February 17, 2021: Throwing Fuel on the Fire⛽🔥 Curve's plan to fight high gas prices

Curve Market Recap

Here are today’s trends to watch from Curve Market Cap:

Everybody’s talking about those gas prices!

The Curve telegram chat is generally a wonderful place for everything Curve related (except price discussion).

But with frustration mounting at rising gas prices, it’s turning into an angry mob lately.

As always, the Curve admin team are trying all the options!

In fact, Vitalik has lent his name to EIP-2929 and EIP-2930 that may help at some point. Nonetheless, since gas prices may always be an issue in the future, we wanted to take more of a data-driven look.

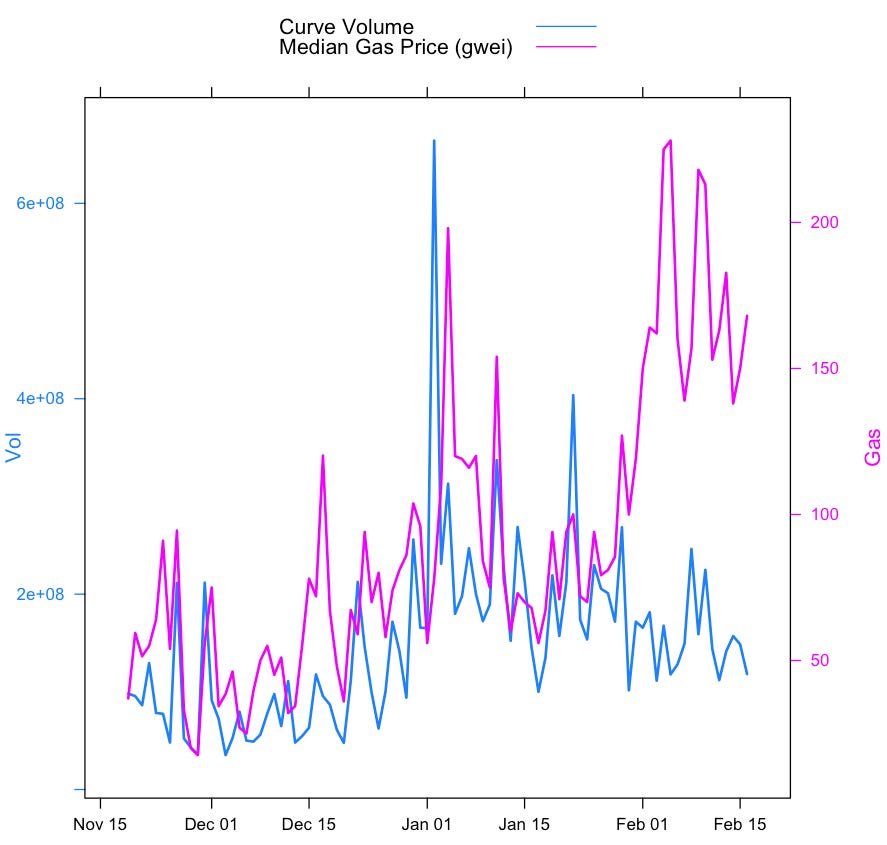

We pulled the last three months of median daily gas prices from Dune Analytics and matched them up against the last three months of trading data from Curve’s daily stats. Here’s the story:

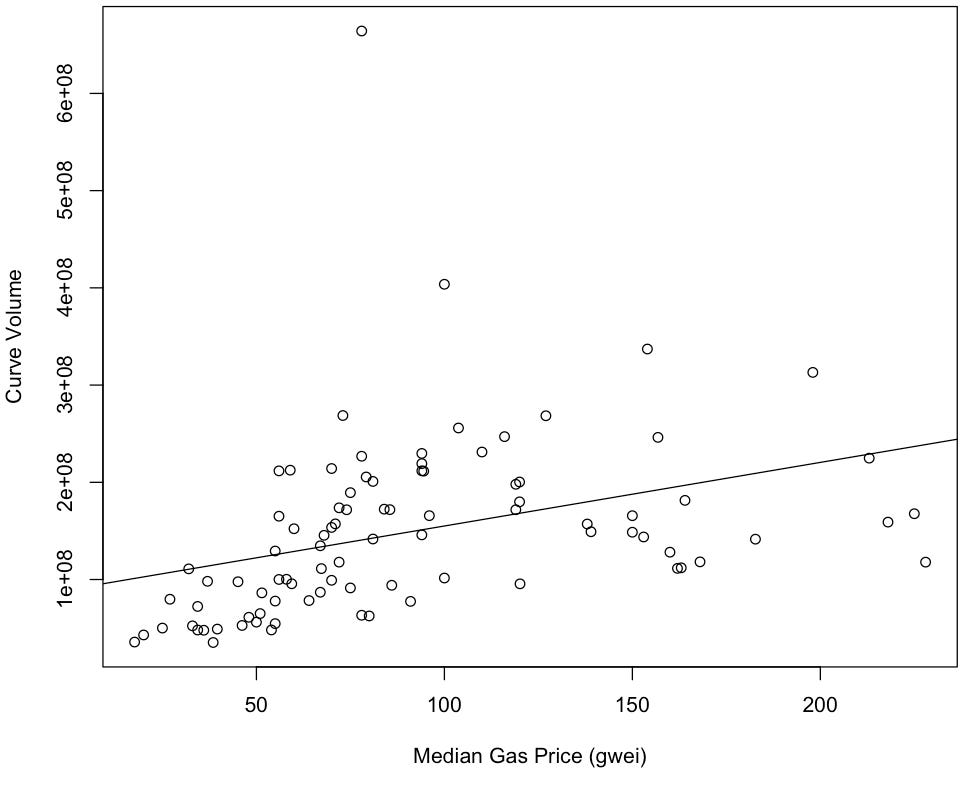

Hmm, interesting… it looks a bit like Curve somewhat kept pace with high gas prices. Let’s regress Volume vs Gas:

Holy 💩. Volume actually tends to increase with higher gas fees. When Charlie gets Vitalik on the horn, he should ask him his plan to raise gas prices!

In fact, an increase in gas prices of 1 gwei is will add about $650K worth of volume.

Not bad, but I know what you’re thinking… what about the sort of natural growth that should occur to Curve over time? That is… Curve should just be growing anyway, how much do gas prices inhibit this growth? Up only!

Well, one quick check is to toss in the date as a column in the regression analysis, just to see the extent to which Curve volume depends on Date.

There could be a point here… toss in “Date” and gas price loses a lot of explanatory value. Here’s what we’ll do… let’s add “Expected Volume” as a variable, which will be the expected volume of Curve based on date. Then we’ll look at whether actual volume is higher or lower than expectation. It looks a bit like this over time:

Now, let’s look at how this difference compared with gas prices:

This one is a bit more mixed. We don’t see a particularly strong positive or negative effect.

It should be the case that high gas prices should have strong explanatory value, yet it doesn’t show any particular correlation. This makes a bit more sense than above — we shouldn’t expect high gas prices to drive more usage. What we see instead is no particular correlation.

In other words, if you’re worried about gas prices, you’re basically just signaling that you’re not a whale.

Of course, there’s still a lot more analysis to do. Ping us if you want a copy of our dataset and find anything better! At early glance, it seems there’s a bit of a bow-shape to the last plot that could indicate some differences may be focused on the 100-200 gwei range.

But since this is a free newsletter, we’ll only write enough as to earn your occasional praise.

Thanks!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV staker and perma-bull.