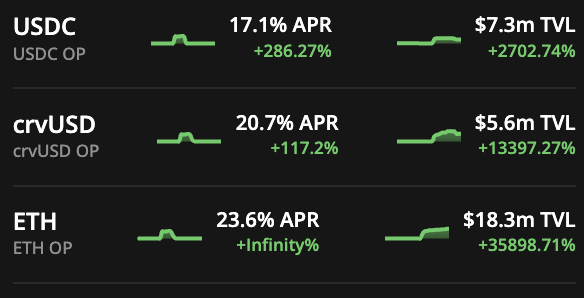

If you find yourself getting ghettoized onto sidechains, you can at least be relieve that these chains are no longer the yield desert they once were.

What follow is our annotated review of some of our favorite Curve pools on sidechains and L2s (not financial advice, of course).