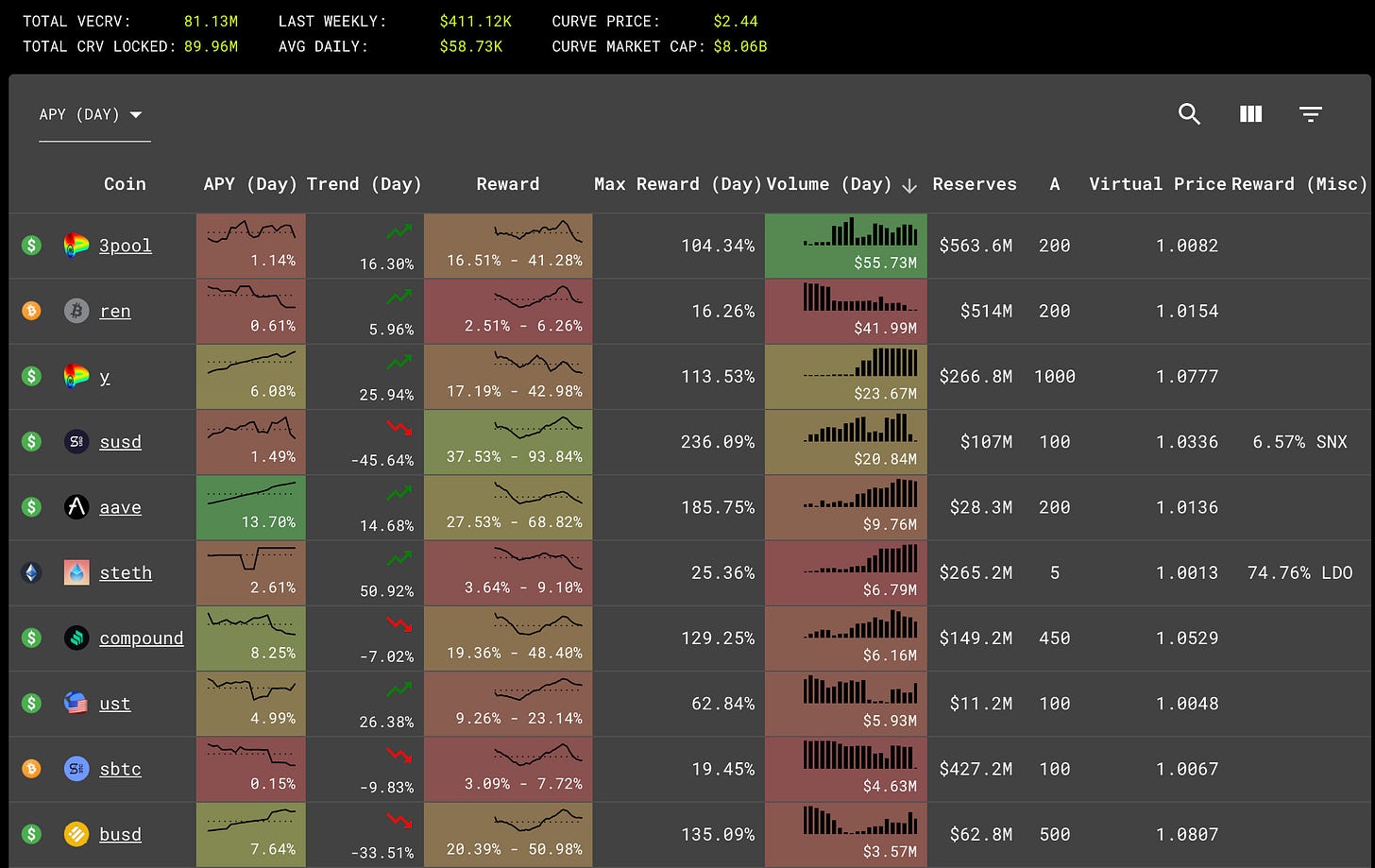

Here are today’s trends to watch from Curve Market Cap:

‘Member the good ole’ days when perma-bears trolled about how there was no real use case for Ethereum?

