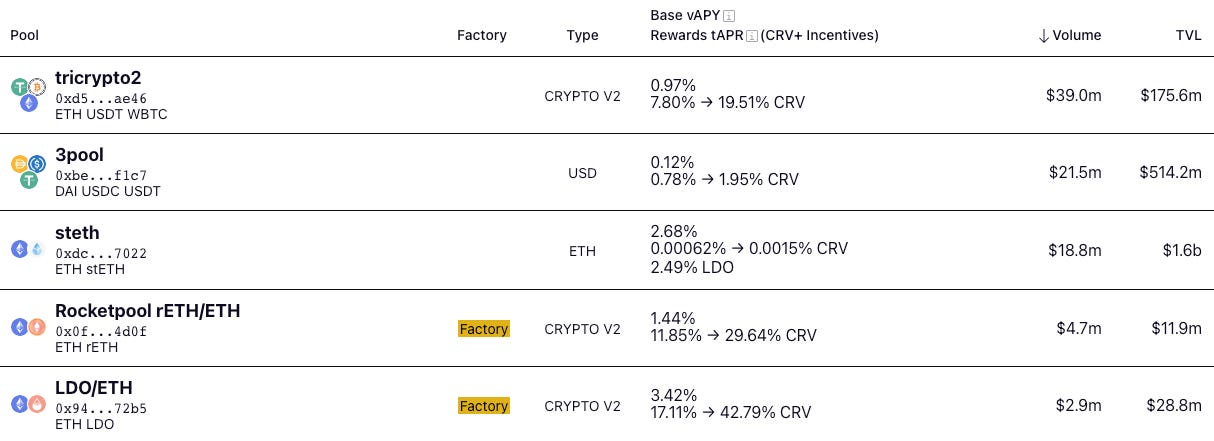

What’s the best place around the flywheel to park your $CRV?

As you can see, there’s a variety of beautiful destinations, mostly involving a combo of Aladdin, StakeDAO, Yearn, and Convex.

We bring this up mostly to show off the robust family of applications that touches the Curve flywheel in some fashion, often building atop each other.

Over the past few weeks, we’ve noticed a ton of development announcements related to so many of these protocols. One reader commented that all the building being done during the bear market appears to be coming to fruition.

Here’s a quick rundown of so many of the updates we noticed across the flywheel — each of these could have been expanded to full articles, but here’s the cliff’s notes versions. We may have missed some so feel free to drop more in the comments!

AAVE

With Curve and AAVE racing to see who can launch their stablecoin slower, there’s another interesting governance battle playing out. The protocol has a stack of nearly 650K $CRV, and is debating what to do with this stash.

Aladdin DAO

The Aladdin DAO team, encompassing Concentrator and CLever, have had a series of major Curve DAO votes resolved in the affirmative.

The team is still riding the highs of its partnership with StakeDAO to launch $asdCRV, the top yielding destination for $CRV.

Archimedes

The new protocol, which we covered last week, has begun operating its leverage rounds.

If you were early to Archimedes thanks to our newsletter, you’re welcome! Following early developments in the flywheel ecosystem remains indistinguishable from magic. (We also have receipts to prove we frontran the China narrative!)

The pool yield has calmed to about 40%, but the system is rolling out to great effect.

A good overview:

Frax

We’d need a bigger newsletter to cover all of Frax’s dev activity (which, incidentally, is why FlywheelDeFi exists and must be followed).

Many big announcements as always, but two in particular we wanted to highlight. First up, Frax launches veFPIS for the token underlying their inflation-based stablecoin:

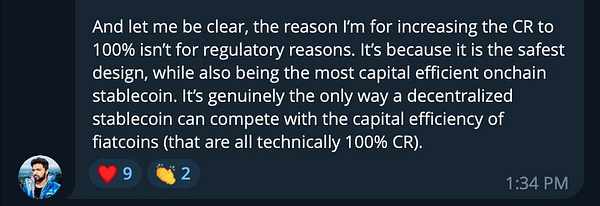

Second, the protocol voted unanimously to adjust their collateral ratio to 100% backing. This was badly misreported, so DeFi Dave corrects the record:

Liquity

The $LUSD stablecoin remains a bespoke example of a decentralized stablecoin. It’s now supported at AAVE:

Maker

Maker DAO, the team behind Dai, has been aggressively pushing their way towards TradFi.

Somewhat confusingly, they’re also pushing in the direction of $LUNA?

Concerns rebutted here:

Olympus DAO

The $OHM token is seeing a massive revival of activity as we enjoy signs of a bull market. It’s important to remember that despite token prices going down, the protocol never stopped controlling a large treasury. They wanted to put their idle assets to work yield farming, and the big brains chose the FraxBP:

Pirex

Redacted Cartel enjoys sitting in the shadows tossing gasoline onto the fires of the sundry DeFi Wars and turning it into profits.

The role of Pirex in the Convex Wars is often overlooked, perhaps because the useful DAOCVX resource doesn’t include Pirex’s stack in its methodology.

The Pirex stack totals 2.7MM CVX, a stack only exceeded by Frax Finance.

Earn float like a $BTRFLY, sting like a bee…

StakeDAO

StakeDAO’s partnership with Aladdin DAO to build out $asdCRV has already been noted. The team has had a number of other notable achievements, but the team’s work with their Vote Market birb aggregator cannot be dismissed.

Synthetix

The Synthetix team completed audits and launched v3 onto mainnet.

The new version has yet to attach markets to it, but was built in a way to be compatible with existing positions for easy upgrades.

It’s good news for the users who have enjoyed trying Synthetix v2 perps. They launched dozens of markets, already driving $300MM in volume.

Yearn

Yearn Finance’s $yCRV launch has been a pleasant success at holding peg and delivering high yield. The team is now teasing their entry into the LSD wars:

We’re sure we missed plenty of alfa — plug anything we missed in the comments! Disclaimers!