Check out that gorgeous new “collateral” column, along with so many other great trends to watch from Curve Market Cap:

New governance proposals suggest that three new pools are coming soon to Curve!

Given ETH’s recent all time high, today we dive into $ankrETH pool, which would be the third ETH pool on Curve after $sETH and $stETH.

The $ankrETH pool has been teased since late 2020. Their protocol allows you to stake Ether into an Eth2 node and receive $ankrETH (sometimes referred to as $aETH). The issuance is currently at a 1:1 ratio, and you receive staking rewards for the duration.

Where things get interesting is that the issuance of $ankrETH is planned to fall off over time, so its price is expected to increase over time relative to ETH. Most Curve pools are between fixed price assets, so expect this pool to incorporate a ratio.

At the moment 1400 stakers have staked 34,000 ETH into $ankrETH (up 10x from November), an amount currently worth over $50MM.

The ANKR team created a great explainer for $ankrETH for newcomers.

You can also learn more in this interview with ANKR COO Ryan Fang.

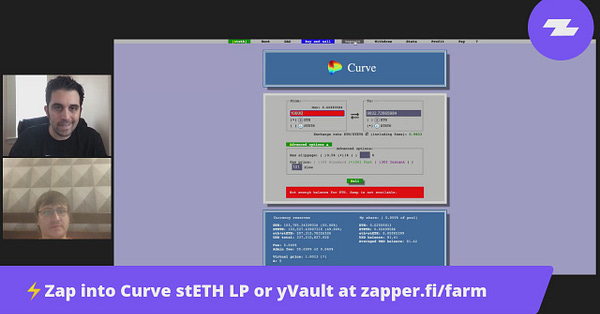

Curve’s existing ETH pools have been extremely popular, with volume quickly hitting the millions and great incentives for both pools.

The $stETH pool is still providing $LDO rewards for a little longer. If you’re interested in learning more about what $LDO is good for, the team just launched their new ecosystem page:

$stETH is also useful as an Eth2 bridge, with 120K ETH already locked up:

Meanwhile, $sETH is an endpoint for Curve’s popular cross-asset transactions, which means it’s likely to be useful for some time.

We are looking forward to $ankrETH providing another source for ETH-heads to get their fix!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. The author performs development work for Curve compensated partly in $CRV, all content is otherwise independent.