Then #DeFi came along, and demand for Ethereum, along with gas prices, skyrocketed.

Suddenly the trolls turned a 180, now claiming high gas prices are killing Ethereum. Apparently very high demand is now a bearish indicator?

That said, the rise in gas prices really has changed the scene. Small transactions are out. At the moment, DeFi is mostly only accessible for whales who can afford the gas.

In a bizarre way, having DeFi as a whale playground has been great for getting the industry off the ground. Entrepreneurship 101 states that your business is a lot more likely to succeed if your target customers are rich than poor.

But is there any hope for DeFi to help out the little guy? Will we ever get back to micro-transactions? Today we look at a few possible solutions for how DeFi can cope with gas prices.

Bitcoin Lightning Network

OK, that was good for a laugh. But seriously, what can DeFi do about gas prices?

Eth2

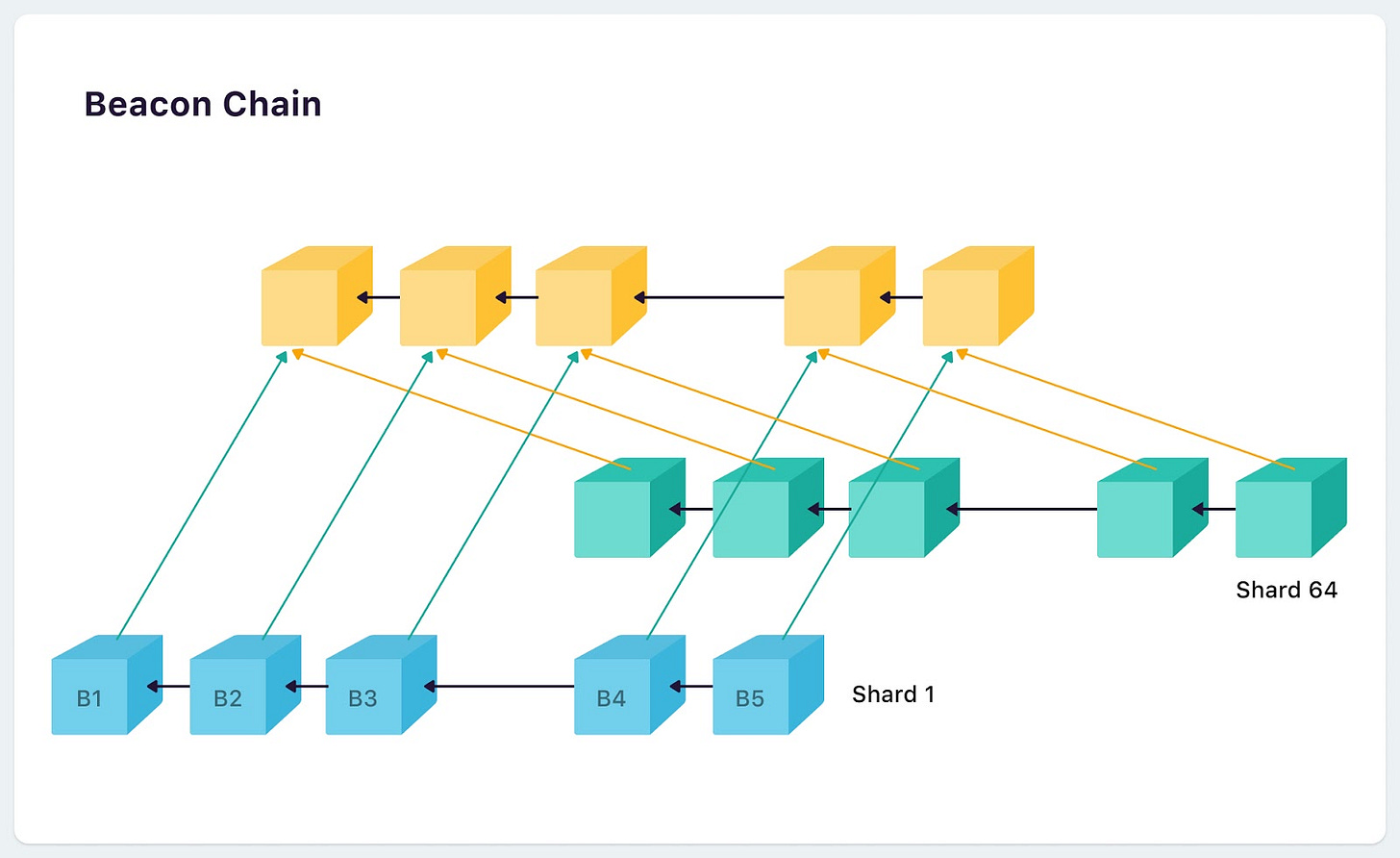

We can always wait around for the next generation of Ethereum to launch. In the Eth2 world, instead of every transaction being validated by every node, work will be distributed as shards and then aggregated back onto the “Beacon Chain.” Boomers might liken it to the SETI@Home project.

Eth2 is making progress towards becoming a reality. After much hype it finally launched its bridge on December 1st, now with over $4 billion locked in the deposit address.

The transition is going to be phased, but even if they don’t hit any obstacles it would be years before Eth2 is fully implemented. And what software development manages to follow such a straight line?

Solana

Even with Ethereum’s sharding mechanism, Eth2 could only dream of hitting the efficiency of Solana. Solana can handle 50,000 transactions per second with 400 ms block times, putting it at twice the volume Visa currently boasts. Solana’s website even has a game inviting you to try to break it. And it currently costs just $0.00001 per transaction, though this could rise with adoption.

Solana is so fast they had to invent a completely new consensus mechanism called “proof of history”, essentially proving that certain events happened in a particular order.

What’s really cool is that none of this is theoretical. The Solana network is already live and hosting a variety of applications within DeFi.

Serum already launched a fully liquid exchange on Solana, in what may well be best exemplar of a robust, fast, and usable decentralized exchange.

