We know Curve is a FUD —> $$$ engine. And it’s a bull market for FUD…

One of the latest batches of FUD making the rounds is that the Shanghai update might shanghai any market momentum.

The argument apparently goes that every $ETH superfan who acquired >32 ETH and locked it up for months, possibly years, to earn even more $ETH are suddenly going to dump en masse when withdrawals are enabled.

As we gird our bags for the Shanghai update, the major LSDs are also preparing. Much of this includes some adjustments to their Curve pools.

We know Curve is a FUD —> $$$ engine. And it’s a bull market for FUD…

One of the latest batches of FUD making the rounds is that the Shanghai update might shanghai any market momentum.

The argument apparently goes that every $ETH superfan who acquired >32 ETH and locked it up for months, possibly years, to earn even more $ETH are suddenly going to dump en masse when withdrawals are enabled.

As we gird our bags for the Shanghai update, the major LSDs are also preparing. Much of this includes some adjustments to their Curve pools.

Paywalled for 72 hours.

Lido $stETH

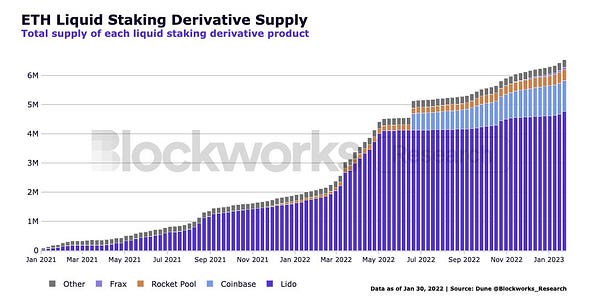

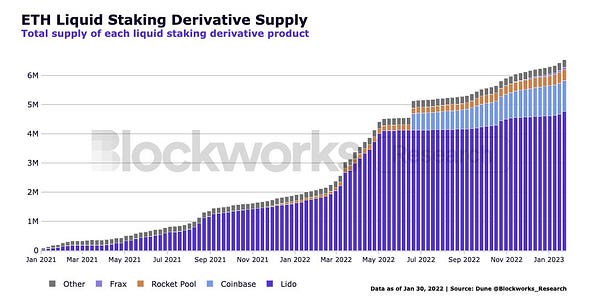

Lido runs the biggest staking derivative by far, although its growth has plateaued somewhat as new LSD solutions hit the market. Lido looks to remain dominant through Shanghai, the moment some stETH holders have waited years for.

Accordingly, Lido recently made some adjustments to shore up two of its Curve pools. The main stETH pool, which remains Curve’s largest and only remaining pool with over a billion in assets, is lowering its A parameter to prevent potential depegging attacks.

Meanwhile, some may have forgotten the stETH concentrated pool — which carries a much higher A parameter. It was created back when the peg was considered an issue, and seeded with very high rewards.

The pool hasn’t done much since, but still has about 1500 ETH sitting around, perfectly content to not earn rewards.

The team is adding a gauge to the pool, thinking it may be a useful weapon to add to its arsenal during any mass unlockening.

Coinbase $cbETH

Coinbase’s cbETH, sitting in second place, is likely facing the heaviest offline pressure, the result of Gensler waging a holy war against retail investors to better “protect” them. Unfortunately, Coinbase finds itself right in the crosshairs.

After Kraken got roughed up for $30MM and $BUSD got libeled as a security, speculation is rampant that regulators want to maul $cbETH. The events led CEO Brian “Based“Armstrong to issue the following proclamation:

The fears are manifesting in the form of a slight drawdown of TVL.

The good news is that there’s opportunity for those who want to absorb this risk. Under the expectation that investors are able to redeem 1:1, anything shy of a 100% peg could be quick profit if redemptions proceed normally at the Shanghai update. NOTE: None of this is financial advice

With some users fleeing, the 10% boosted rewards one could get as an LP to the Curve pool are the highest of the liquid staked ETH pools on Curve.

Rocket Pool $rETH

While Rocket Pool previously put up a Curve pool, it was a 1:1 pool between rETH and wrapped stETH. This unusual pairing was to make it play well as a v1 pool. The problem was that there’s not a ton of wrapped $stETH floating around, so it never really took off as a pool — only about 2K $ETH sitting in the pool. Nor did this have any natural trading pairs, so it wasn’t even possible to route between $ETH to $rETH on Curve.

Lately Rocket Pool has seen some big activity. Recently a v2 pool launched, based off the same parameters of the successful $cbETH v2 pool, allowing $rETH to trade directly against $ETH. This more natural pairing got quickly picked up by aggregators and integrated into trading. The pool quickly attracted 5K $ETH, over double what its inaugural pool collected over time.

