Seeking the best dollar yields on Curve?

The highest yield, by far, is MetronomeDAO’s $msUSD / $FraxBP pool, yielding a crazy 108% boosted.

Additionally, the $msETH pool is yielding almost 60%. What is happening?

We hope by now you’re conditioned to see sky-high yields and be naturally skeptical. You presumably notice the TVL is on the smaller side ($600K - $1.5MM is still somewhat tiny for DeFi), and trading is stagnant.

High yields are sometimes a sign the rewards are new and you happen to be first into the pool. Or it may be a case of the wisdom of the crowds signaling you should avoid something dangerous. Which is it in this case?

We took a cursory overview of MetronomeDAO. They describe themselves:

Metronome is a decentralized finance (DeFi) multi-collateral/multi-synthetic protocol. Through the Metronome dApp, users are able to deposit crypto assets as collateral, and use that collateral to mint popular crypto synthetics. These synthetics allow users to perform slippage free trades (swaps) and engage in yield farming.

Metronome is a sister project of Vesper Finance. The team has a lengthy history in DeFi despite never hitting the front page of CoinGecko. Recently the team became enamored with synthetic assets. They published a series of blog posts on the subject before proposing to launch their own synthetic protocol, which deployed January 2023.

Per the launch announcement

This collateral can include productive assets (yield bearing assets, such as Vesper Finance vPool tokens) or naked assets like ETH and USDC. Depositing collateral allows users to mint synthetic assets, which can then be swapped without slippage on the Metronome Synth Marketplace, or used for looped yield farming. These assets can also be used more generally for lending, farming, trading, or whatever else users desire.

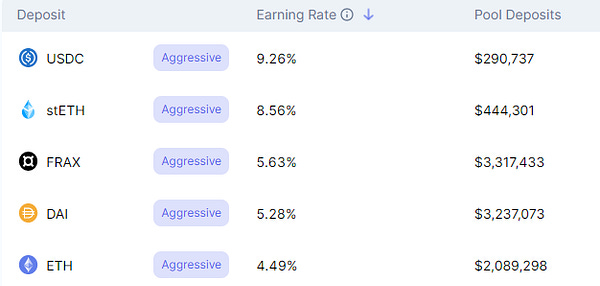

Their app is straightforward and easy to understand for any user experienced in DeFi. For collateral you can use a handful of popular tokens ($DAI, $ETH, $FRAX, $USDC, $WBTC) as well as Vesper Finance’s yield bearing tokens. These can be used to mint Synths for $BTC, $DOGE, $ETH, and $USD.

Their current collateralization ratios:

Touting their focus on yield-bearing collaterals through the Vesper protocol, they highlight the capability of looping the process to lever up and produce higher yield.

Of course, higher leverage is risky. Please remember that everything written here carries a disclaimer. None of this is financial advice. Do your own research. Be cautious when aping chadlike into degenerate internet Ponzis.

As a synthetic protocol, Metronome see themselves in the same orbit as titans like Maker, Abracadabra, and Synthetix. Where can Metronome differentiate?

They primarily tout superior “UX” as their key differentiator, as well as nodding towards future multichain ambitions.

Is Metronome safe? We’ve taken a cursory glance at the contracts. The biggest red flag we immediately observed was the use of proxy contracts (a common practice to be sure, but also a potential rug vector). We’ve not ourselves had time to conduct a thorough review.

The team received an audit from Quantstamp. The audit uncovered a few risks, the most pressing of which (possibly unresolved) involves oracle risks.

The team joined the Curve Wars this year.

Their obligatory self-report to the Curve Discussion Forum received no chatter. The great Llama Risks team did not issue an endorsement; the discussion forum post and gauge vote occurred in quick proximity, and the team did not have time to prepare a full report. Nonetheless, the gauge was approved shortly thereafter by the DAO.

Around this time, Metronome also announced it was acquiring $CVX to incentivize their pools.

So where does the yield come from? In this case the yield is fairly straightforward: buying cheap $CVX. The protocol does not appear to be tracked by DAO CVX, but the protocol’s stash would put them 16th on the leaderboard. With small liquidity, it’s good enough to generate high yields for whomever braves the choppy pool.

Based on the numbers posted above and on their website, we see $849K in Metronome synths in the Curve pools, out of a total of $870K minted.

If our napkin math is accurate, this means that nearly 98% of the token’s liquidity sits in the Curve pools. Perhaps the savvy team is soaking up all the rewards for themselves?

We’re excited to see more synthetics protocols — synths remain a compelling and proven use case for DeFi. Metronome’s long on-chain history works to their credit, they haven’t rugged anybody (to our knowledge) in several years of operation, which is decades in crypto time.

If the oracle risk remains unresolved, the greatest risks would be centered on assets that rely on price feeds (presumably crypto assets like $ETH, $BTC, $DOGE). You might presume a pure dollarcoin position to have risk of underlying price fluctuations, but who knows, crypto is truly the craziest casino.

Should you ape? Well, if you can’t afford a newsletter subscription, then absolutely not. You should stay away from this pool and cryptocurrency more broadly.