In some cases it’s easy to port existing Ethereum applications onto Solana, made possible through the existence of the Ethereum to Solana wormhole. Many of the tokens trading on Curve already have built onto Solana. Even Curve itself has some footprint on Solana through the StableSwap project.

So why hasn’t the entire DeFi world already moved to Solana? Well, VHS crushed Betamax, but that’s probably not an apt analogy as opening a Solana wallet (“sollet”) is cheaper than buying a video player. But habits take time to change.

It took Ethereum a long time to build a large community, and now it’s reaping the rewards. At the moment the high usage of DeFi Ethereum apps drive the outsized returns. If users see opportunities to save gas by staking on other chains, volume will inevitably be nudged to more efficient chains like Solana.

PolkaDot

For this reason, we’re keenly interested in the promise of PolkaDot. Polkadot is solving the problem of connecting blockchains together at scale.

Look how tough and inefficient it has been to connect Bitcoin with Ethereum. That’s just one single bridge between two blockchains. To connect 5 blockchains you’d need 10 bridges. As the number of blockchain grows, the number of bridges keeps growing in accordance with Metcalfe’s Law, until you get something like this illustration on Polkadot’s homepage:

Polkadot has already spent five years already solving this problem. They’ve worked out all the intricacies of this complex problem and created a viable solution:

We’re not going to get into the full mechanics of this solution, as there’s a wide variety of better explainers out there.

The important thing to note is that the Polkadot team are geniuses (Polkadot was founded by Ethereums’s original CTO Gavin Wood) and investors are betting big on them (Polkadot’s $DOT token and XRP are in a tight horse race for fourth largest coin).

The promise of Polkadot would allow a lot of the expensive DeFi activity to be easily ported to less crowded blockchains.

We are already expecting to see Bitcoin being wrapped onto Polkadot as PolkaBTC, and a Polkadot Defi Alliance formed last December

With all these cool solutions, Ethereum 1.0 is now the gas-guzzling SUV amidst a fleet of Teslas.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. The author performs development work for Curve compensated partly in $CRV, all content is otherwise independent.