While we don’t particularly expect the team will be heavily incentivizing the pool, at minimum it is pursuing a gauge vote, so it might be worth keeping an eye out.

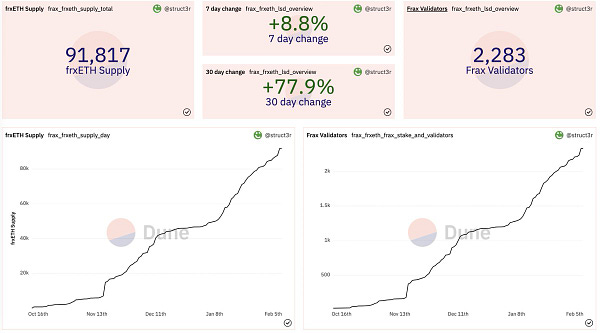

Frax $frxETH

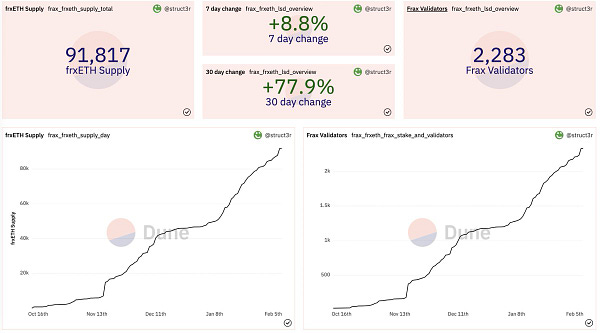

Frax probably has to do the least amount of work figuring out its Curve strategy, given that what it is doing is working quite well. Liquidity continues flowing quickly towards $frxETH, powering its rocket ship growth.

Frax has big ambitions for after the Shanghai update. From the recent Empire Podcast with Sam, the founder identified his target: WETH. He intends to make frxETH a superior version of the simple and popular Wrapped Ethereum contract, with sfrxETH handling staking strategy.

Must listen

https://www.defiwars.xyz/wars/eth

stETH

Lido is by far the biggest staking derivative, although its growth has plateaued somewhat as new LSD solutions dropped. It still looks to remain dominant throughout the moment some stETH holders have waited years for… the great unlockening.

Accordingly, they recently made some adjustments to shore up two of its pools. The main stETH pool, which remains Curve’s largest and only remaining pool with over a billion in assets, is lowering its A factor to prevent potential depegging attacks.

Meanwhile, some may have forgotten the stETH concentrated pool — which carried a different A factor and much greater rewards for a time when the peg was under threat. It hasn’t done much since, but still has about 1500 ETH sitting around content to not earn rewards.

The team is adding a gauge to the pool, with thoughts to use it for the unlockening.

cbETH

Coinbase’s cbETH is arguably facing the most direct offline pressure, the result of Gensler waging a holy war against retail investors to better “protect” them. Unfortunately Coinbase is right in the crosshairs.

After Kraken got roughed up for $30MM and $BUSD got labeled a security, speculation is rampant that the SEC is going to drop the hammer on Coinbase. With the cbETH forming a major part of Coinbase’s business, speculators are concerned about $cbETH.

The fears are manifested in the form of a slight drawdown of TVL.

The good news is that there’s opportunity for those who want to absorb this risk. Under the expectation that investors are able to redeem 1:1, sitting anywhere shy of 100% peg could be quick profit.

Plus, the 10% boosted rewards one could get as an LP to the Curve pool are the highest of the liquid staked ETH pools.

rETH

While Rocket Pool previously put up a Curve pool, it was a 1:1 pool between rETH and wrapped stETH to make it work well as a v1 pool. The problem was that there’s not a ton of wrapped stETH, so it never got deep liquidity. Nor did this have any natural trading pairs, so it never collected much in the way of trading fees.

Seems there’s some big moves here though. Recently a v2 pool launched, based off the success of the cbETH v2 pool, allowing rETH to trade directly against ETH. This more natural pairing got quickly picked up by aggregators, and the 5K worth of ETH in the pool is starting to generate some volume.

While we don’t particularly expect the team will be heavily incentivizing the pool, at minimum it is pursuing a gauge vote, so we might expect something is afoot. Worth keeping an eye out.

frxETH

After Shanghai, wants frxETH to compete with WETH… back frxETH with stETH / rETH

Nor is there a lot of people who wrapped their stETH, so liquidity was a bit short — about 2K ETH total sitting around claiming the meager rewards.

More recent coverage on Frax: