February 27, 2021: Are NFTs as 💩 as they seem?

Idle speculation about the newest form of speculation

Here are today’s trends to watch from Curve Market Cap

DISCLAIMER: The author has no interest, financially or psychologically, in NFTs.

It’s a great lifehack to ignore irrelevant things. For instance, I don’t care about NFTs, so I just pay zero attention them. Likewise, I also don’t care about Clubhouse and 99% of all news articles. These all seem to be about NFTs anyway. So I conveniently tune out this overlapping bucket of distractions and focus on important things.

Unfortunately, the “staying poor” set have started asking me my thoughts about NFTs, so I felt compelled to formulate an informed opinion. If you’re not familiar, here’s a quick rundown:

Who Cares?

Seemingly, a lot of people are hyped about NFTs. In the Economy 1.0, aka the real world, artists’ livelihood has been effectively criminalized. Some artists are seeking refuge in the digital world, Economy 2.0.

It’s starting to make people decent money.

So much so that people are looking at it as an asset class.

Now, it’s hard to get too excited about art as an asset class. Sure, art is a plaything of the rich, but it’s always been a relatively small market. Arts and culture is estimated to be an $800 billion industry in the US. This puts it at about 4% of GDP, significant but Apple could still afford to acquire the entirety of “art.”

Has there ever been a civilization where artists were the top of the pecking order? None we could find, so we’d be interested in hearing from armchair historians. In the strict Hindu caste system, the artisans sat in the Vaishya class, above the laborers and untouchables, but below the academics and warriors. Ancient Greece is known for their culture, but even there the artists fell into the Metics (middle) class, and Sparta took their lunch money a lot. Our hunch is that any civilization that put too much time into art got conquered.

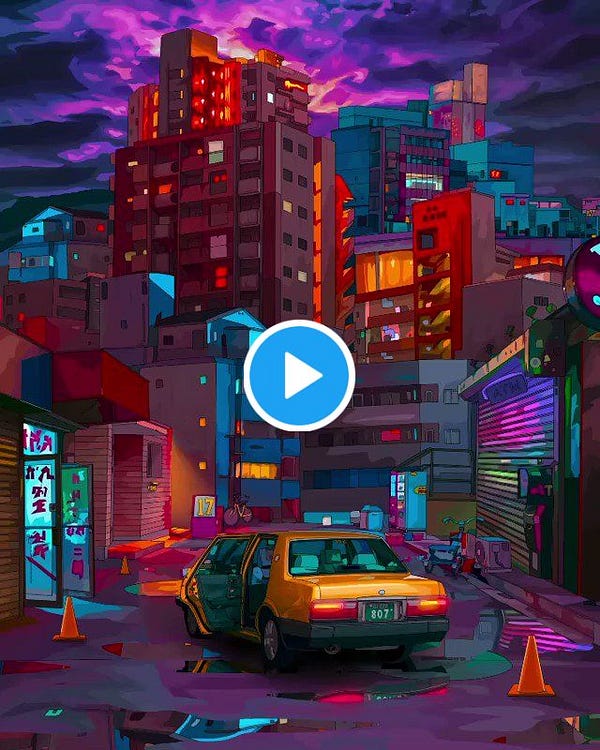

Indeed, even in crypto, the creative NFT arena is not a big deal numerically speaking. TechCrunch boasts about $60MM of digital goods moving in a relatively short timeframe. Yet Curve alone regularly moves a few hundred million per day with little fanfare. NFTs are a trivial market relative to DeFi, yet they are getting the hype:

Clearly NFTs have captured regular people’s attention. Where from? There’s obviously been no shortage of mainstream press coverage about it.

The news bubble makes sense… journalists are disproportionately liberal arts graduates who don’t understand math. They can’t wax poetic about Merkle trees, but NFTs are easy for a non-technical person to understand. Plus there’s good visuals to drive clicks, and memes and celebrities and all that.

From the news clips above, it looks safe to ignore. But then I also see some smart people dropping real cash on digital goods. So what’s going on?

User error aside, I understand why crypto whales might invest. Anybody sitting on stacked wallets from years ago is already loaded and likely also earning bank on interest, so tossing some chump change into art and lambos makes sense. But degen chump change alone isn’t enough to make an industry, nor does this crowd tend to tell the tech press what to write about.

The Eye of the Beholder

It’s no secret that art at the high end is a vehicle for money laundering. It’s sort of like signing a multi-million dollar book deal for a book nobody is going to read, it’s a good way to move around large sums of cash. Would you pay $8MM for this?

This should therefore be everybody’s first thought — is the NFT craze a way for rich people to commit financial misdeeds?

It doesn’t really square with anything we cited so far — if a malicious bag holder wanted to launder money it’s far more efficient to convert to ZCash and transact anonymously. Why mess around with Crypto -Punks and -Kitties?

Then I noticed who was pumping NFTs and it started to make sense.

Aha… the Economy 1.0 VC crowd is getting into NFTs. Now it starts to make sense.

There’s no doubt a lot of tech-savvy investors who are stuck on the sinking ship of fiat currency and looking for a lifeboat into the crypto world. It’s easy enough for VC types to get their minions in the tech press to dance to their tune. For the first time, it’s starting to make sense…

Mind you, in very clear terms, I’m not accusing any of the above people of anything illegal or untoward. Quite the opposite — I’ve met them both in real life and they seemed like good and honest people. In fact, they mostly told me to get lost, which demonstrates outstanding character judgement!

Thought exercise though. Among the among the hundreds of honest and well-intentioned NFT purchases, would I be surprised if there were some bad apples affiliated with the VC ecosystem doing something shady?

Let’s just say I’d be more surprised if there wasn’t. There’s established history of unethical behavior in the Valley. Just because we’re not privy to it, doesn’t mean we don’t know it exists.

So please if you’re buying NFTs, do it because you enjoy them, not to break the law!

We aren’t pumping NFTs, but we do have thoughts on solving ETH gas fees! Our Telegram channel will soon be announcing the first destination for our inaugural Pool Party, come join the fun in the sun!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Newsletter is an independent roundup of interesting trends in cryptocurrency, never financial advice. Author stakes $CRV, but no NFTs.